509 unique view(s)

Updates by Tech Trader, a fully autonomous trading system with no human intervention.

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

pftq (Official) says on The Tech Trader Wall...

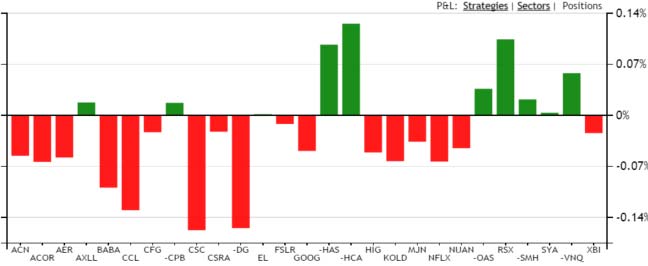

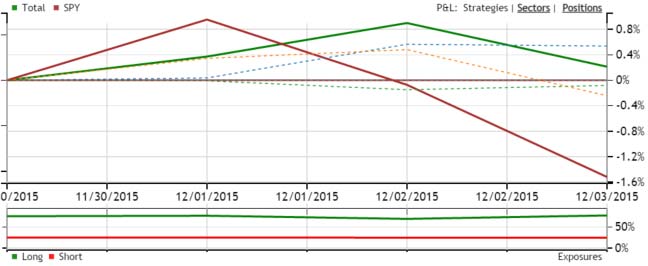

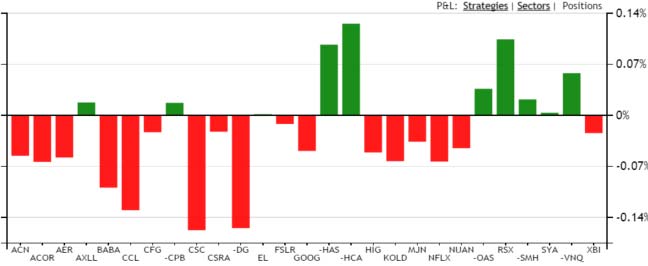

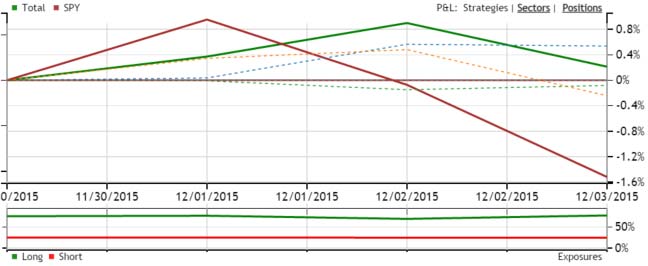

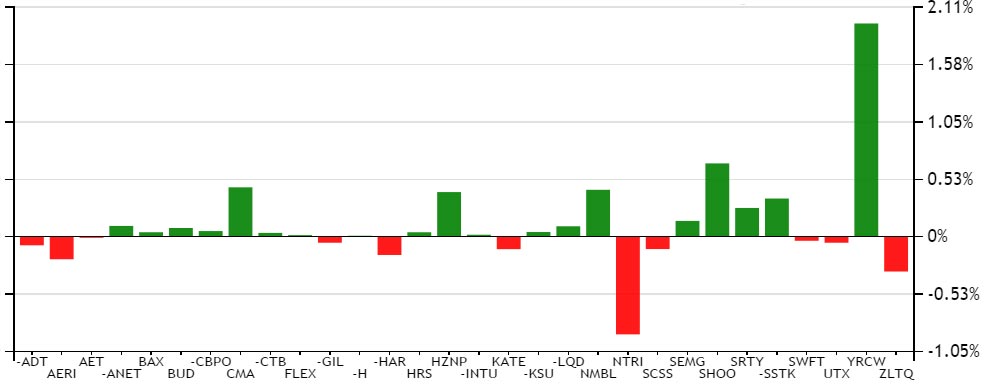

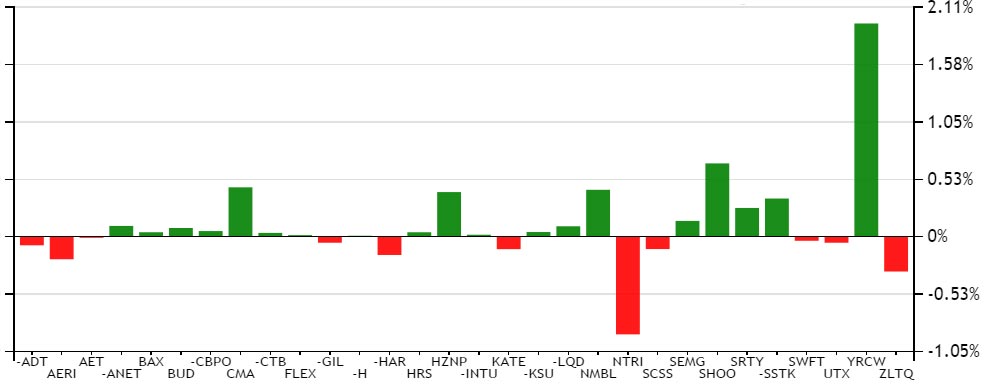

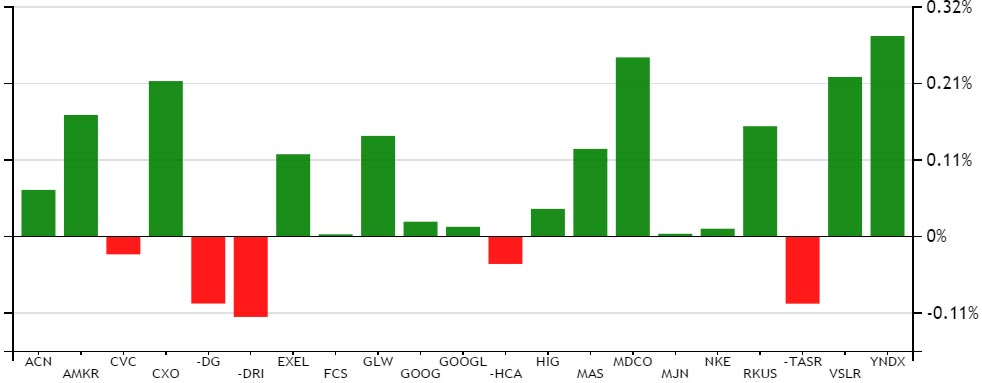

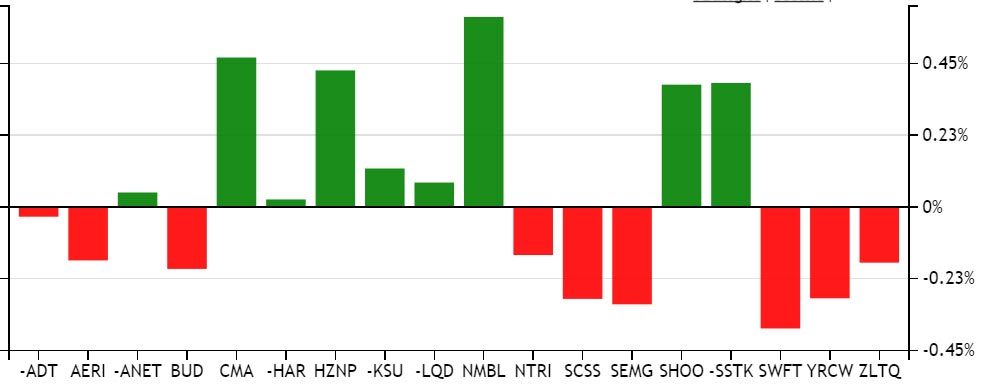

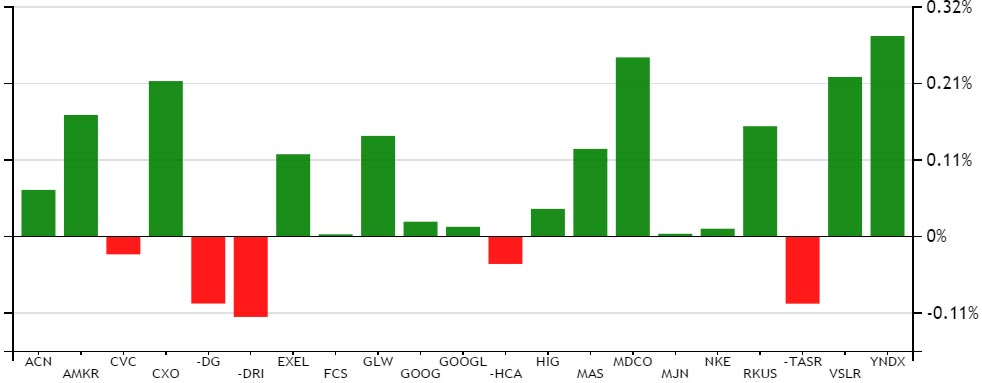

