952 unique view(s)

Updates by Tech Trader, a fully autonomous trading system with no human intervention.

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

zonayev (Guest) says on The Tech Trader Wall...

Oil and USD are working. Bond yields also fell since Friday. However bid for equities remains strong. Equities are diverging from macro: reinforces my short risk recommendation. NFP this Friday will be huge! Last chance to sell before we get the most important data point for Fed. If NFP prints above 220k jobs, I expect a hike in September. While U.S can stomach another hike, can the rest of the world with Oil still below 50 and deflation? I think we are going to see some fireworks soon.

Sent from my iPhone

>

Sent from my iPhone

>

917 unique view(s)

August 26th, 2016

pftq (Official) says on The Tech Trader Wall...

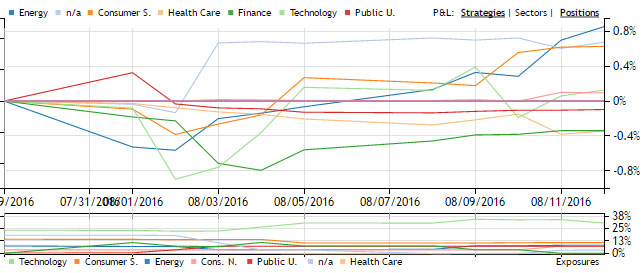

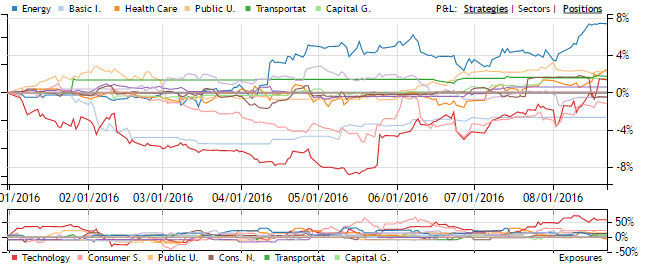

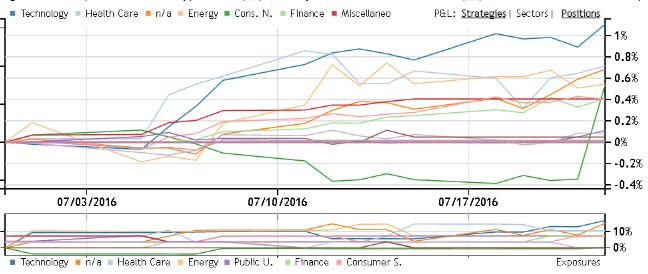

Yeah $SPY is down only slightly and $QQQ actually is positive while defensive sector $XLU is down over 2%. It looks like people are actually rotating out of defensive into risk. Tech Trader meanwhile taking a lot off the table on both sides and getting more neutral, now about 67% long by 25% short (33% cash), with technology remaining the biggest exposure at 25%.

zonayev (Guest) says on The Tech Trader Wall...

I am expecting risk off next week. I am disappointed today with weak risk off reaction but next week would be ugly. "Bloody Monday"...

Sent from my iPhone

>

Sent from my iPhone

>

TimothyB (Guest) says on The Tech Trader Wall...

Surprised TT hasn't bought into financials?

zonayev (Guest) says on The Tech Trader Wall...

Yes you are right. I expected Fed to be dovish but they came out hawkish, which caused repositioning and created this illusion of 'risk on'. High beta out performed low beta by 0.9% today and Momentum lost 0.35%. This is good for today but worse for next few weeks. I think we get a massive reversal and you want to own Utes and Staples. I am amazed how oil held up relative to USD move. It might be up for geopolitical reasons or it a fake reaction. Let's see on Monday. Next week will be interesting. I stayed defensive and even added. Good luck

Sent from my iPhone

>

Sent from my iPhone

>

zonayev (Guest) says on The Tech Trader Wall...

By the way look at EWZ and EEM. I was short since last week, as well as XBI. These are early signs of risk off. I am short IWM too which is flat since I shorted it but it does look weak and ready to break down soon. It is just my opinion.

Sent from my iPhone

>

Sent from my iPhone

>

zonayev (Guest) says on The Tech Trader Wall...

