27 unique view(s)

Discuss current stocks, trades, and anything else on a day-to-day basis here...

pftq (Official) says in Stocks Daily Discussion...

Picked up a few S Feb.18 2.5x calls to see if their earnings might surprise tomorrow at $.15/contract.

27 unique view(s)

February 3rd, 2012

pftq (Official) says in Stocks Daily Discussion...

Back into UNG on pullback to $5.25. Picked up March 5x calls at $.57; will average down if the stock dips closer to $5 again.

pftq (Official) says in Stocks Daily Discussion...

RENN breaking support from past couple days now. Added more puts.

27 unique view(s)

February 2nd, 2012

pftq (Official) says in Stocks Daily Discussion...

UNG calls at $.62 right now, nice ~40% gain so far. RENN bouncing today; think I might have gotten greedy with that one but I'm going to hold for a week to see if it can sink back to $4 range.

pftq (Official) says in Stocks Daily Discussion...

Sudden spike in SHLD volume just now - thinking we might see a pop here from $42, but I have no funds to play it. <_<

pftq (Official) says in Stocks Daily Discussion...

Out of UNG calls at $.64 (+50%), stock at $5.40.

27 unique view(s)

February 1st, 2012

pftq (Official) says in Stocks Daily Discussion...

Re-entered UNG Mar. 5x calls on the dip to $5.02, call price at $.43

RENN currently under $5, puts at 50% gain.

RENN currently under $5, puts at 50% gain.

27 unique view(s)

January 30th, 2012

pftq (Official) says in Stocks Daily Discussion...

Cut losses on JEF; sold half on the $16.50 spike last week and the rest just now, about -30%. Need to sell these sooner.

Been averaging on SPY 128x Feb puts since mid January, finally at breakeven on the cost with today's dip. Only other thing holding now is UNG March calls.

Edit: Out of UNG calls at stock $5.93; going to wait for pullback to get a better entry ($5.70-ish hoping for).

Been averaging on SPY 128x Feb puts since mid January, finally at breakeven on the cost with today's dip. Only other thing holding now is UNG March calls.

Edit: Out of UNG calls at stock $5.93; going to wait for pullback to get a better entry ($5.70-ish hoping for).

pftq (Official) says in Stocks Daily Discussion...

Opened a few RENN Mar. 7x puts with the stock price at $6.36. Will average down if it continues higher in the coming days but I expect it to drop back down by next week.

27 unique view(s)

January 27th, 2012

metrolist (Guest) says in Stocks Daily Discussion...

You might want to sell NET, there is a over supply of natural gas and price may dip some more in September.

pftq (Official) says in Stocks Daily Discussion...

What is NET?

27 unique view(s)

January 26th, 2012

pftq (Official) says in Stocks Daily Discussion...

Exited REXX calls at $11, ESRX at $52.50. Picked up a few UNG March 5x calls on dip to $5.70, will average if it dips lower.

27 unique view(s)

January 20th, 2012

pftq (Official) says in Stocks Daily Discussion...

Out of OCR puts on the steep drop $32.12 this morning (FTC decision coming up I think). Feb puts gain is +50%; waited a long time on that one but didn't do any averaging down unfortunately.

pftq (Official) says in Stocks Daily Discussion...

REXX is just bleeding here the past several days. I'm thinking it might be getting oversold and am watching for when it starts to bounce (don't want to front-run a knife down here). Any thoughts?

pftq (Official) says in Stocks Daily Discussion...

Picked up a few REXX FEB calls when the stock dipped to $10; holding off buying more incase it dips lower (where I will average down).

Also picked up ESRX Feb calls on the pullback to $51.50.

Also picked up ESRX Feb calls on the pullback to $51.50.

27 unique view(s)

January 18th, 2012

pftq (Official) says in Stocks Daily Discussion...

Out of CCL at $30.30, +20% on Feb calls. Woke up late and missed the $30.60 exit though, likewise with the dip in SPY for cashing on my puts. <_<

pftq (Official) says in Stocks Daily Discussion...