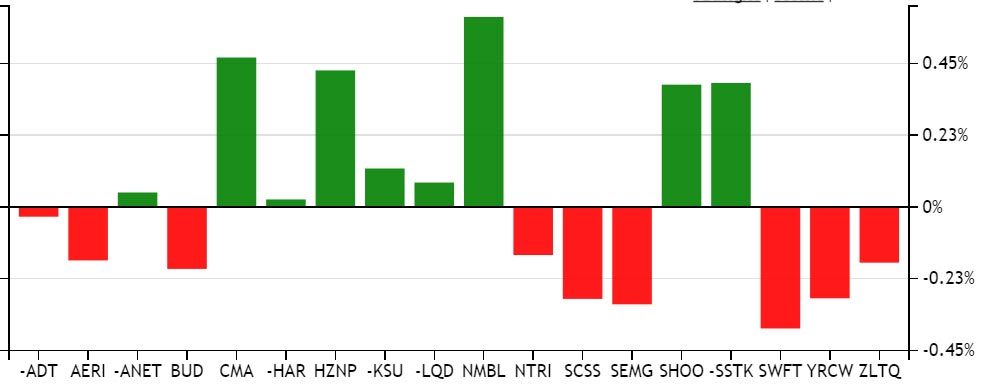

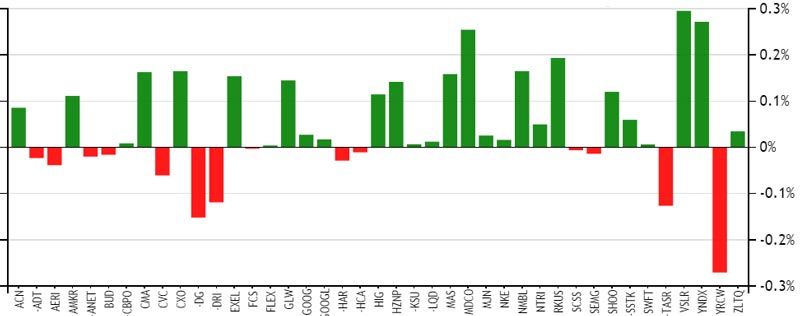

Very strong day again. Tech Trader down a bit at -0.5%, but SPY is down over a percent. The stock selection really shines today with Tech Trader still being 75% long and 25% short (25% in actual cash). Again Tech Trader is short a lot of retail and oil names (KOLD, OAS, HAS...) while being long tech/cybersecurity/internet (PANW, BABA, NFLX...). We also just got an intraday bottom signal in XBI at the last hour; usually we get a couple more ETFs before the real bounce but we'll see.

