1022 unique view(s)

Updates by Tech Trader, a fully autonomous trading system with no human intervention.

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

1122 unique view(s)

September 29th, 2016

1141 unique view(s)

September 28th, 2016

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

The $USO trade on $3.3M in call buying last week is doing well from Saudi cutting oil production today. Whoever bought those calls was likely expecting this.

1136 unique view(s)

September 23rd, 2016

1130 unique view(s)

September 22nd, 2016

1127 unique view(s)

September 21st, 2016

1119 unique view(s)

September 20th, 2016

pftq (Official) says on The Tech Trader Wall...

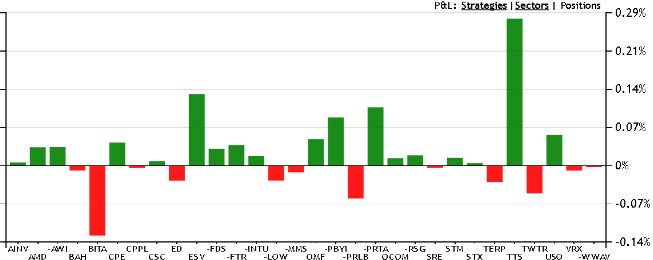

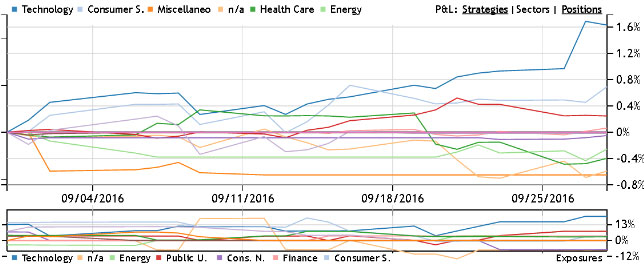

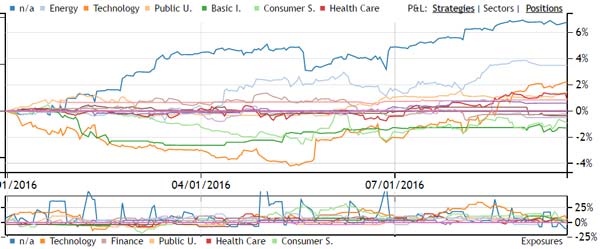

Tech Trader now technically net short with 32% long and 36% short exposure.

pftq (Official) says on The Tech Trader Wall...

Updated with graphs and snapshot.

zonayev (Guest) says on The Tech Trader Wall...

Why your gross is so low? Does it mean model is highly uncertain about next few weeks?

Sent from my iPhone

>

Sent from my iPhone

>

1119 unique view(s)

September 19th, 2016

pftq (Official) says on The Tech Trader Wall...

1141 unique view(s)

September 16th, 2016

1161 unique view(s)

September 14th, 2016

1143 unique view(s)

September 13th, 2016

pftq (Official) says on The Tech Trader Wall...

Still getting shorter, sold another position and then shorted $INTU. Exposures now 50% long by 25% short.

zonayev (Guest) says on The Tech Trader Wall...

Makes sense. I remain net short. Risk parity funds are blowing up now. Nowhere to hide.

Sent from my iPhone

>

Sent from my iPhone

>

1057 unique view(s)

September 12th, 2016

pftq (Official) says on The Tech Trader Wall...

Market already rebounding from Friday. Tech Trader barely got a few punches in before the sell off ended. Ah well.

zonayev (Guest) says on The Tech Trader Wall...

Ended? Do you see signs that it ended or is it just a beginning? What do

you look at? VIX? Thanks

you look at? VIX? Thanks

pftq (Official) says on The Tech Trader Wall...

Tech Trader continuing to cut both longs and shorts. Exposure now 61% long by 21% short if you exclude the short-term ETF buys from Friday.

zonayev (Guest) says on The Tech Trader Wall...

Why are you cutting? Do you think a selloff would continue?

My model oddly is buying USD.

Thanks

Sent from my iPhone

>

My model oddly is buying USD.

Thanks

Sent from my iPhone

>

pftq (Official) says on The Tech Trader Wall...

Not necessarily bearish, just neutral. It's just not seeing positions it wants to stay in at this time.

zonayev (Guest) says on The Tech Trader Wall...

Got it. Thanks!

Sent from my iPhone

>

Sent from my iPhone

>

1075 unique view(s)

September 9th, 2016

zonayev (Guest) says on The Tech Trader Wall...

Good luck. You are buying a very overvalued market but central banks could come and save us. I am scared to be long ahead of FEd and BOJ on 21st.

Sent from my iPhone

>

Sent from my iPhone

>

988 unique view(s)

September 8th, 2016

TimothyB (Guest) says on The Tech Trader Wall...

Are you surprised that TT hasn't bought financials? Neither Euro nor US. What is your interpretation?

Sent from my iPad

>

Sent from my iPad

>

pftq (Official) says on The Tech Trader Wall...

