1268 unique view(s)

Updates by Tech Trader, a fully autonomous trading system with no human intervention.

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

pftq (Official) says on The Tech Trader Wall...

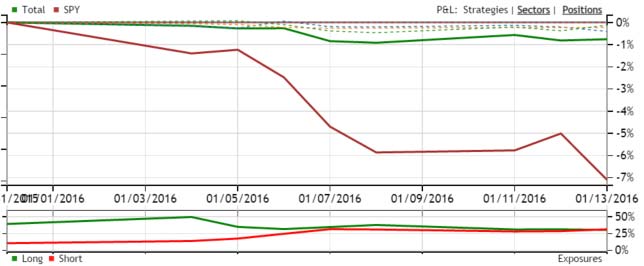

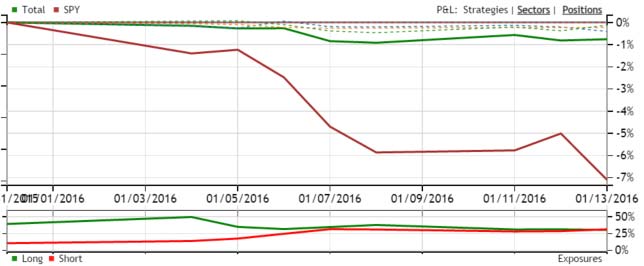

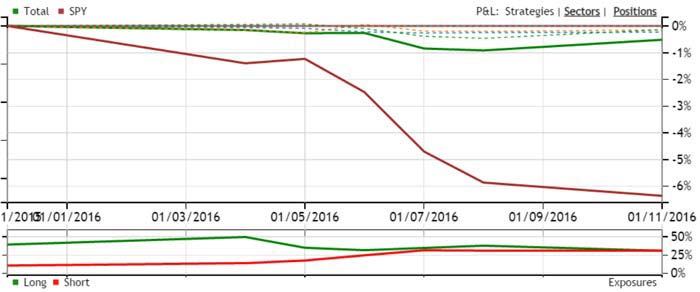

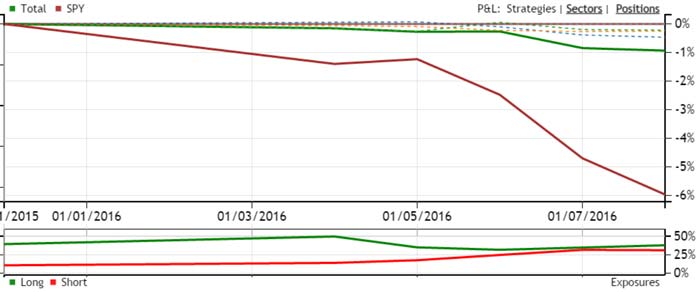

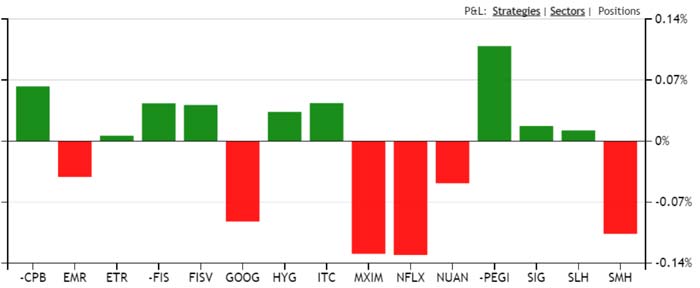

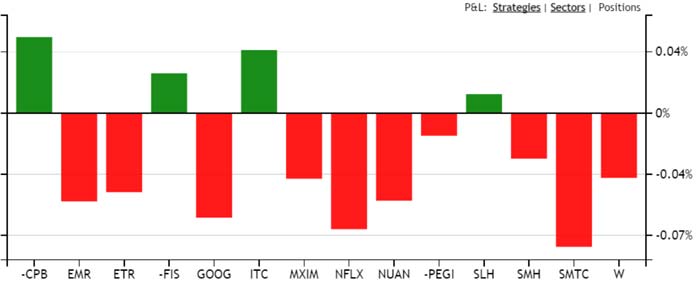

Pretty incredible day. Market down another 2% while Tech Trader is actually slightly up. Tech Trader now solidly outperforming SPY by over 6%. Exposures actually net short now at 31% long by 35% short. Still waiting for the Tech Trader to call a bottom with its once-in-a-blue-moon RSI2 SPY signal but just awesome to be making money on the way down as well.

pftq (Official) says on The Tech Trader Wall...

Yet another name shorted by Tech Trader, this time in energy. Tech Trader now slightly net short at 31% long by 35% short.

Below is the options activity for TSO:

TSO 2/5/2016 90x Puts, 7650@$2.9

MV: $2.2M | $Not.: $22.4M | OI: 25 | 5.6% TotalOI

7.7% StockVolume | 45.2% OptionVolume

Below is the options activity for TSO:

TSO 2/5/2016 90x Puts, 7650@$2.9

MV: $2.2M | $Not.: $22.4M | OI: 25 | 5.6% TotalOI

7.7% StockVolume | 45.2% OptionVolume

1181 unique view(s)

January 11th, 2016

pftq (Official) says on The Tech Trader Wall...