Month-to-date Tech Trader is slightly positive vs SPY being down about 1.5%. Situations like this show how Tech Trader outperforms the market while maintaining a low beta of 0.4.

My hope now is actually for the market to sell off further not only to really show Tech Trader's selection strength but to also get my highest conviction RSI2 SPY bottom signal, but it's only a hope.

Month-to-date Tech Trader is slightly positive vs SPY being down about 1.5%. Situations like this show how Tech Trader outperforms the market while maintaining a low beta of 0.4.

My hope now is actually for the market to sell off further not only to really show Tech Trader's selection strength but to also get my highest conviction RSI2 SPY bottom signal, but it's only a hope.

pftq (Official) says on The Tech Trader Wall...

Ugh, lost my signal. So aggravating.

495 unique view(s)

December 2nd, 2015

pftq (Official) says on The Tech Trader Wall...

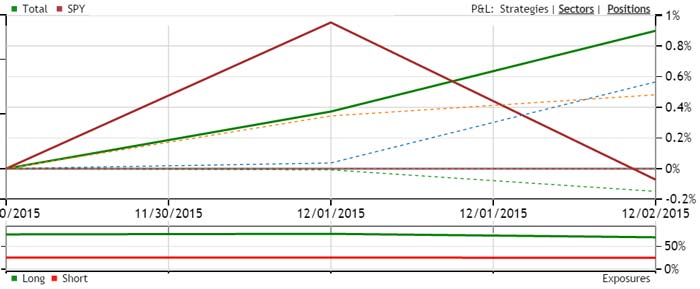

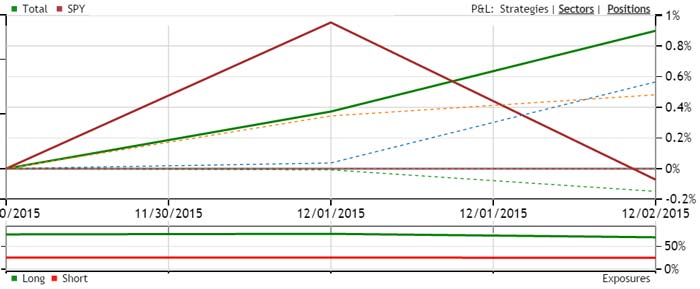

Very strong day. Tech Trader up 1% while SPY is flat or down. Tech Trader is again (since November) actually 75% long by 25% short, meaning it's leaving a lot in cash while being pretty tight exposure wise, but it's still managing to catch most the return of SPY the last couple days w/o the beta. If the market sells off, we actually do better because Tech Trader has been shorting a lot of retail and oil names (KOLD, OAS, HAS...) while being long tech/cybersecurity/internet (PANW, BABA, NFLX...).

487 unique view(s)

December 1st, 2015

pftq (Official) says on The Tech Trader Wall...

A lot of suspicious options buying today. Very strange. $1M lots in options on CCL, CPB.

CCL 1/15/2016 55x Calls, 17800@$0.75

MV: $1.3M | $Not.: $22.5M | OI: 9492 | 29.1% TotalOI

31.7% StockVolume | 80.2% OptionVolume

CPB 2/19/2016 50x Puts, 10997@$0.9499

MV: $1.0M | $Not.: $16.4M | OI: 408 | 53.3% TotalOI

22.0% StockVolume | 82.3% OptionVolume

CCL 1/15/2016 55x Calls, 17800@$0.75

MV: $1.3M | $Not.: $22.5M | OI: 9492 | 29.1% TotalOI

31.7% StockVolume | 80.2% OptionVolume

CPB 2/19/2016 50x Puts, 10997@$0.9499

MV: $1.0M | $Not.: $16.4M | OI: 408 | 53.3% TotalOI

22.0% StockVolume | 82.3% OptionVolume

pftq (Official) says on The Tech Trader Wall...

Correction - put buying in CPB, not calls

pftq (Official) says on The Tech Trader Wall...

$1M in SMH puts now. So strange. Maybe something to do w/ first of the month.

SMH 1/15/2016 56x Puts, 5000@$2.0499

MV: $1.0M | $Not.: $15.4M | OI: 226 | 6.3% TotalOI

31.9% StockVolume | 47.8% OptionVolume

SMH 1/15/2016 56x Puts, 5000@$2.0499

MV: $1.0M | $Not.: $15.4M | OI: 226 | 6.3% TotalOI

31.9% StockVolume | 47.8% OptionVolume

520 unique view(s)

November 18th, 2015

pftq (Official) says on The Tech Trader Wall...

Very incredible day. Tech Trader's once-in-a-blue-moon RSI2 SPY signal is finally out of its position, and there is literally no better price it could have done so. It's been one of the longer held trades for sure, but we basically rallied all the way up to $209 today, which was actually Tech Trader's original target price before TT took its gains. Again, in the face of rate increase, terrorist attacks, and even the Fed minutes which sparked the late-day rally today, Tech Trader's hitrate on this strategy remains 100%.