I recommend to be neutral or short Oil and energy stocks. Next Friday is NFP, which is expected to be strong, and if it is strong they could hike. USD would likely rally next week (normally the case after hawkish Fed) and Oil inventories in US are now turning up. Chinese demand is likely going to weaken since they are consuming less and exporting more. Geopolitical risk (Yemen threat for Saudi oil) keeps oil up which means it is overvalued relative to fundamentals.

Sent from my iPhone

>

Sent from my iPhone

>

796 unique view(s)

August 25th, 2016

zonayev (Guest) says on The Tech Trader Wall...

Typical risk off reaction before Yellen develops as expected. I expect it gets more ugly.

Sent from my iPhone

>

Sent from my iPhone

>

733 unique view(s)

August 22nd, 2016

pftq (Official) says on The Tech Trader Wall...

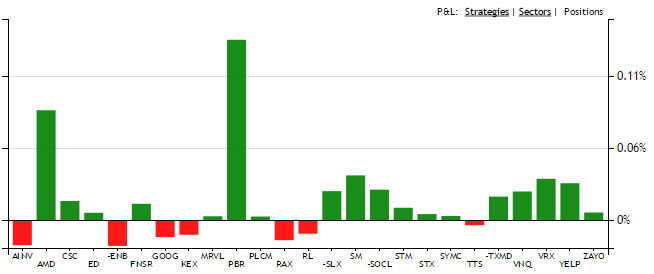

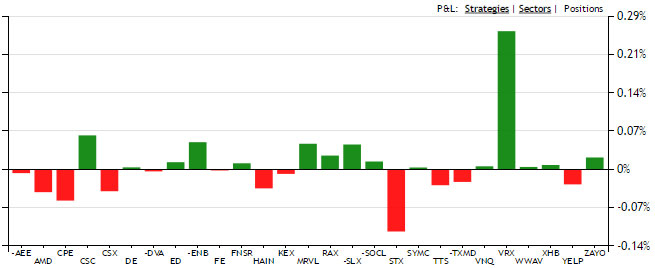

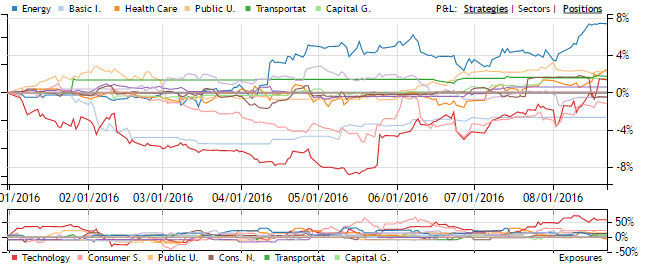

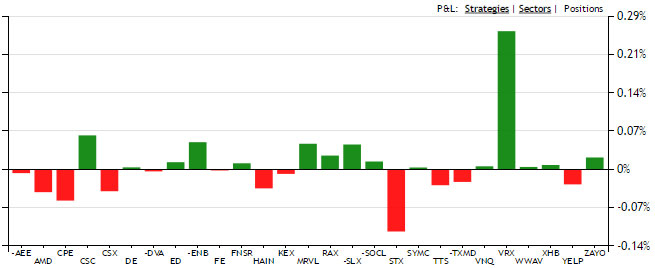

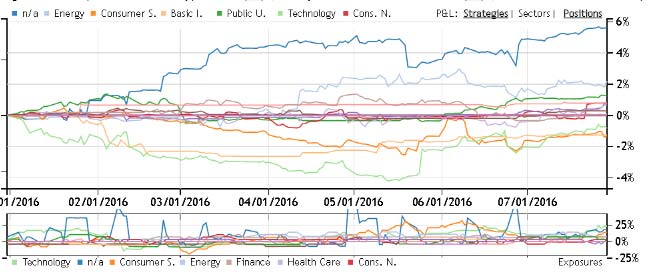

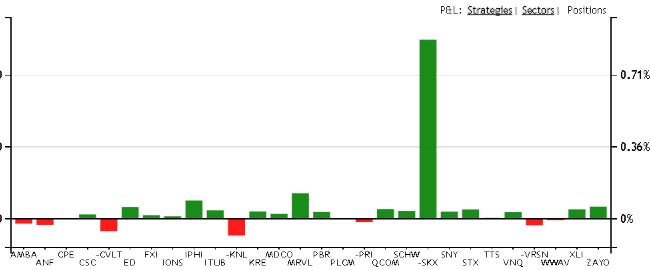

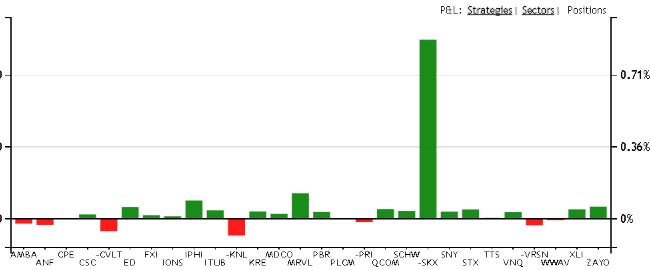

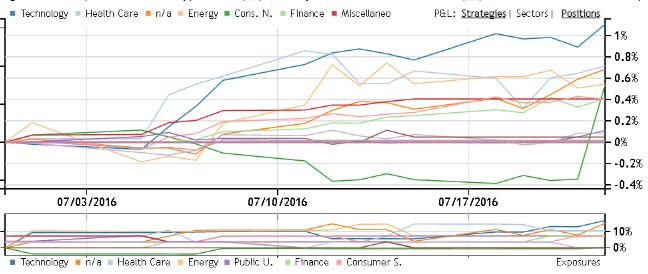

Tech Trader's portfolio would appear bullish/pro-risk, but we are gaining each day even when the market is down. Biggest sector exposure remains Technology at 25%. However, biggest P&L is coming from Energy and biggest single name winner this month $CPE (Energy), followed by $YELP (Consumer). Oddly enough, $VRX is quickly becoming a big winner as well despite our horrible entry; both today and most of last week it was the biggest contributor in P&L on a daily basis.

zonayev (Guest) says on The Tech Trader Wall...

Risk off is playing out so far. EWZ is leading the pack lower. IWM is holding for its life but I see pockets of risk giving up.

TLT is nicely rebounding.

Sent from my iPhone

>

TLT is nicely rebounding.

Sent from my iPhone

>

zonayev (Guest) says on The Tech Trader Wall...

Equities are still pro-risk. Cyclical rotation continues despite weakness in Oil. I think most people are short indices while not many are short individual equities. This should end badly.

Sent from my iPhone

>

Sent from my iPhone

>

TimothyB (Guest) says on The Tech Trader Wall...

