Comparing Options Contracts

Bitcoin Options Price Feed Data and Analysis on LedgerX

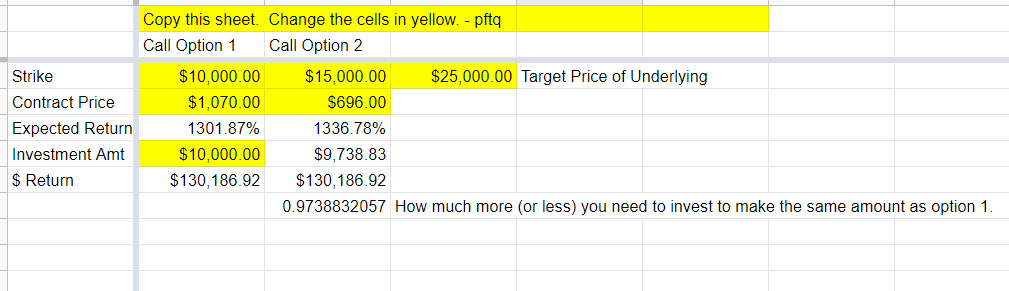

This is a spreadsheet I created to compare what call or put options are best to buy, specifically using this for Bitcoin options on LedgerX but can be used with any options really. You can essentially use this as an API for LedgerX options price data into your own scripts as well by using the ImportRange function.https://docs.google.com/spreadsheets/d/1dZbFjCrr2FykdPvE4UVLp8kOO5Iox9lmctSmfqSTq1I/edit#gid=0

Sometimes the further out of money contract actually has less upside than something in the money, and this sheet makes it easier to see. It also tells you how much money you need to have in another contract to make the same return as the first, so you can have less money tied up in one place.

As a live example using this, you can see currently that the December 15K strike calls for Bitcoin are not worth buying, that you'll make more buying the 10K strike unless Bitcoin goes above $25K by December. Going up any less would lead to the 10K strike making more.

Using this, you can also find the minimum cash to make $1M on $BTC going to $100K by Dec. 2020:

- $10K strike: $30K

- $25K strike: $12K

- $50K strike: $6K

You lose everything if the strike isn't hit in 1.5 yrs, but you avoid locking up $80K if directly invested in BTC instead.

Last Updated Jan 31st, 2020 | 1265 unique view(s)

Added tabs pulling live Bitcoin options data and prices from @LedgerX's API. Anyone else can also pull from this sheet into their own Googlesheet or Excel with Import Range: https://docs.google.com/spreadsheets/d/1dZbFjCrr2FykdPvE4UVLp8kOO5Iox9lmctSmfqSTq1I/edit#gid=1326954055

Added rough estimate of deltas to be able to see what contracts would move most: https://docs.google.com/spreadsheets/d/1dZbFjCrr2FykdPvE4UVLp8kOO5Iox9lmctSmfqSTq1I/edit#gid=1326954055

ETH contracts added to the sheet: https://docs.google.com/spreadsheets/d/1dZbFjCrr2FykdPvE4UVLp8kOO5Iox9lmctSmfqSTq1I/edit#gid=1584230668