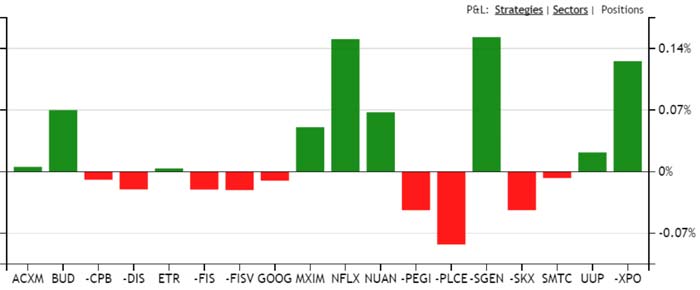

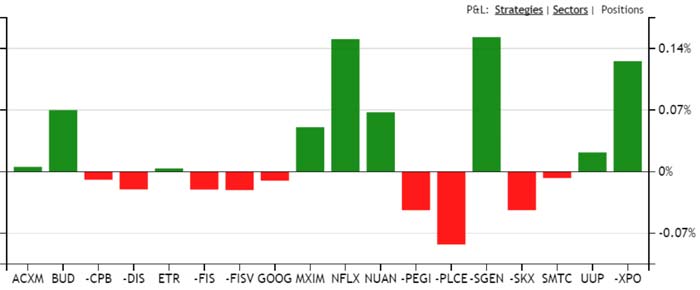

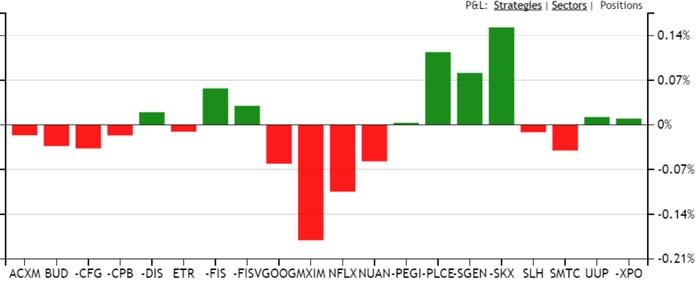

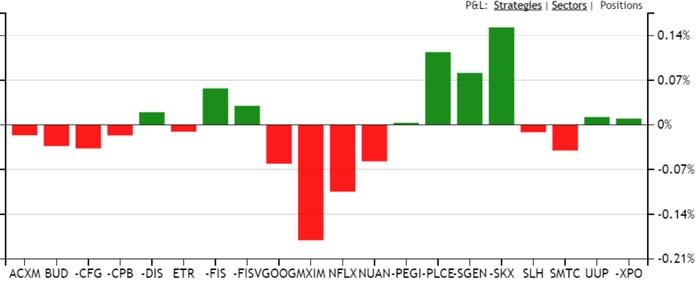

Tech Trader up half a percent today despite the market being down. Exposures are exactly 31% long by 31% short, over 60% in cash. Both sides are making money thanks to names like being long NFLX and short XPO and SGEN. Still no bottom signals yet.

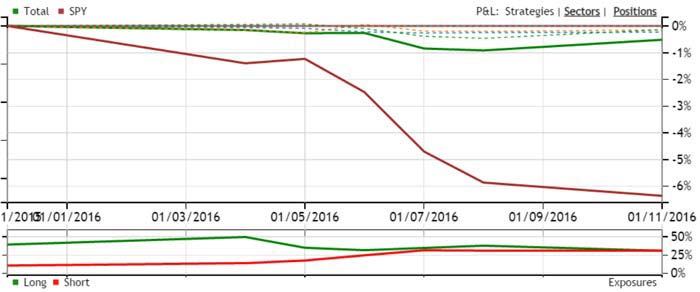

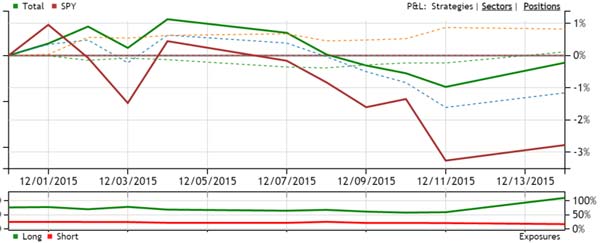

Year-to-date putting even more distance between Tech Trader and the market (TT now still flat while the market down over 6%).

Year-to-date putting even more distance between Tech Trader and the market (TT now still flat while the market down over 6%).

pftq (Official) says on The Tech Trader Wall...

Another financial name shorted based on options activity. Pretty hilarious as it's basically wealth management, which I frequently hate on. Tech Trader giving me a chance to express my hatred of these guys.

Signal on which it was shorted below:

FNGN 3/18/2016 30x Puts, 857@$2.2999

MV: $0.2M | $Not.: $1.1M | OI: 15 | 78.3% TotalOI

12.5% StockVolume | 85.4% OptionVolume

Signal on which it was shorted below:

FNGN 3/18/2016 30x Puts, 857@$2.2999

MV: $0.2M | $Not.: $1.1M | OI: 15 | 78.3% TotalOI

12.5% StockVolume | 85.4% OptionVolume

875 unique view(s)

January 8th, 2016

pftq (Official) says on The Tech Trader Wall...

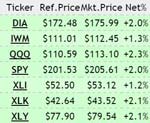

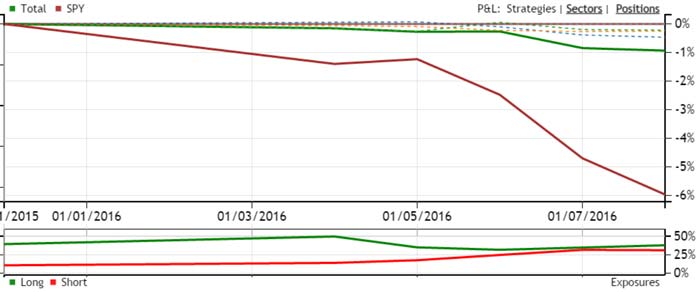

Another down day - 1% down on SPY - even though it opened with gap up; SPY is below $192 now, when it seemed strange enough that Tech Trader wasn't buying below $200.

Tech Trader again unaffected, flat for the day and continuing to remain 60% in cash, 38% long in mainly tech names, and 31% short in mainly consumer/financials. Again, just very interesting that Tech Trader has yet to send any bottom signals on SPY or the sector ETFs; will be all the more exciting when it finally makes its first move, especially on the once-in-a-blue-moon RSI2 SPY signal.