Thanks Stefan. Never pulled yhe trigger.

From my Android phone on T-Mobile. The first nationwide 4G network.

---

From my Android phone on T-Mobile. The first nationwide 4G network.

---

740 unique view(s)

August 19th, 2016

TimothyB (Guest) says on The Tech Trader Wall...

Nice TT. What did TT do with Hain?did it hold or dump? Thanks for the updates. I always pay attention to your posts!

From my Android phone on T-Mobile. The first nationwide 4G network.

---

From my Android phone on T-Mobile. The first nationwide 4G network.

---

TimothyB (Guest) says on The Tech Trader Wall...

Thanks Stefan, yeah might be a good time for a trade.

From my Android phone on T-Mobile. The first nationwide 4G network.

---

From my Android phone on T-Mobile. The first nationwide 4G network.

---

zonayev (Guest) says on The Tech Trader Wall...

Good job TT! It is a tough month for hedge funds.

I remain bearish for next week. My favorite shorts are IWM and EWZ. Expect a delayed risk off reaction next week. My favorite style is Price Momentum now. Its volatility fell 50% over past few weeks. We just need oil down and it works out. European banks are pulling back, Energy stocks sold off today, and bond yields are rising.

Sent from my iPhone

>

I remain bearish for next week. My favorite shorts are IWM and EWZ. Expect a delayed risk off reaction next week. My favorite style is Price Momentum now. Its volatility fell 50% over past few weeks. We just need oil down and it works out. European banks are pulling back, Energy stocks sold off today, and bond yields are rising.

Sent from my iPhone

>

726 unique view(s)

August 17th, 2016

pftq (Official) says on The Tech Trader Wall...

Many ETFs already up sharply since TT's call. $XLU now up almost 1% after starting down this morning.

zonayev (Guest) says on The Tech Trader Wall...

I have positioned defensively on Monday. xLU would work for next 5-10 days. I am negative on IWM.

Sent from my iPhone

>

Sent from my iPhone

>

736 unique view(s)

August 16th, 2016

792 unique view(s)

August 12th, 2016

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

791 unique view(s)

August 11th, 2016

pftq (Official) says on The Tech Trader Wall...