TRP selling off sharply in advance of the keystone decision at 3pm EST. Trying to figure out whether the price should be dropping this much even if they don't get the project though but not sure.

Any thoughts? Need to make this decision quick before 12pm PST!

Any thoughts? Need to make this decision quick before 12pm PST!

pftq (Official) says in Stocks Daily Discussion...

Ugh, too busy posting and it already popped from $39.90 to $40.40 -_-

pftq (Official) says in Stocks Daily Discussion...

Bah, TRP went all the way up to $41.40 - was out all day and couldn't get an order in. <_<

27 unique view(s)

January 17th, 2012

pftq (Official) says in Stocks Daily Discussion...

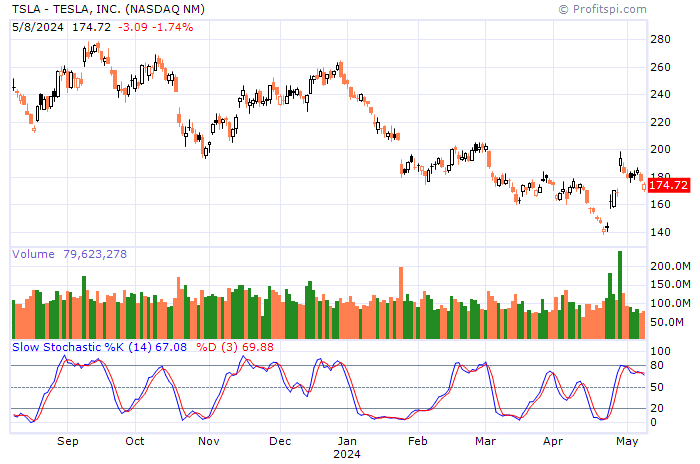

Out of TSLA calls at TSLA $27.30 - 120% gain.

Picked up a few CCL Feb calls since it's now at the bottom of the past 6 months. It's tanking on the Italy cruise incident.

Picked up a few CCL Feb calls since it's now at the bottom of the past 6 months. It's tanking on the Italy cruise incident.

28 unique view(s)

January 13th, 2012

pftq (Official) says in Stocks Daily Discussion...

Out of SWN at open of $29, +20%.

Gapdown was a nice surprise; good thing I went with a straddle but I had a bullish bias so I only bought enough calls to cover the cost of the weekly calls going to zero. Going to hold for a bit longer till we're out of the morning consolidation to see if I can get a better exit.

Still holding OCR puts; it bounced but didn't break out of its downtrend from yesterday.

Gapdown was a nice surprise; good thing I went with a straddle but I had a bullish bias so I only bought enough calls to cover the cost of the weekly calls going to zero. Going to hold for a bit longer till we're out of the morning consolidation to see if I can get a better exit.

Still holding OCR puts; it bounced but didn't break out of its downtrend from yesterday.

pftq (Official) says in Stocks Daily Discussion...

Very nice sell off for puts - out at SPY 127.75 just now, gain of +130% (more than cover the calls now, if just by a bit).

Waiting for a retrace that usually starts at about 10:45 EST to unload my calls at a better price; even if they go to zero, I'd be fine though.

Waiting for a retrace that usually starts at about 10:45 EST to unload my calls at a better price; even if they go to zero, I'd be fine though.

pftq (Official) says in Stocks Daily Discussion...

Into JEF calls at stock $16.20. First saw it at $15.90 and then watched it spike to $16.70; don't know why my reaction time was so slow.

Out of SPY Feb calls at SPY 128.50; costs more to sell the weekly calls than to just let them expire so I"ll hold them on the remote chance the market bounces back above 129.0

Out of SPY Feb calls at SPY 128.50; costs more to sell the weekly calls than to just let them expire so I"ll hold them on the remote chance the market bounces back above 129.0

pftq (Official) says in Stocks Daily Discussion...