Tech Trader again unaffected, flat for the day and continuing to remain 60% in cash, 38% long in mainly tech names, and 31% short in mainly consumer/financials. Again, just very interesting that Tech Trader has yet to send any bottom signals on SPY or the sector ETFs; will be all the more exciting when it finally makes its first move, especially on the once-in-a-blue-moon RSI2 SPY signal.

874 unique view(s)

January 7th, 2016

pftq (Official) says on The Tech Trader Wall...

Tech Trader closing the day down slightly at about half a percent, but it's nothing compared to the 2.4% the rest of the market is down. Exposures are still very tight and actually getting tighter by shorting financial names today rather than trying to buy this dip. Current exposures are now 35% long by 31% short (60% in cash).

The rest of us here are on the edge of our seats waiting for when Tech Trader finally fires off its bottom signals and more importantly, the once-in-a-blue-moon RSI2 SPY signal to put that 60% cash to use.

The rest of us here are on the edge of our seats waiting for when Tech Trader finally fires off its bottom signals and more importantly, the once-in-a-blue-moon RSI2 SPY signal to put that 60% cash to use.

pftq (Official) says on The Tech Trader Wall...

SPY below $195 now in premarket after China again hitting circuit breakers for 7% down overnight. Pretty amazing how Tech Trader basically positioned itself to dodge this and has chosen this one time to not buy the dip yet. It's almost like Tech Trader has been waiting for this to happen in the market. Will be all the more amazing when Tech Trader finally spins around and starts buying.

pftq (Official) says on The Tech Trader Wall...

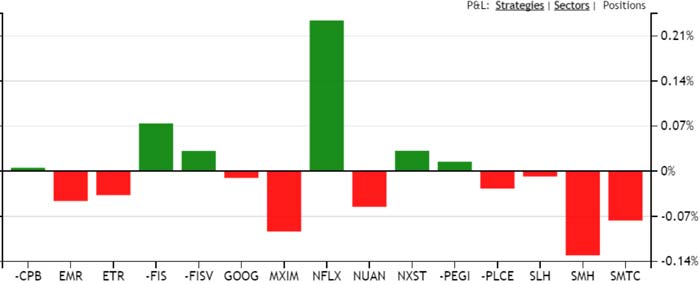

Tech Trader again actually up today while the market is down 1.5% thanks to strong selection. Biggest gainer today is literally the short XPO from yesterday.

pftq (Official) says on The Tech Trader Wall...

Tech Trader signals both live and older Trendline signals starting to move from short consumer to short financials. Names include CFG (shorting at close) and older trendline short signals on JPM, MCY, PB, SLF, etc.

Very interesting how we are seeing this sector rolling effect on the sell off.

Very interesting how we are seeing this sector rolling effect on the sell off.

813 unique view(s)

January 6th, 2016

pftq (Official) says on The Tech Trader Wall...

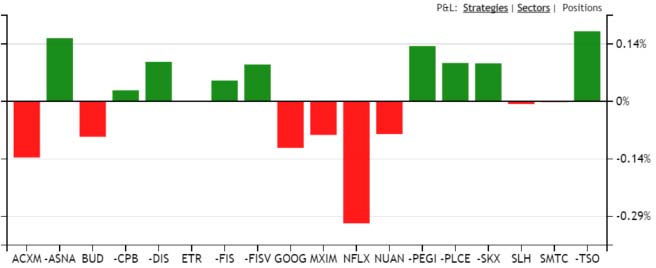

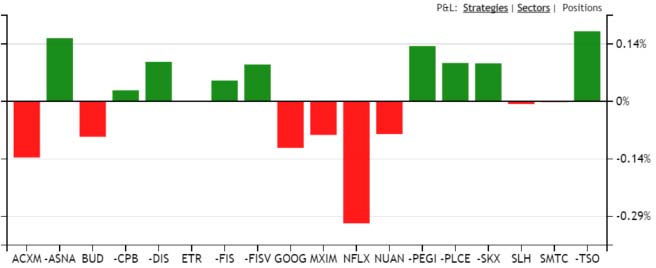

Tech Trader still refusing to buy this dip even after SPY got below $198 and is actually getting even more conservative by shorting DIS, SKX, and XPO at the close. It'll be truly exciting when Tech Trader decides to buy SPY again on its once-in-a-blue-moon RSI2 signal. Total exposure is now 31% long by 17% short with most longs being in tech and most shorts being in consumer.

Tech Trader is slightly up today despite the market being down almost 2%, thanks to strong stock selection catching NFLX today up 8%.

Year-to-date, Tech Trader is essentially flat while SPY has sold off 3%.

Tech Trader is slightly up today despite the market being down almost 2%, thanks to strong stock selection catching NFLX today up 8%.

Year-to-date, Tech Trader is essentially flat while SPY has sold off 3%.

pftq (Official) says on The Tech Trader Wall...

SPY back below $200 with Tech Trader still over 60% in cash. Looking forward to when we get bottom signals or the once in a blue moon SPY RSI2 signal.

pftq (Official) says on The Tech Trader Wall...

Tech Trader currently down only about 0.3% while the market market down over a percent. Pretty hilarious that CNBC just said the only stock positive in the Dow is Walmart (WMT), mentioned yesterday as the long side of a pair trade (STNG short also working).

pftq (Official) says on The Tech Trader Wall...

Tech Trader positive now with market down 1% thanks to sudden 6% jump in NFLX.

775 unique view(s)

January 5th, 2016

pftq (Official) says on The Tech Trader Wall...

Interesting pair trade showing up on one of my older Trendline strategies - long WMT (Walmart) and short STNG (transportation). Again, these are older ones no longer run automatically but still interesting to monitor and get more color on the markets.

781 unique view(s)

January 4th, 2016

pftq (Official) says on The Tech Trader Wall...