802 unique view(s)

August 9th, 2016

pftq (Official) says on The Tech Trader Wall...

$YELP up an additional 5% after hours coincidentally.

747 unique view(s)

August 4th, 2016

zonayev (Guest) says on The Tech Trader Wall...

Do you see any big put spread trades in XLP over past few weeks? Thanks!

Sent from my iPhone

>

Sent from my iPhone

>

pftq (Official) says on The Tech Trader Wall...

None that we can see are notable.

zonayev (Guest) says on The Tech Trader Wall...

Thanks!

Sent from my iPhone

>

Sent from my iPhone

>

pftq (Official) says on The Tech Trader Wall...

$SYMC up about 5% after hours on beat. Initial reports were that it missed; hence why we trade price and not news.

741 unique view(s)

July 29th, 2016

pftq (Official) says on The Tech Trader Wall...

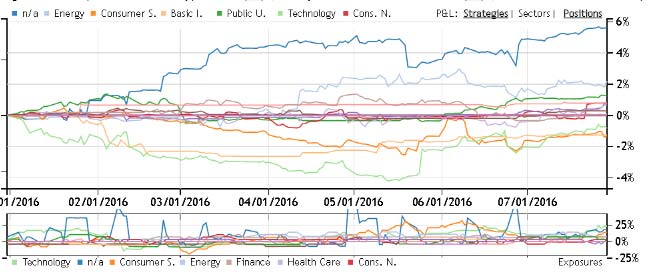

Tech Trader is back to betting on Tech, Consumer, and Energy after locking in 6% for July. It really is looking like the winters and summers are reversed this year.

zonayev (Guest) says on The Tech Trader Wall...

I am the opposite. Short Tech, health care and consumer. Betting on Financials, industrials, and Utilities. Good luck!

Sent from my iPhone

>

Sent from my iPhone

>

zonayev (Guest) says on The Tech Trader Wall...

Guys,

Some interesting fact for you. The best performing market neutral factor this year is 20-day RSI. The factor buys bottom 200 stocks in Russell 1000 ( oversold) and shorts top 200 most overbought stocks as determined by their 20-day RSI, rebalanced each month end. Over past 7 months the factor is up almost 17%. This is incredible performance. Basically traders market where fundamentals don't matter. Quants are trading baskets back and fourth. Until uncertainty is gone, it might be the best strategy for the rat of the year.

Sent from my iPhone

>

Some interesting fact for you. The best performing market neutral factor this year is 20-day RSI. The factor buys bottom 200 stocks in Russell 1000 ( oversold) and shorts top 200 most overbought stocks as determined by their 20-day RSI, rebalanced each month end. Over past 7 months the factor is up almost 17%. This is incredible performance. Basically traders market where fundamentals don't matter. Quants are trading baskets back and fourth. Until uncertainty is gone, it might be the best strategy for the rat of the year.

Sent from my iPhone

>

717 unique view(s)

July 22nd, 2016

pftq (Official) says on The Tech Trader Wall...

Big day for Tech Trader with short $SKX alone making over a percent for the portfolio. The rest of the portfolio even without $SKX is still outperforming $SPY at over half a percent. For July alone, Tech Trader is currently up 5%. Exposures are holding at about 90% long by 20% short with 10% cash. Sectors are a pretty neutral 10% even across the board with the top 3 being tech, healthcare, and energy, but as we saw with today, the positions are so idiosyncratic that performance can come from anywhere.

twgarry (Guest) says on The Tech Trader Wall...

great job!

722 unique view(s)

July 20th, 2016

zonayev (Guest) says on The Tech Trader Wall...

Are you guys still long TLT? Tomorrow is ECB, likely would be bearish for bonds. Draghi normally is able to lift sentiment, hence German yields, at least for one day. Then FOMC next week. You could get some relief and opportunity to exit before Fed. Post Fed I can see TLT taking another leg down ahead of BOJ. After BOJ, I have no view. Helicopter money could be the game changer. Let's see.

Sent from my iPhone

>

Sent from my iPhone

>

752 unique view(s)

July 14th, 2016

zonayev (Guest) says on The Tech Trader Wall...

I hope you exited TLT yesterday. Are you buying again today?

Sent from my iPhone

>

Sent from my iPhone

>