1131 unique view(s)

Updates by Tech Trader, a fully autonomous trading system with no human intervention.

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

pftq (Official) says on The Tech Trader Wall...

$LGF basically a free gain this morning opening at pre-earnings price of $19.76; was above $22 yesterday after hours. Call buyers that got us into the stock in the first place are targeting $24 strike for June.

LGF 6/17/2016 24x Calls, 3400@$1.2999

MV: $0.4M | $Not.: $3.1M | OI: 1583 | 10.9% TotalOI

3.8% StockVolume | 54.5% OptionVolume

LGF 6/17/2016 24x Calls, 3400@$1.2999

MV: $0.4M | $Not.: $3.1M | OI: 1583 | 10.9% TotalOI

3.8% StockVolume | 54.5% OptionVolume

1146 unique view(s)

May 25th, 2016

pftq (Official) says on The Tech Trader Wall...

Market back to all-time highs. Both longs and shorts working. $CSC up 30% on merger while $BBY dropped 7% despite beating earnings. Even the $UUP dollar bet is up, which is ironic. Still very long consumer, energy, and healthcare here while being short brick-and-mortar. For whatever reason, Tech Trader is short a bunch of brick-and-mortar mattress companies $MFRM and $TPX; looking forward to see how those turn out.

twgarry (Guest) says on The Tech Trader Wall...

Well done

Sent from my iPhone

>

Sent from my iPhone

>

pftq (Official) says on The Tech Trader Wall...

1233 unique view(s)

May 18th, 2016

pftq (Official) says on The Tech Trader Wall...

Shorted $BBY on $1M puts being bought. Tech Trader just hating on retails even though it's long all other consumers.

zonayev (Guest) says on The Tech Trader Wall...

Tough bet after today's hawkish FOMC minutes. I hope your UUP bet is big enough to offset "short dollar" longs, in case dollar strength continues. Good luck!

Sent from my iPhone

>

Sent from my iPhone

>

1226 unique view(s)

May 17th, 2016

rppp (Guest) says on The Tech Trader Wall...

What does Techtrader say about George Soros’ big short bet against SPY?

pftq (Official) says on The Tech Trader Wall...

The weird thing is we're up with the market down despite our 90% long by

30% short exposure, so it's hard to interpret what that means as in terms

of where S&P500 is going. I would say it almost seems Tech Trader is

agnostic and only cares about Energy, Healthcare, Tech, Consumer here (even

then, it's very idiosyncratic since it's actually also short specific areas

like brick-and-mortor retail).

30% short exposure, so it's hard to interpret what that means as in terms

of where S&P500 is going. I would say it almost seems Tech Trader is

agnostic and only cares about Energy, Healthcare, Tech, Consumer here (even

then, it's very idiosyncratic since it's actually also short specific areas

like brick-and-mortor retail).

pftq (Official) says on The Tech Trader Wall...

Our beta for the year is 0.2 - effectively uncorrelated to the market.

rppp (Guest) says on The Tech Trader Wall...

Exactly why I asked. The chatter in the news media is that Soros has a “big put bet” However Techtrader doesn’t read news which in this case is great.

zonayev (Guest) says on The Tech Trader Wall...

We have a massive 'risk on' rally today (high beta is outperforming low

beta by over 2%). USD is down after a 10-day rally. You must have a high

exposure to Oil and Beta which is saving you today.

beta by over 2%). USD is down after a 10-day rally. You must have a high

exposure to Oil and Beta which is saving you today.

1156 unique view(s)

May 16th, 2016

pftq (Official) says on The Tech Trader Wall...

$AAPL flagging a bottom as well as being near multi-year-support. Older less-used algorithm but interesting to note nonetheless.

1165 unique view(s)

May 13th, 2016

pftq (Official) says on The Tech Trader Wall...