The funniest part about all this is I spent most the trading day looking for WiFi spots in HK (disgusting place to wander at night, really). Fate and Irony at its best when I physically cannot trade and Tech Trader is just killing it without me. The weekly calls on SPY I put on with TT yesterday were exploding all day with me nowhere in sight (but under the care of Tech Trader of course).

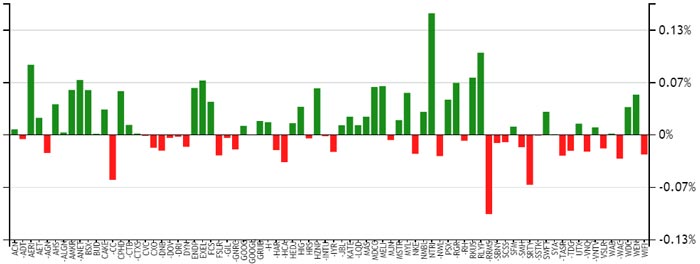

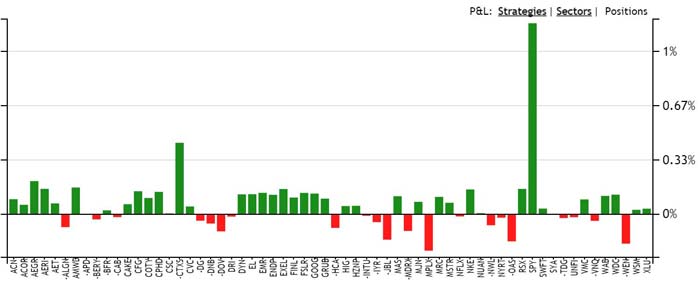

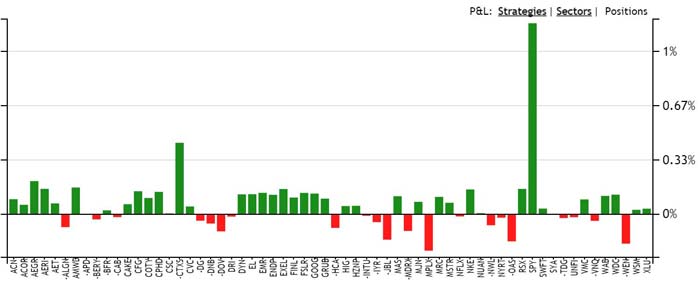

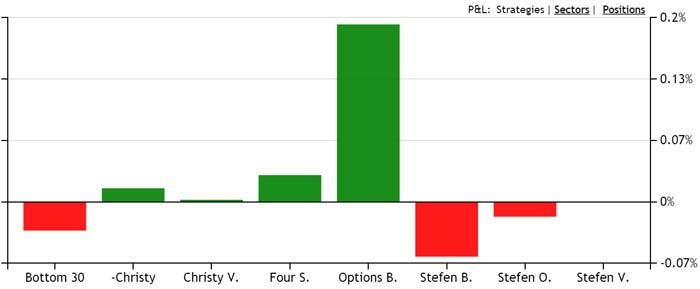

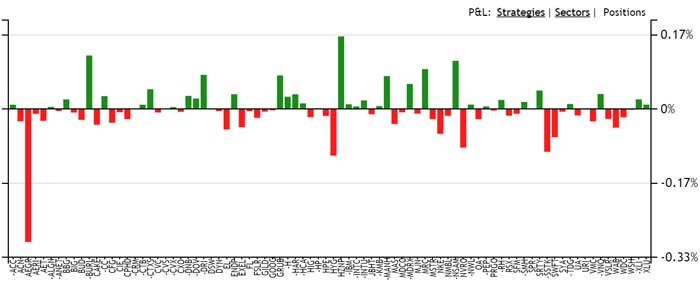

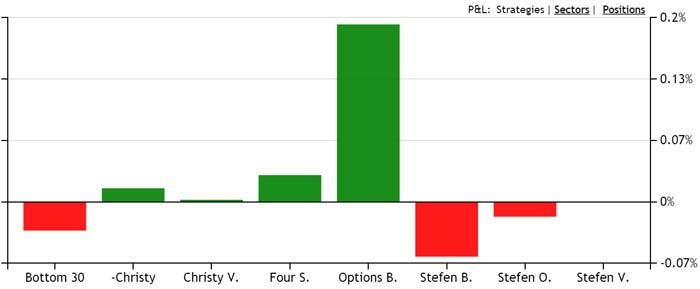

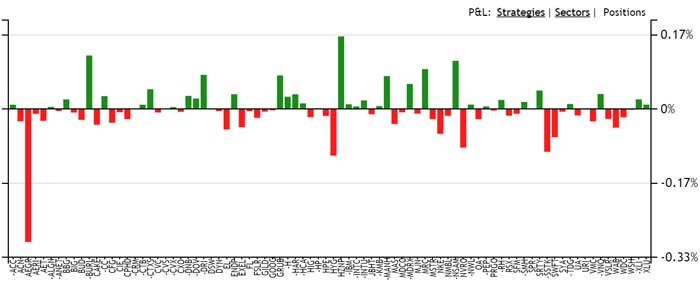

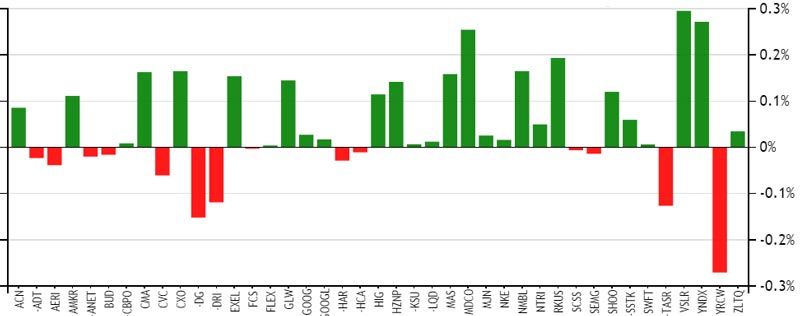