Great start to the year. Overall market down 1.5% (at one point down over 2%) with Tech Trader down only 0.2%, essentially flat, and slowly increasing long exposure with two new names so far (HYG and SIG). Still 35% long only by 18% short (>60% cash).

pftq (Official) says on The Tech Trader Wall...

Seeing the China market chaos overnight combined with Dow down 300 pts before open explains why Tech Trader is positioned as conservative as it is for the new year.

pftq (Official) says on The Tech Trader Wall...

Massive call bet on SIG identified by Tech Trader. Almost $1M in 5% out-of-the-money calls expiring in 2 weeks.

SIG 1/15/2016 135x Calls, 5000@$1.8999

MV: $0.9M | $Not.: $15.0M | OI: 566 | 12.5% TotalOI

8.8% StockVolume | 42.3% OptionVolume

SIG 1/15/2016 135x Calls, 5000@$1.8999

MV: $0.9M | $Not.: $15.0M | OI: 566 | 12.5% TotalOI

8.8% StockVolume | 42.3% OptionVolume

668 unique view(s)

January 3rd, 2016

pftq (Official) says on The Tech Trader Wall...

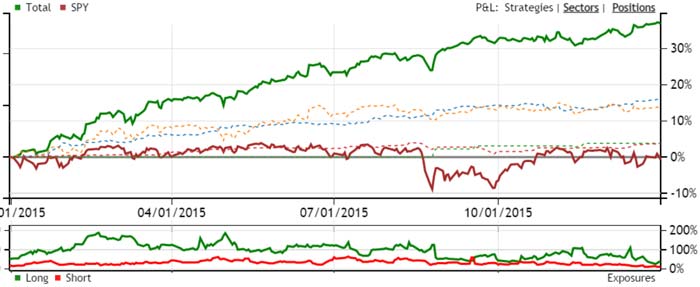

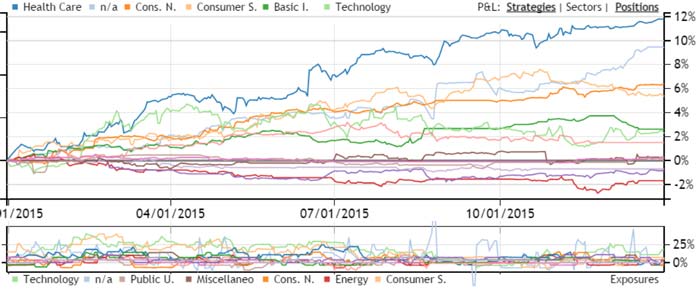

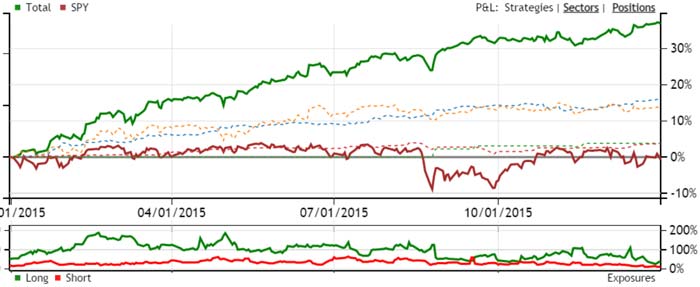

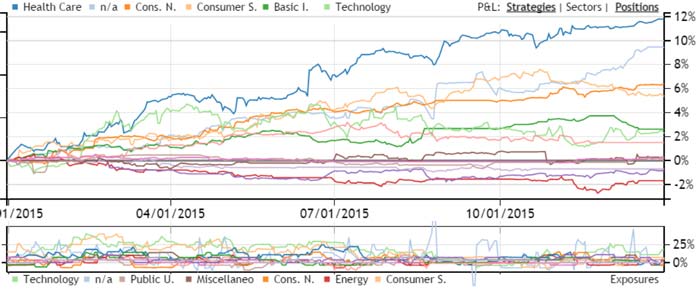

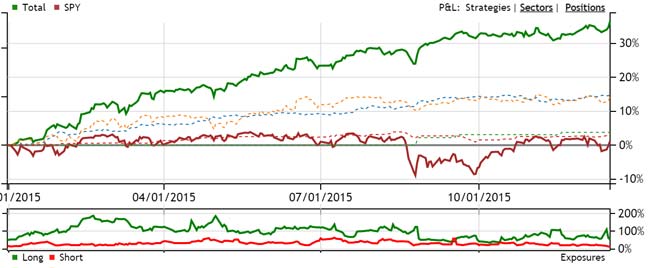

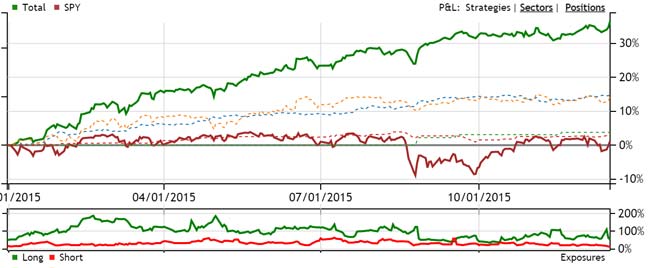

Tech Trader closed out 2015 with a very conservative long exposure of 39% and short exposure of 11%, a grand total of 13 names being held into the new year which is near the lowest exposure all year. Overall, performance of the strategies in aggregate has been about 35% with a beta of 0.39, alpha of 31% vs S&P500 which was essentially flat.

661 unique view(s)

December 21st, 2015

pftq (Official) says on The Tech Trader Wall...

Intraday bottom signals in XLV and IBB today. Already holding SMH and XLB from Friday afternoon as well (those snuck in right before the close). Personally hoping we keep going lower so we can really load up on more bottom signals before the bounce.

pftq (Official) says on The Tech Trader Wall...

lmao the price swing in IBB is so extreme ($3=1% in 30 min) that Tech Trader just sold it right back. This is probably the first time I've seen it daytrade. Keep in mind I don't explicitly code any sense of time in the system; it's all about price action. This just shows how illiquid and whippy the markets are right now.