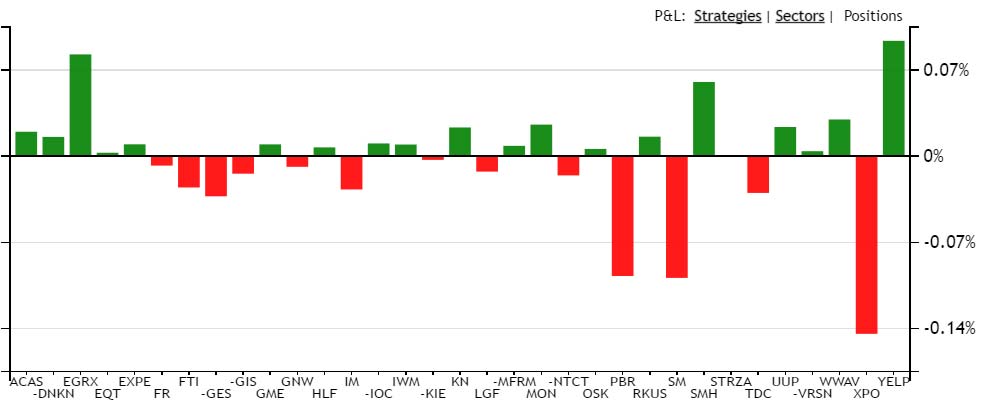

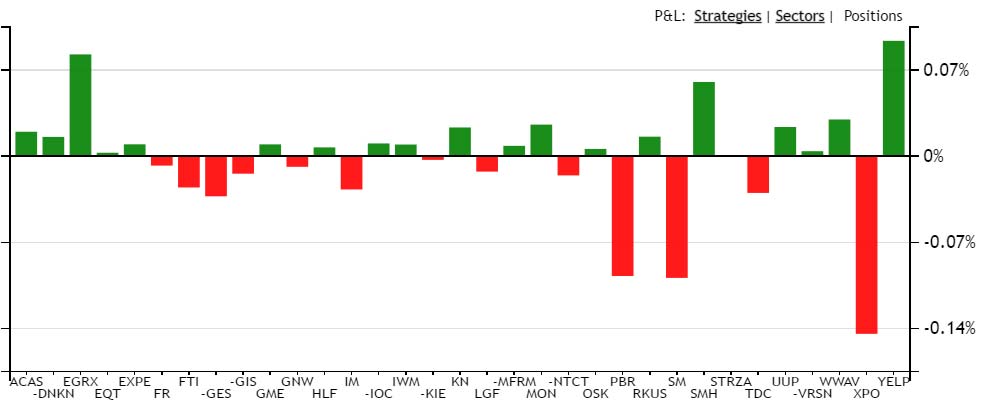

Tech Trader continuing to get longer here, almost 100% long by 30% short. Biggest bets are Consumer, Energy, and then Healthcare. Most interesting names in the last few days are $MON, $STRZA, and $EGRX, which are getting increased buying activity in both stock and options after the initial signals. Tech Trader overall is getting much more idiosyncratic in its bets with long Consumer names like $YELP and $WWAV but also short Consumer names like $MFRM and $DNKN.

zonayev (Guest) says on The Tech Trader Wall...

As I expected, Chinese loan data came out well below consensus. Credit conditions are tightening. Not good for risk.

Sent from my iPhone

>

Sent from my iPhone

>

1134 unique view(s)

May 11th, 2016

pftq (Official) says on The Tech Trader Wall...

Tech Trader's been gradually rotating back into Energy this week: $PBR, $EQT, $FTI, $SM

Looks like it was a play into the oil report today, which caused the energy sector to flip from negative to positive this morning.

Tech Trader overall (if you look at the chart from yesterday) is now mainly long Energy, Consumer, and Healthcare. Again, exposures are at year highs now with longs at 96% and shorts at 33%.

$PBR and $EQT are old favorites of Tech Trader; been in and out of those since March. $FTI and $SM are new ones picked up from risk reversal activity in the options market.

Looks like it was a play into the oil report today, which caused the energy sector to flip from negative to positive this morning.

Tech Trader overall (if you look at the chart from yesterday) is now mainly long Energy, Consumer, and Healthcare. Again, exposures are at year highs now with longs at 96% and shorts at 33%.

$PBR and $EQT are old favorites of Tech Trader; been in and out of those since March. $FTI and $SM are new ones picked up from risk reversal activity in the options market.

zonayev (Guest) says on The Tech Trader Wall...

Chinese data is not out yet. The oil number is bullish but not clear how much of the draw is due to wildfires in Canada. Let's see if Oil holds its gains into close.

Sent from my iPhone

>

Sent from my iPhone

>

1144 unique view(s)

May 10th, 2016

pftq (Official) says on The Tech Trader Wall...

Out of $SPY now but still very long with $PAH, $WWAV, $EGRX, and many other names finally playing out after months of consolidation. Tech Trader remains 90% long by 30% short, the most invested we've been all year since going 60% cash in November. I expect this will continue into the end of Q2 with many people who expect seasonal weakness to be disappointed. If you look at the charts below, many names we have are just now starting to break to the upside.

zonayev (Guest) says on The Tech Trader Wall...

Good luck. Tomorrow's Oil report and Chinese data later this week would set up the tone. I expect loan data from China to be weak. Today buyback window is reopened, so we have incremental buying from fundamental insensitive players.

Sent from my iPhone

>

Sent from my iPhone

>

1116 unique view(s)

May 6th, 2016

twgarry (Guest) says on The Tech Trader Wall...

Nice call on yelp

Sent from my iPhone

>

Sent from my iPhone

>

1033 unique view(s)

May 7th, 2016

zonayev (Guest) says on The Tech Trader Wall...

Good luck. Very important trade data out of China would be released this weekend. If exports miss, I expect continuation of weakness for the rest of the month. And then we have June- very weak seasonal.