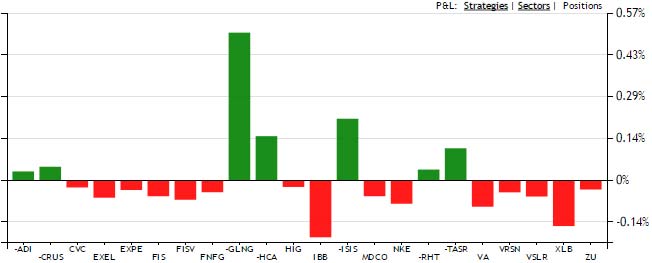

Performance from Tech Trader on today alone. Needless to say SPY singlehandedly contributed more than 1% to the portfolio.

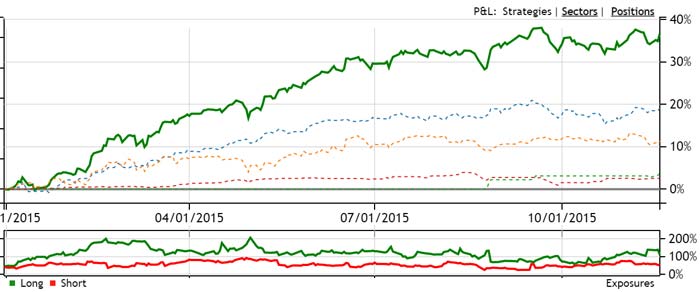

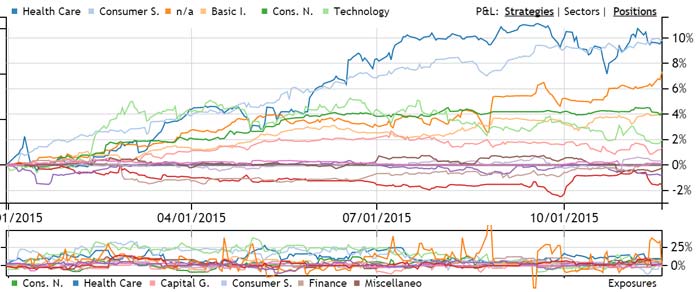

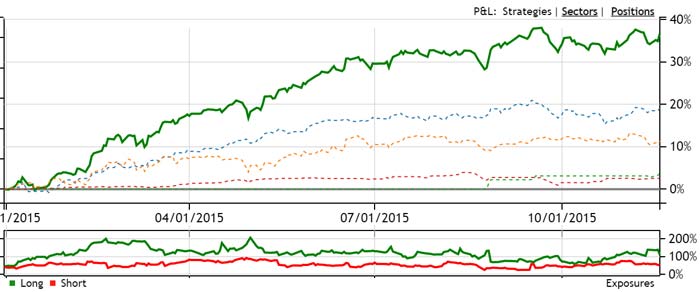

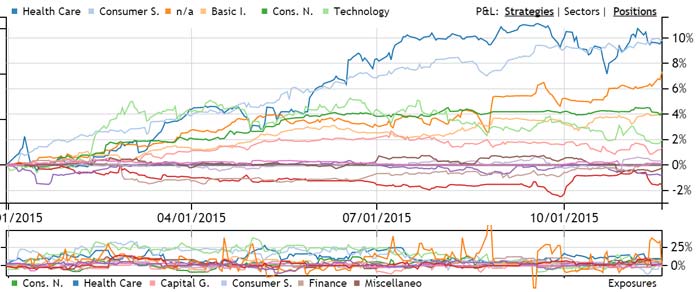

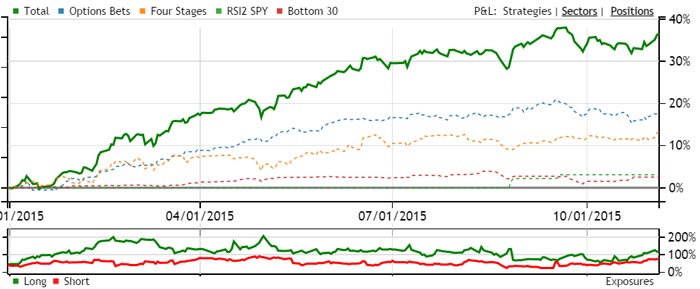

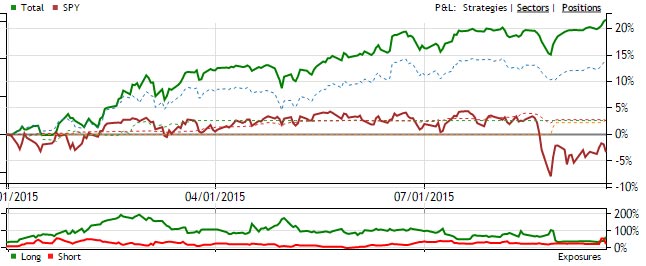

Year-to-date, Tech Trader is again back to highs, with the small dip being the November sell off. Sector-wise, ETFs are quickly becoming among the top contributers to performance, meaning trading SPY just these 3 or so times this year has been almost as much P&L as trading an entire sector all year long.