665 unique view(s)

December 18th, 2015

pftq (Official) says on The Tech Trader Wall...

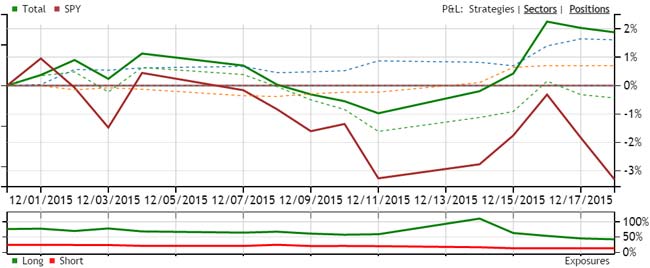

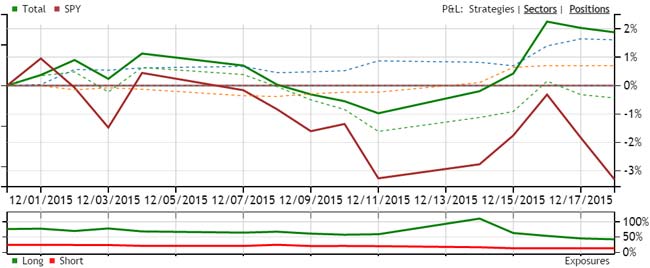

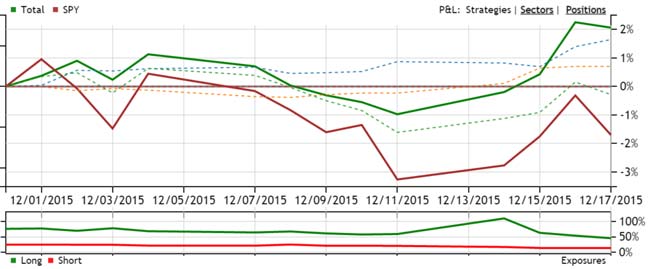

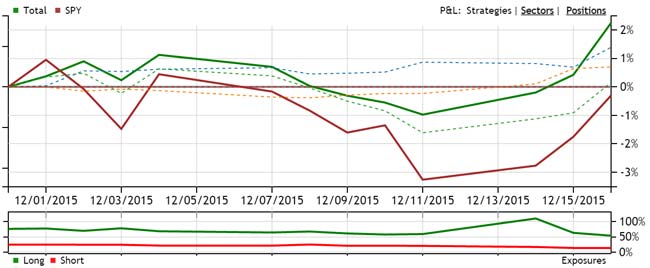

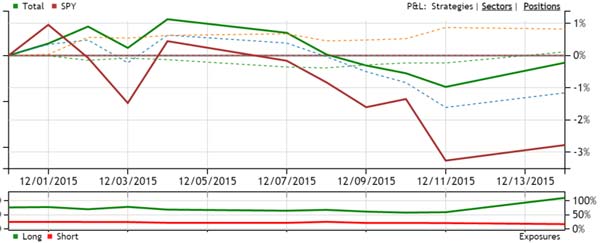

Market down almost a percent already; Tech Trader is again flat for the day and now holding 5% lead over SPY for the month. Tech Trader's immediate move back to 50% in cash right on day of Fed announcement was essentially the high of the market and couldn't have been timed better.

pftq (Official) says on The Tech Trader Wall...

Market down over 1.5% now with Tech Trader still essentially flat. Really stoked for next week to see if we get one last once-in-a-blue-moon SPY buy signal before end of year.

pftq (Official) says on The Tech Trader Wall...

More finance names breaking down on Trendlines today: AFG, MCY, THG, WRB

610 unique view(s)

December 17th, 2015

pftq (Official) says on The Tech Trader Wall...

Market giving back most of the gains from yesterday (down almost 1%) while Tech Trader is down 0.1%, literally 50% in cash.

Tech Trader actually getting even more neutral here and slowly picking up shorts in Financials, two notable names today FIS on the breakout/breakdown strategy and AJG on an older discontinued but still interesting to note Trendlines strategy. Another interesting name on the older Trendlines strategy would be EYES breaking to the upside.

Tech Trader actually getting even more neutral here and slowly picking up shorts in Financials, two notable names today FIS on the breakout/breakdown strategy and AJG on an older discontinued but still interesting to note Trendlines strategy. Another interesting name on the older Trendlines strategy would be EYES breaking to the upside.

pftq (Official) says on The Tech Trader Wall...

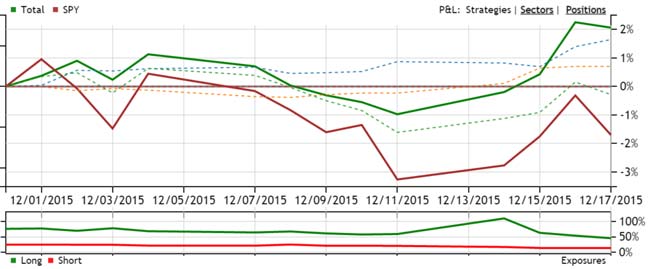

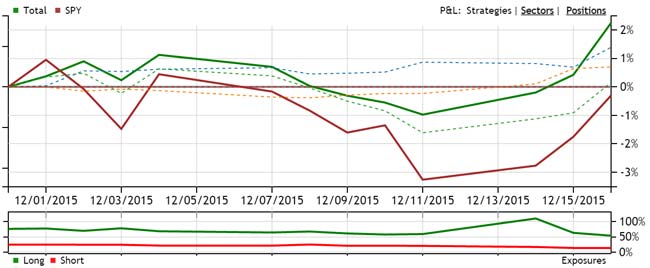

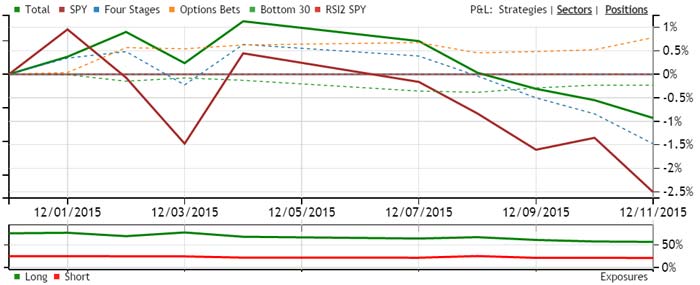

Market down over a percent and Tech Trader essentially flat. The MTD chart really highlights how Tech Trader is essentially just capturing the up-moves while sidestepping the selloffs.