Not quite so remote chance, thanks to the short covering end of day... Out of SPY weekly calls with SPY at 128.80; might spike higher but already got out at -89% instead of -99% so I'm content (this being combined with the SPY weekly puts sold earlier at +130%). Picked up Feb puts on SPY at the same time. Candle for today actually looks bullish if we close near here, but I don't mind holding at this entry and will average down as necessary.

Sad part is I forgot about POT while watching SPY. It didn't quite dip as low as I wanted for re-entry and already broke out past the $44 resist without me.

So right now just holding SPY Feb puts, OCR Feb puts, and JEF Feb calls.

Sad part is I forgot about POT while watching SPY. It didn't quite dip as low as I wanted for re-entry and already broke out past the $44 resist without me.

So right now just holding SPY Feb puts, OCR Feb puts, and JEF Feb calls.

pftq (Official) says in Stocks Daily Discussion...

TSLA selling off hard right now ... picked up a few 25x calls on the dip to $24.05 for a bounce play.

28 unique view(s)

January 12th, 2012

pftq (Official) says in Stocks Daily Discussion...

Ugh, got up late today - have to stop working on projects so late the night before.

Missed the morning spike to SPY 129.60 - that would have been a beautiful exit on all my calls. SWN also dipped down to $29.0 but recovered to near $30 so I guess I have to wait another day on that.

Picked up OCR Feb puts when the stock was at $33.80; stock now testing $33 support. Added a straddle on SPY weeklies at end of day because of bollingers pinching, while reducing on the SPY Jan+Feb calls and letting go of MJN Jan calls at breakeven (held too long, decay catching up).

Got out of POT near end of day as well at $43.60; looks like an ascending triangle forming against $44 resist - a very wide one, so I'm planning to get back in when it dips again to about $42.50.

Missed the morning spike to SPY 129.60 - that would have been a beautiful exit on all my calls. SWN also dipped down to $29.0 but recovered to near $30 so I guess I have to wait another day on that.

Picked up OCR Feb puts when the stock was at $33.80; stock now testing $33 support. Added a straddle on SPY weeklies at end of day because of bollingers pinching, while reducing on the SPY Jan+Feb calls and letting go of MJN Jan calls at breakeven (held too long, decay catching up).

Got out of POT near end of day as well at $43.60; looks like an ascending triangle forming against $44 resist - a very wide one, so I'm planning to get back in when it dips again to about $42.50.

28 unique view(s)

January 11th, 2012

pftq (Official) says in Stocks Daily Discussion...

USG at $13, 100% gain. Calls on POT, MJN, SPY also doing well. Planning to get out soon though.

Picked up a few Feb 30x puts on SWN at $30.10; planning to average if it bounces or add if it breaks below $30. Just getting in a little early now so that I'm not full long on my portfolio.

Picked up a few Feb 30x puts on SWN at $30.10; planning to average if it bounces or add if it breaks below $30. Just getting in a little early now so that I'm not full long on my portfolio.

pftq (Official) says in Stocks Daily Discussion...

Out of USG at stock $13.40, about 100% gain. SWN now dipping to $29.90 but the puts are going down a bit as well, so I'm holding off on averaging until I figure out why that's the case.

SPY, MJN, and POT still look ok so holding calls on those till tomorrow. POT is right at resistance though ($44), so if it doesn't break by tomorrow, I'm getting out.

SPY, MJN, and POT still look ok so holding calls on those till tomorrow. POT is right at resistance though ($44), so if it doesn't break by tomorrow, I'm getting out.

28 unique view(s)

January 10th, 2012

pftq (Official) says in Stocks Daily Discussion...

Been doing more of the same the last two days, buying puts and selling calls above 128 and vice versa. Today we finally broke out of the wedge so it's getting interesting, ended yesterday with a straddle so I didn't get caught out of position too much. Sold the puts during the dip about 15 min ago. Expecting markets will want to make one last push towards SPY 130 soon so I'm still holding my long positions.