Second, USD move last week was quite extreme, seasonality for USD in May is very bullish, so likely we would see more strength in USD, which could keep market rebounds contained.

Sent from my iPhone

>

Second, USD move last week was quite extreme, seasonality for USD in May is very bullish, so likely we would see more strength in USD, which could keep market rebounds contained.

Sent from my iPhone

>

zonayev (Guest) says on The Tech Trader Wall...

Expecting a selloff on Monday. See the link below

http://www.wsj.com/articles/weak-demand-dents-chinas-exports-1462685934

Sent from my iPhone

>

http://www.wsj.com/articles/weak-demand-dents-chinas-exports-1462685934

Sent from my iPhone

>

956 unique view(s)

May 6th, 2016

899 unique view(s)

May 3rd, 2016

zonayev (Guest) says on The Tech Trader Wall...

Did you get another Buy signal? Or more pain tomorrow?

Sent from my iPhone

>

Sent from my iPhone

>

pftq (Official) says on The Tech Trader Wall...

No signals today, just holding.

zonayev (Guest) says on The Tech Trader Wall...

Tomorrow European and Chinese services PMIs are going to be released which could impact USD. DoE oil report would probably be a market mover too. Gasoline inventory component would be important as well as rate of production decline. USD moved a lot today and weaker international data along with weak Oil report could add to further USD strength causing more weakness for equities. Stronger PMI data would weaken USD and cause a rebound in equities.

Good luck.

Sent from my iPhone

>

Good luck.

Sent from my iPhone

>

pftq (Official) says on The Tech Trader Wall...

Great color and information, thanks.

865 unique view(s)

May 2nd, 2016

pftq (Official) says on The Tech Trader Wall...

Tech Trader's once-in-a-blue-moon $SPY signal keeps its 100% hitrate intact yet again. $SPY at $208 from $206.6; current target price is $208.2, which isn't far off. Probably an exit at end of day or tomorrow. The signal normally only happens a few times a year, yet this is our third one a few months into 2016. Very interesting times. So unreal every time we get this signal, but it never fails (knock on wood).

zonayev (Guest) says on The Tech Trader Wall...

Nice! It did rally despite negative Chinese data and weak Oil. Good job!

Sent from my iPhone

>

Sent from my iPhone

>

twgarry (Guest) says on The Tech Trader Wall...

Great job! Love this signal!

Sent from my iPhone

>

Sent from my iPhone

>

914 unique view(s)

April 29th, 2016

pftq (Official) says on The Tech Trader Wall...

zonayev (Guest) says on The Tech Trader Wall...

Will,

Did you get RSI2 buy on SPY?

Thanks!

Sent from my iPhone

>

Did you get RSI2 buy on SPY?

Thanks!

Sent from my iPhone

>

pftq (Official) says on The Tech Trader Wall...

The once-in-a-blue-moon RSI $SPY buy signal triggered at $206.60. The big one is a go!

Again, this signal only happens a few times a year and has a 100% hitrate since inception.

Again, this signal only happens a few times a year and has a 100% hitrate since inception.

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

max.podlone (Guest) says on The Tech Trader Wall...

A picnic? During market hours? Sheesh…

zonayev (Guest) says on The Tech Trader Wall...

Good luck with signals. Macro funds are throwing everything today to contain a selloff. They are buying oil to have market supported. Let's see what happens on Monday!

Sent from my iPhone

>

Sent from my iPhone

>

zonayev (Guest) says on The Tech Trader Wall...

Cool! Good luck. Chinese PMI data is out on Saturday and estimated Saudi oil production data will be released.

Sent from my iPhone

>

Sent from my iPhone

>

818 unique view(s)

April 27th, 2016

pftq (Official) says on The Tech Trader Wall...

$EQT (energy) finally really moving up after a $1M Sept. 75x risk reversal was bought last month. $PBR (Brazil) also continuing higher as usual. It's almost like Tech Trader chose to keep only its best names during its rotation out of the Brazil/Energy trade. On a side note, some of the older RSI2 strategies are calling a short-term bottom to $IBB, so we might see the Biotech/Healthcare trade pick up again as well, which Tech Trader started entering the last few weeks. It's a constant ebb and flow between Energy names performing for us and then Biotech names performing for us.

EQT 9/16/2016 75x Calls, 4000@$2.5999

MV: $1.0M | $Not.: $7.2M | OI: 37 | 41.5% TotalOI

50.5% StockVolume | 49.8% OptionVolume

Leg: EQT 9/16/2016 50x Puts, 4000 on OI of 57

EQT 9/16/2016 75x Calls, 4000@$2.5999

MV: $1.0M | $Not.: $7.2M | OI: 37 | 41.5% TotalOI

50.5% StockVolume | 49.8% OptionVolume

Leg: EQT 9/16/2016 50x Puts, 4000 on OI of 57