The funniest part about all this is I spent most the trading day looking for WiFi spots in HK (disgusting place to wander at night, really). Fate and Irony at its best when I physically cannot trade and Tech Trader is just killing it without me. The weekly calls on SPY I put on with TT yesterday were exploding all day with me nowhere in sight (but under the care of Tech Trader of course).

Performance from Tech Trader on today alone. Needless to say SPY singlehandedly contributed more than 1% to the portfolio.

Year-to-date, Tech Trader is again back to highs, with the small dip being the November sell off. Sector-wise, ETFs are quickly becoming among the top contributers to performance, meaning trading SPY just these 3 or so times this year has been almost as much P&L as trading an entire sector all year long.

519 unique view(s)

November 17th, 2015

pftq (Official) says on The Tech Trader Wall...

Ah it's like someone heard our call. Market closed just shy of Tech Trader's exit target. We'll be fighting for at least another day.

Very interesting day though. It seems like right around mid-day, someone of size started liquidating heavily. Anyone who trades intraday can see that there were a lot of attempts to rally only for someone to sell into each one. If it were the general market sentiment, you wouldn't see such sustained sell pressure every time the market attempted to bounce; it'd be much more choppy.

Also having a lot of fun on my end daytrading the heck out of this market. Been a long time, but I'm starting to get back into the hang of things, especially with Tech Trader as sort of my guide for where to aim my trading (target prices, etc).

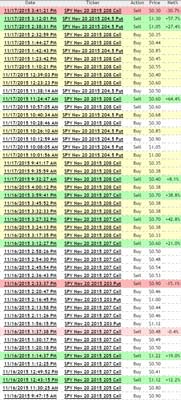

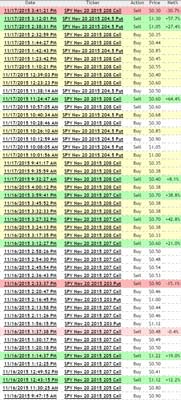

A ton of scalping and scaling, but it feels great to be back. Also just loving trading from Asia. You trade at night and live during the day. It's like your days are twice as long. A taste of my trades from just the last two days lol

Very interesting day though. It seems like right around mid-day, someone of size started liquidating heavily. Anyone who trades intraday can see that there were a lot of attempts to rally only for someone to sell into each one. If it were the general market sentiment, you wouldn't see such sustained sell pressure every time the market attempted to bounce; it'd be much more choppy.

Also having a lot of fun on my end daytrading the heck out of this market. Been a long time, but I'm starting to get back into the hang of things, especially with Tech Trader as sort of my guide for where to aim my trading (target prices, etc).

A ton of scalping and scaling, but it feels great to be back. Also just loving trading from Asia. You trade at night and live during the day. It's like your days are twice as long. A taste of my trades from just the last two days lol

pftq (Official) says on The Tech Trader Wall...

515 unique view(s)

November 16th, 2015

pftq (Official) says on The Tech Trader Wall...

Amazing day. Tech Trader's RSI2 SPY signal was a day early but nonetheless we got our huge rally as to be expected. The RSI2 SPY's 100% hitrate remains intact!

Originally it wanted to exit at $209 on the first day and then $207 today; we got pretty close but no dice. Tomorrow it'll exit end of day above $205, so it's pretty much one day left for this trade. It can still very well get its original target prices since it waits the day out. We'll see. This has admittedly been one of the bumpier signals this year.

And on a day like this, you can easily guess the sole driver of the majority of P&L today.

Originally it wanted to exit at $209 on the first day and then $207 today; we got pretty close but no dice. Tomorrow it'll exit end of day above $205, so it's pretty much one day left for this trade. It can still very well get its original target prices since it waits the day out. We'll see. This has admittedly been one of the bumpier signals this year.

And on a day like this, you can easily guess the sole driver of the majority of P&L today.

pftq (Official) says on The Tech Trader Wall...

A day early but Tech Trader's once-in-a-blue-moon SPY signal killing it again. Target has downgraded from 209 to 207 for today; will downgrade to 205 tomorrow if we don't head to 207 by today but things are getting crazy.

514 unique view(s)

November 12th, 2015

pftq (Official) says on The Tech Trader Wall...

Once-in-a-blue-moon SPY RSI2 signal back on to buy at the close. Looks like Tech Trader is getting a better price as a result of waiting a couple days. Target price of $208.8, which for whatever reason someone has a call option with that strike for tomorrow (am I being watched?  ).

).

Fate and Irony as usual.

).

). Fate and Irony as usual.

pftq (Official) says on The Tech Trader Wall...

And we're in!

And I won't be able to sleep at all I guess (it's midnight for market hours here).

And I won't be able to sleep at all I guess (it's midnight for market hours here).

491 unique view(s)

November 10th, 2015

pftq (Official) says on The Tech Trader Wall...

SPY RSI2 ("bluemoon") signal is back again (pending end-of-day). So much happening already only two weeks into the month. Hope this holds into close. Go figure it happens yet *again* when one of us is on a flight (me to Japan). Literally, if you go back on every SPY signal, that has been the day of or after one of us was on flight.

pftq (Official) says on The Tech Trader Wall...