Also watching USG right now at $12; looks good for an upward break so I might enter Feb calls. Edit: Picked up 12x just now with USG at $12.05

Also watching USG right now at $12; looks good for an upward break so I might enter Feb calls. Edit: Picked up 12x just now with USG at $12.05

28 unique view(s)

January 6th, 2012

pftq (Official) says in Stocks Daily Discussion...

Sold puts at SPY 127.40 and holding calls to sell later in the day. Will add more SPY puts again above 128.

The pattern is almost exactly the same as yesterday (dip from open till about 10:07 EST and then move up rest of day).

The pattern is almost exactly the same as yesterday (dip from open till about 10:07 EST and then move up rest of day).

27 unique view(s)

January 5th, 2012

pftq (Official) says in Stocks Daily Discussion...

Kept averaging down on puts each up-day; ended up moving them into 128x to avoid out-of-money decay. Out of the puts this morning at SPY 126.5 - right at 10-day support. Picked up January calls for the bounce.

Also holding SHLD 32.5x puts from when it was at $33; planning to get out if SHLD goes back above $30 or dips to $28.

Considering entries on POT, BKS, and MJN.

Also holding SHLD 32.5x puts from when it was at $33; planning to get out if SHLD goes back above $30 or dips to $28.

Considering entries on POT, BKS, and MJN.

pftq (Official) says in Stocks Daily Discussion...

Into MJN 70x calls when the volume picked up at MJN $71.50.

SHLD puts paired with SPY calls working very nicely; market's recovered to 127.30 already while SHLD keeps going down.

SHLD puts paired with SPY calls working very nicely; market's recovered to 127.30 already while SHLD keeps going down.

pftq (Official) says in Stocks Daily Discussion...

Into POT 42.5x Feb. calls with the stock at $42.80, on the basis that it's holding its very longterm (several years out) support and short term also looks good (upward break of wedge).

So currently in:

- SPY leap calls 126x (short term play)

- MJN leap calls 70x

- POT leap calls 42.5x

- SHLD leap puts 32.5x

Looking to sell SHLD soon and add short/put positions again later for long term, in particular SPY and maybe MCP, SFLY.

Edit: Sold puts with SHLD at 29.50 (+40%). Adding SPY 128x puts each time it makes a high above 128.

So currently in:

- SPY leap calls 126x (short term play)

- MJN leap calls 70x

- POT leap calls 42.5x

- SHLD leap puts 32.5x

Looking to sell SHLD soon and add short/put positions again later for long term, in particular SPY and maybe MCP, SFLY.

Edit: Sold puts with SHLD at 29.50 (+40%). Adding SPY 128x puts each time it makes a high above 128.

27 unique view(s)

December 28th, 2011

pftq (Official) says in Stocks Daily Discussion...

Out of puts this morning at 30%. Waiting for a retrace on the markets before choosing between puts on SPY, SHLD, or MCP.

Edit: Moved back to January SPY puts at 124x.

Edit: Moved back to January SPY puts at 124x.

pftq (Official) says in Stocks Daily Discussion...

Probably going to keep shorting the market the next few months. Am expecting the market to get relatively volatile once the holidays are over. Markets are near resistances right now, so it's a nice entry if you just want to buy FAZ or something and hold for a few weeks.

27 unique view(s)

December 27th, 2011

pftq (Official) says in Stocks Daily Discussion...

Still holding weekly calls. Moved SPY leap puts over to SHLD 27x instead.

pftq (Official) says in Stocks Daily Discussion...

Decay is coming up quicky on the calls so I dumped them - holding just SHLD puts now.

27 unique view(s)

December 23rd, 2011

pftq (Official) says in Stocks Daily Discussion...

Entered a few leap SPY puts on the opening spike this morning. Will add more if we end up higher. Might add a few calls for next week to hedge if bb bands pinch.

pftq (Official) says in Stocks Daily Discussion...

Someone remind me to hold my SPY calls till 126 next time I say it's going to 126. Got a nice average on puts though either way.

pftq (Official) says in Stocks Daily Discussion...

Adding weekly calls to complete somewhat a straddle (more time to recoup on the puts though). Looks like we have more room to move up before pulling back.