611 unique view(s)

December 16th, 2015

pftq (Official) says on The Tech Trader Wall...

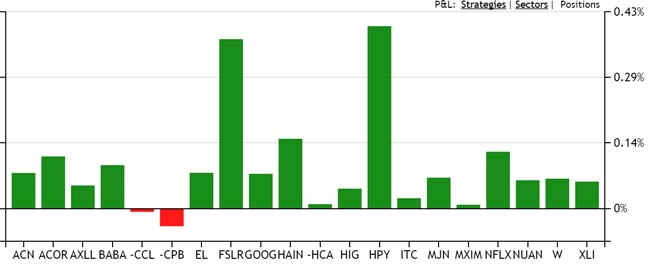

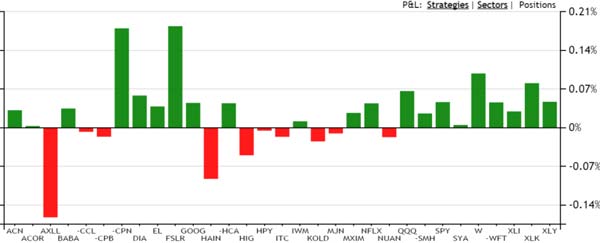

Tech Trader up almost 2% today while SPY up 1.4% after Fed. This and Tech Trader is only 50% long by 15% short (50% in cash) after scaling out of its ETF positions yesterday. MTD maintaining its 3% lead above SPY and YTD at new highs.

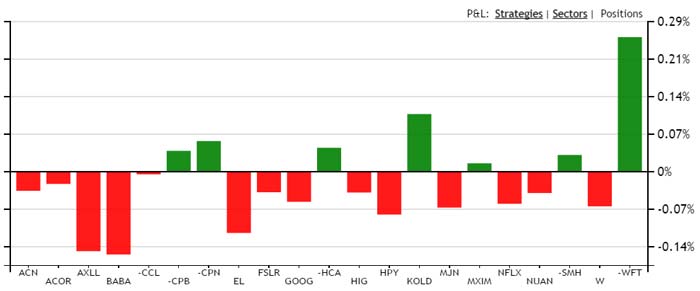

The best part is that the bulk of performance came not from the market rally but from individual names (HPY, FSLR, HAIN...) that each had idiosyncratic news.

The best part is that the bulk of performance came not from the market rally but from individual names (HPY, FSLR, HAIN...) that each had idiosyncratic news.

543 unique view(s)

December 15th, 2015

pftq (Official) says on The Tech Trader Wall...

543 unique view(s)

December 14th, 2015

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

Excellent day today. Tech Trader came in with a flood of intraday bottom buys on nearly every sector/index ETF at $201 on SPY this morning; SPY just closed at $203. Today, Tech Trader is up nearly a percent while SPY is up half that. Lastly, Tech Trader is finally coming out of being 40% in cash only after it has missed the sell off in SPY. Month-to-date, Tech Trader has almost a 3% lead over SPY performance with nowhere near the volatility/drawdown. Great example today how we maintain performance while only being 0.4 beta.