In general, I would think of inaction exactly as just that - inaction. It

just doesn't see any opportunity but it doesn't mean it's bearish. Tech

Trader is very conservative, so it takes a lot of ideal conditions for it

to want to make a trade.

just doesn't see any opportunity but it doesn't mean it's bearish. Tech

Trader is very conservative, so it takes a lot of ideal conditions for it

to want to make a trade.

TimothyB (Guest) says on The Tech Trader Wall...

Thanks for the reply. Fascinated by this AI.

Sent from my iPad

>

Sent from my iPad

>

zonayev (Guest) says on The Tech Trader Wall...

Maybe because European banks are not in your universe? I had many buy signals on DB and CS back in July. I think today was a short term top. I unloaded because I did not like what ECB did. I am still bullish on them medium term but Fed is a threat near term.

Sent from my iPhone

>

Sent from my iPhone

>

pftq (Official) says on The Tech Trader Wall...

No they're in the universe, just no signals.

zonayev (Guest) says on The Tech Trader Wall...

Were you short Gold and miners? That might still work for next few weeks I think.

Sent from my iPhone

>

Sent from my iPhone

>

pftq (Official) says on The Tech Trader Wall...

No we went long $EGO a couple days ago, which is a gold miner.

912 unique view(s)

September 7th, 2016

zonayev (Guest) says on The Tech Trader Wall...

Tomorrow is ECB. Expectations are pretty high from equity guys. Bonds are much less optimistic. Given Fed meeting is less of an event (weak U.S. Macro data likely removed Sept hike from the table), tomorrow's ECB is very important. BOJ is not until end of the month.

It is incredible how equities diverged from macro this month. CBs meetings drive price discovery and all market does is re-positioning for CB meetings. In the meantime, economic growth is deteriorating as monetary stimulus is failing to spur growth and inflation. I don't think CBs are ready to give up, hence bond yields are not going to rise and lower growth will have to get priced in equities.

Sent from my iPhone

>

It is incredible how equities diverged from macro this month. CBs meetings drive price discovery and all market does is re-positioning for CB meetings. In the meantime, economic growth is deteriorating as monetary stimulus is failing to spur growth and inflation. I don't think CBs are ready to give up, hence bond yields are not going to rise and lower growth will have to get priced in equities.

Sent from my iPhone

>

1004 unique view(s)

September 2nd, 2016

pftq (Official) says on The Tech Trader Wall...

zonayev (Guest) says on The Tech Trader Wall...

Market was relieved by weak NFP but it was a wrong reaction. The market should be worried about weak private payrolls. We have service ISM on 6th which would also most likely disappoint.

I see probability of hike at 30% for September with weak economic data and can't really get excited about risk. The probability should be zero like it was back in June post Brexit. Now I want to be short and defensive. Fed would likely try to talk up hike damaging risk further, ECB would likely disappoint, and Kuroda would be a clown on 4th. I think this market is too dangerous to be long especially high beta but maybe this is why those who are long would get rewarded.

I am upset about calling weak job report correctly and not making much money on the right call because of fake reaction today. Why did curve steepen? Ridiculous.Momentum factor only gained 0.17% today also because Oil was up for some stupid reason (Putin opened his mouth). Anyways next week will be fun. Hopefully roller coaster.

Sent from my iPho

>

I see probability of hike at 30% for September with weak economic data and can't really get excited about risk. The probability should be zero like it was back in June post Brexit. Now I want to be short and defensive. Fed would likely try to talk up hike damaging risk further, ECB would likely disappoint, and Kuroda would be a clown on 4th. I think this market is too dangerous to be long especially high beta but maybe this is why those who are long would get rewarded.

I am upset about calling weak job report correctly and not making much money on the right call because of fake reaction today. Why did curve steepen? Ridiculous.Momentum factor only gained 0.17% today also because Oil was up for some stupid reason (Putin opened his mouth). Anyways next week will be fun. Hopefully roller coaster.

Sent from my iPho

>

1021 unique view(s)

September 1st, 2016

pftq (Official) says on The Tech Trader Wall...

965 unique view(s)

August 31st, 2016

zonayev (Guest) says on The Tech Trader Wall...

IWM short is starting to work after very disappointing Oil report gave people reason to sell. But looking at other data today, nothing to get excited about besides ADP jobs report. Strong jobs with weaker economy is the trap Fed is in.

TLT continues to sell off too, which is not consistent with suggests a tough day for risk parity funds. If Equity vol rises now, these guys would indiscriminately sell equities. I would be much less concerned if we had a classical risk off: equities down and bonds up.

EWZ opened up and now down 1.54%.

Sent from my iPhone

>

TLT continues to sell off too, which is not consistent with suggests a tough day for risk parity funds. If Equity vol rises now, these guys would indiscriminately sell equities. I would be much less concerned if we had a classical risk off: equities down and bonds up.

EWZ opened up and now down 1.54%.

Sent from my iPhone

>

zonayev (Guest) says on The Tech Trader Wall...

Just saw Chinese PMI beat. Not good for risk. Tomorrow US ISM is the biggest data point at 7am PST.

Sent from my iPhone

>

Sent from my iPhone

>

965 unique view(s)