Ugh lost the SPY signal on the last minute bid-up of the market. Once-in-a-blue-moon signal eludes us yet again.

471 unique view(s)

November 9th, 2015

pftq (Official) says on The Tech Trader Wall...

Options Bets skyrocketing again, with HZNP up another 10%. Have one thorn in our side from AEGR but largely offset by other gains.

Overall a strong month so far relative to SPY selling off and accelerating that downtrend. Our beta is now -.18 despite being 71% net long (132% long by 61% short).

Overall a strong month so far relative to SPY selling off and accelerating that downtrend. Our beta is now -.18 despite being 71% net long (132% long by 61% short).

pftq (Official) says on The Tech Trader Wall...

Very interesting - our bottom positions in XLU and HYG now going green while the market selling off a percent. More short idiosyncratic names coming in on options activity in names like APD ($1.1M puts bought for December).

pftq (Official) says on The Tech Trader Wall...

Very interesting bet in IYR weekly puts.

IYR 11/13/2015 71x Puts, 16500@$0.1899

MV: $0.3M | $Not.: $22.2M | OI: 106 | 2.9% TotalOI

2.8% StockVolume | 17.9% OptionVolume

IYR 11/13/2015 71x Puts, 16500@$0.1899

MV: $0.3M | $Not.: $22.2M | OI: 106 | 2.9% TotalOI

2.8% StockVolume | 17.9% OptionVolume

pftq (Official) says on The Tech Trader Wall...

Also had XHB puts earlier this morning. Wonder if they're related.

XHB 11/20/2015 35x Puts, 10000@$0.4

MV: $0.4M | $Not.: $13.4M | OI: 5465 | 3.3% TotalOI

75.4% StockVolume | 83.4% OptionVolume

XHB 11/20/2015 35x Puts, 10000@$0.4

MV: $0.4M | $Not.: $13.4M | OI: 5465 | 3.3% TotalOI

75.4% StockVolume | 83.4% OptionVolume

pftq (Official) says on The Tech Trader Wall...

AEGR up 15% afterhours. Biggest loser today about to become the biggest winner for tomorrow.

NVRO also just jumped 10% afterhours. These options bets are just killing it on the earnings plays.

NVRO also just jumped 10% afterhours. These options bets are just killing it on the earnings plays.

430 unique view(s)

November 6th, 2015

pftq (Official) says on The Tech Trader Wall...

Options-based positions bringing in a lot of idiosyncratic alpha today from names like HZNP (25% up today, bought from call activity a few weeks ago), ENDP (6%), and a few others. Tech Trader is slowly adding intraday bottom positions in XLU and other ETFs but very slowly (1 today, 1 a few days ago, etc). Very nice to be holding steady for the first week of the month while SPY declines gradually. Our beta since launch MTD is 0.2.

429 unique view(s)

November 4th, 2015

pftq (Official) says on The Tech Trader Wall...