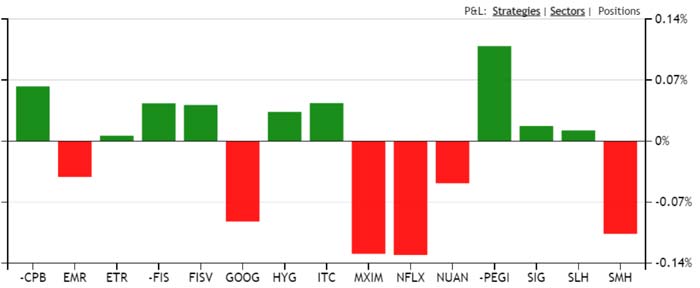

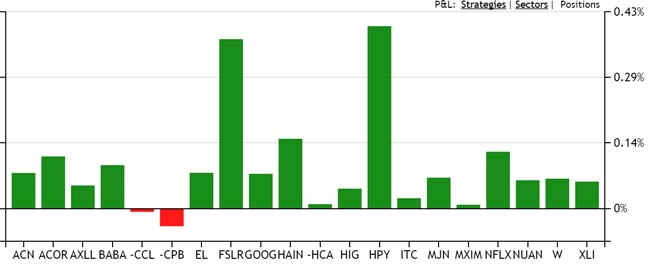

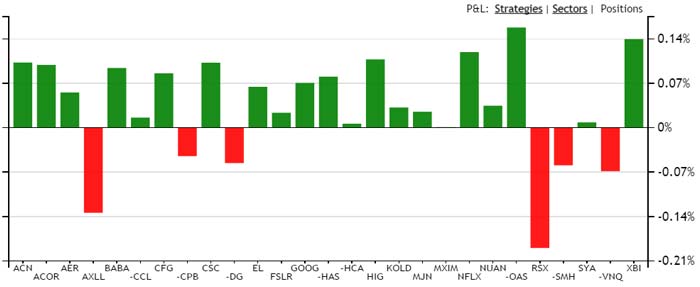

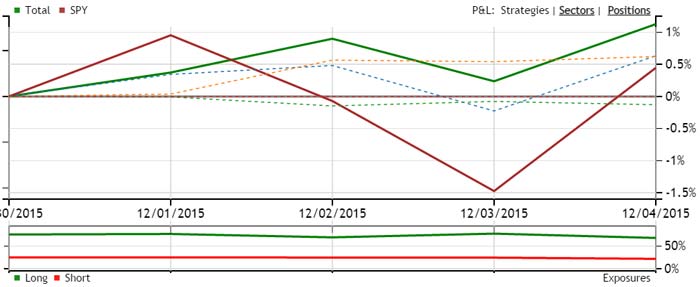

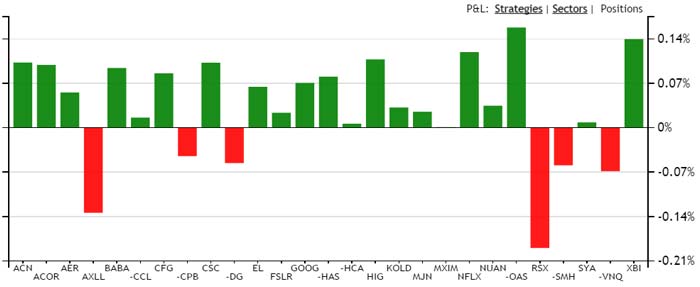

Tech Trader's performance today (~1%):

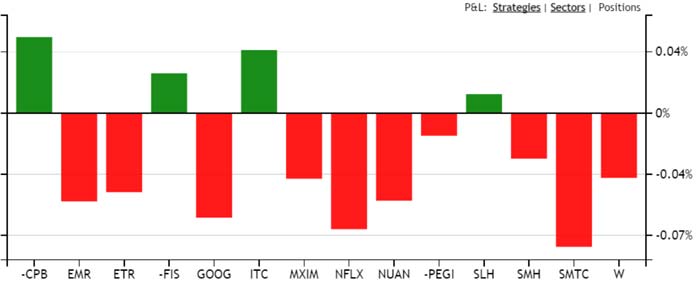

Tech Trader vs SPY MTD (flat with SPY down almost 3%):

Tech Trader's performance today (~1%):

Tech Trader vs SPY MTD (flat with SPY down almost 3%):

pftq (Official) says on The Tech Trader Wall...

Tech Trader's intraday bottom buys just fired on nearly every sector and index ETF just now on SPY's dip to $201. Long exposure literally went from 60% to 90% in the last hour. Tech Trader finally waking up now and putting cash to use.

No daily SPY bottom yet though (the highest conviction once-in-a-blue-moon signal). That one will be the big one.

No daily SPY bottom yet though (the highest conviction once-in-a-blue-moon signal). That one will be the big one.

pftq (Official) says on The Tech Trader Wall...

KOLD finally above $200 (short natgas ETF) and being closed out by Tech Trader. Amazing trade and pretty much a poster child for our options orderflow strategy (nailing both the entry at $150 and the target price of $200).

Again, here's the original signal from November:

KOLD 1/15/2016 200x Calls, 300@$6.4

MV: $0.2M | $Not.: $1.1M | OI: 0 | 11.8% TotalOI

87.8% StockVolume | 43.7% OptionVolume

And here's the trade:

Again, here's the original signal from November:

KOLD 1/15/2016 200x Calls, 300@$6.4

MV: $0.2M | $Not.: $1.1M | OI: 0 | 11.8% TotalOI

87.8% StockVolume | 43.7% OptionVolume

And here's the trade:

521 unique view(s)

December 11th, 2015

pftq (Official) says on The Tech Trader Wall...

Each time the market sells off sharply, Tech Trader yet again outperforms the market and shows why it positioned 30-40% cash since November while being very hedged in remaining positions (60% long by 20% short). Today, the market is down over a percent and Tech Trader is down less than half a percent.

Biggest winners today are again short names in energy/oil which have been set up for a while. OAS has been closed out, but KOLD (short natgas) and more recently short WFT are now main proxies for this.

KOLD, which we thought was insane for Tech Trader to project $200 target price on from $150 a couple weeks ago, is now $190.

Original signal below:

KOLD 1/15/2016 200x Calls, 300@$6.4

MV: $0.2M | $Not.: $1.1M | OI: 0 | 11.8% TotalOI

87.8% StockVolume | 43.7% OptionVolume

More recently, WFT was shorted at $9.20 due to someone buying $3.4M in premium on Feb 9x puts; WFT is already below $9 now.

Original signal below:

WFT 2/19/2016 9x Puts, 30000@$1.12

MV: $3.4M | $Not.: $11.0M | OI: 14389 | 11.0% TotalOI

40.3% StockVolume | 53.2% OptionVolume

Month to date for Dec, Tech Trader is down slightly but now holding over a 1.5% lead on SPY with half the volatility and 0.34 beta. Personally hoping we sell off more so we can get our once-in-a-blue-moon RSI2 SPY signal again and just kill it for the end of year.

Biggest winners today are again short names in energy/oil which have been set up for a while. OAS has been closed out, but KOLD (short natgas) and more recently short WFT are now main proxies for this.

KOLD, which we thought was insane for Tech Trader to project $200 target price on from $150 a couple weeks ago, is now $190.

Original signal below:

KOLD 1/15/2016 200x Calls, 300@$6.4

MV: $0.2M | $Not.: $1.1M | OI: 0 | 11.8% TotalOI

87.8% StockVolume | 43.7% OptionVolume

More recently, WFT was shorted at $9.20 due to someone buying $3.4M in premium on Feb 9x puts; WFT is already below $9 now.

Original signal below:

WFT 2/19/2016 9x Puts, 30000@$1.12

MV: $3.4M | $Not.: $11.0M | OI: 14389 | 11.0% TotalOI

40.3% StockVolume | 53.2% OptionVolume

Month to date for Dec, Tech Trader is down slightly but now holding over a 1.5% lead on SPY with half the volatility and 0.34 beta. Personally hoping we sell off more so we can get our once-in-a-blue-moon RSI2 SPY signal again and just kill it for the end of year.

pftq (Official) says on The Tech Trader Wall...

Some new longs the last few days have been in consumer. It looks like Tech Trader might be slowly rotating back into consumer here after things have sold off so much. HAIN is the most interesting one today, with $1.8M bought in a single call trade. Note the expiration the calls though (May next year); it's almost like a value play and not a short term bounce that TT is looking for here.

HAIN 5/20/2016 40x Calls, 5000@$3.65

MV: $1.8M | $Not.: $10.1M | OI: 336 | 23.1% TotalOI

13.8% StockVolume | 87.3% OptionVolume

HAIN 5/20/2016 40x Calls, 5000@$3.65

MV: $1.8M | $Not.: $10.1M | OI: 336 | 23.1% TotalOI

13.8% StockVolume | 87.3% OptionVolume

pftq (Official) says on The Tech Trader Wall...

S&P down almost 2% now. Tech Trader not moving at all and still only down half a percent.

535 unique view(s)

December 7th, 2015

pftq (Official) says on The Tech Trader Wall...

Market open down slightly today but oil and other energy-related instruments are down a lot again. Really good for our positioning in KOLD (short natgas) and OAS (short oil).

pftq (Official) says on The Tech Trader Wall...

KOLD is up 18% since we entered it. (it's an inverse ETF on natgas, so we're bearish on natgas)

The original signal was someone betting that KOLD would get to 200x from 150 by Jan, which seemed crazy, but here we are at 172 already. Pretty amazing stuff.

KOLD 1/15/2016 200x Calls, 300@$6.4

MV: $0.2M | $Not.: $1.1M | OI: 0 | 11.8% TotalOI

87.8% StockVolume | 43.7% OptionVolume

The original signal was someone betting that KOLD would get to 200x from 150 by Jan, which seemed crazy, but here we are at 172 already. Pretty amazing stuff.

KOLD 1/15/2016 200x Calls, 300@$6.4

MV: $0.2M | $Not.: $1.1M | OI: 0 | 11.8% TotalOI

87.8% StockVolume | 43.7% OptionVolume

pftq (Official) says on The Tech Trader Wall...

Huge call buying on AMJ just now. $2.8M in premium on just out of the money calls.

AMJ 3/18/2016 26x Calls, 19528@$1.4099

MV: $2.8M | $Not.: $19.4M | OI: 0 | 28.5% TotalOI

10.2% StockVolume | 75.8% OptionVolume

AMJ 3/18/2016 26x Calls, 19528@$1.4099

MV: $2.8M | $Not.: $19.4M | OI: 0 | 28.5% TotalOI

10.2% StockVolume | 75.8% OptionVolume

525 unique view(s)

December 4th, 2015

pftq (Official) says on The Tech Trader Wall...

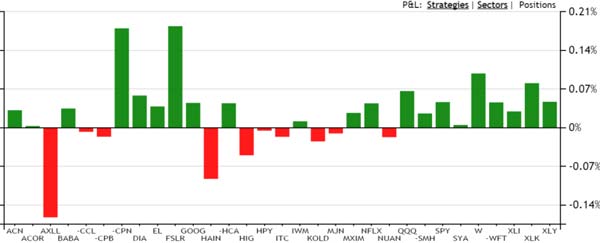

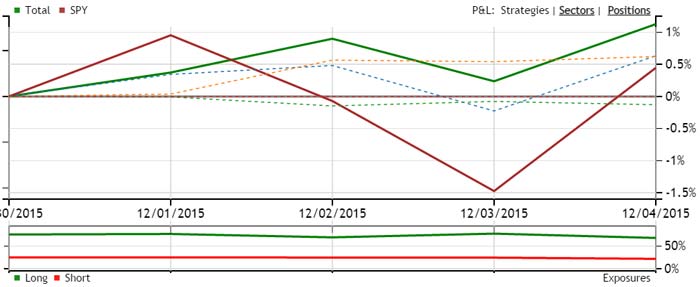

Oil getting crushed now due to OPEC not cutting. Tech Trader positioned beautifully by being hugely short oil/energy names while being net long overall in tech and other names least affected by oil. The icing on the cake is SPY is actually up almost a percent today as well while oil/energy names are down almost 10% a piece.

Naturally you see Tech Trader's long and short positions both doing very well today.

Month-to-date, Tech Trader continues to outperform SPY by a percent with half the volatility.

Naturally you see Tech Trader's long and short positions both doing very well today.

Month-to-date, Tech Trader continues to outperform SPY by a percent with half the volatility.

pftq (Official) says on The Tech Trader Wall...

Very awesome trade in OAS (still holding until close). It shorted this name a month ago due to noticing large buyers of 10-strike December puts in OAS when OAS itself was $12, and now OAS is at $9.40, well below $10. This is the kind of stuff Tech Trader picks up on.

Here's the original orderflow info TT saw back from Nov.13:

OAS 12/18/2015 10x Puts, 12260@$0.75

MV: $0.9M | $Not.: $3.8M | OI: 1189 | 7.9% TotalOI

11.6% StockVolume | 53.2% OptionVolume

Here's the original orderflow info TT saw back from Nov.13:

OAS 12/18/2015 10x Puts, 12260@$0.75

MV: $0.9M | $Not.: $3.8M | OI: 1189 | 7.9% TotalOI

11.6% StockVolume | 53.2% OptionVolume

511 unique view(s)

December 3rd, 2015

pftq (Official) says on The Tech Trader Wall...

Going to be awesome if we can get yet another once-in-a-blue-moon RSI2 SPY bottom. Supposed to only happen a couple times a year and we've already had 3 in 2015. Price has to get below $206 first though to start be considered.