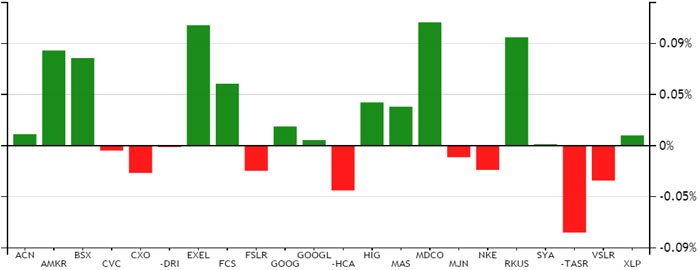

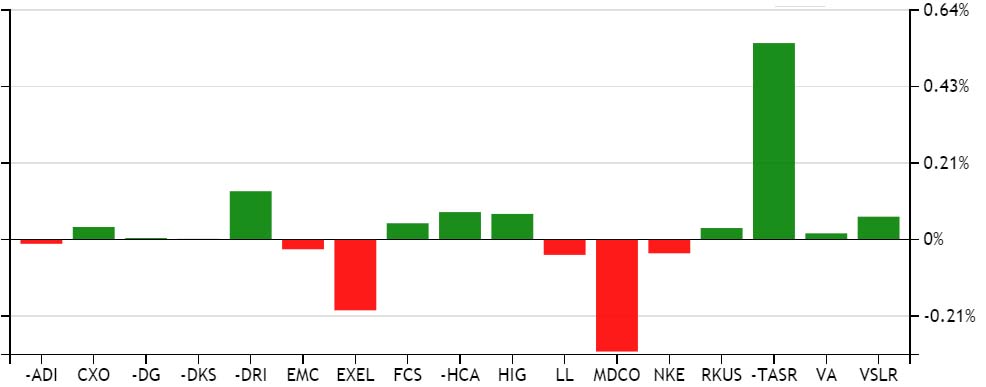

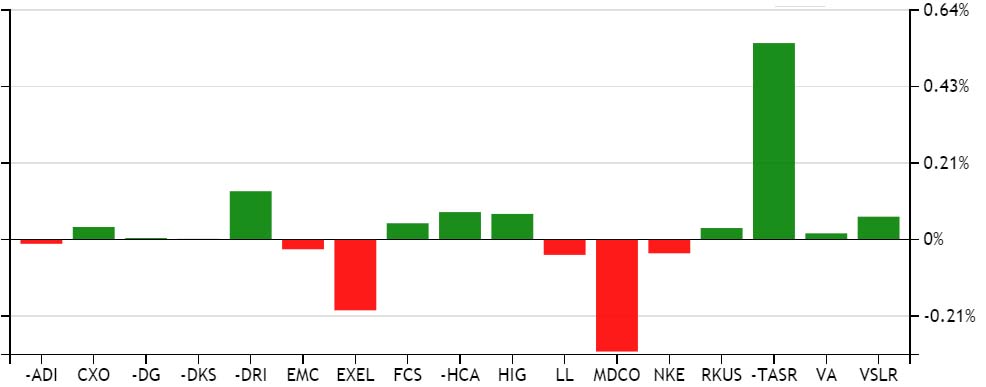

The options data feeding into Tech Trader is putting it on steroids. Just now, AHS is up 15% afterhours on earnings beat. Had pretty sizable gains this week on being long MDCO into earnings and short TASR into earnings as well.

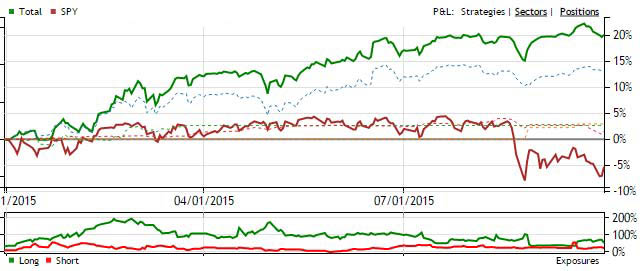

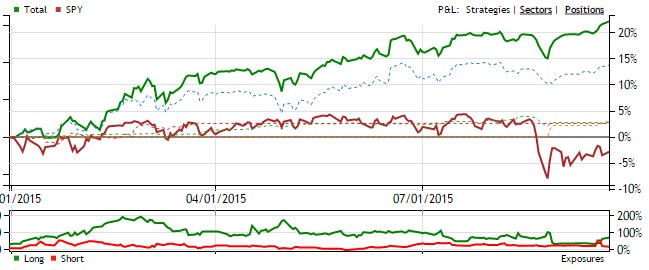

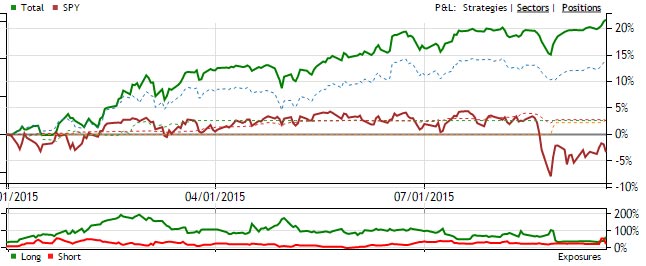

Overall Tech Trader is ramping up exposures on both long and short side (120% long by 70% short now) after a very quiet August-October. There is no particular sizable sector bet, with all sectors being under 10% of the total exposures. The P&L chart itself looks like a cup-and-handle formation.

Note the performance chart looks a little different from prior posts because I've moved the options bets strategy back in (other charts had it discontinued April onwards).

Overall Tech Trader is ramping up exposures on both long and short side (120% long by 70% short now) after a very quiet August-October. There is no particular sizable sector bet, with all sectors being under 10% of the total exposures. The P&L chart itself looks like a cup-and-handle formation.

Note the performance chart looks a little different from prior posts because I've moved the options bets strategy back in (other charts had it discontinued April onwards).

468 unique view(s)

November 2nd, 2015

pftq (Official) says on The Tech Trader Wall...

476 unique view(s)

October 30th, 2015

pftq (Official) says on The Tech Trader Wall...

YRCW! First big win for Tech Trader with options orderflow information now turned back on. Up 20% today with Tech Trader having bought earlier this week. The call activity TT picked up a couple days ago was huge:

YRCW 12/18/2015 15x Calls, 10000@$1.8099 ($1.8M in calls)

Options-based trades from Tech Trader now up 3% as a portfolio since the beginning of the week.

YRCW 12/18/2015 15x Calls, 10000@$1.8099 ($1.8M in calls)

Options-based trades from Tech Trader now up 3% as a portfolio since the beginning of the week.

471 unique view(s)

October 28th, 2015

pftq (Official) says on The Tech Trader Wall...

Tech Trader coming back to life here, putting on more names both long and short. Today up over 1% with the market slightly down.

Finally got the options data feed plugged back into TT as well, and that's just spinning in new trades like crazy the last couple days. The options-based trades alone added 1% over the last couple days.

Finally got the options data feed plugged back into TT as well, and that's just spinning in new trades like crazy the last couple days. The options-based trades alone added 1% over the last couple days.

pftq (Official) says on The Tech Trader Wall...

Tech Trader equity-only is up over 2% today by end of day. Exposures climbing back up at 120% by 50% short.

pftq (Official) says on The Tech Trader Wall...

Very exciting. I don't think we've seen this increase in exposure since June. Even without the options based positions, Tech Trader has added about 40% net long in the past week.

492 unique view(s)

October 23rd, 2015

pftq (Official) says on The Tech Trader Wall...

501 unique view(s)

October 21st, 2015

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

XLV calls up 20% and XBI calls up 10% now.

480 unique view(s)

October 20th, 2015

pftq (Official) says on The Tech Trader Wall...

Tech Trader's short bet on TASR finally playing out after a few months. Overall Tech Trader's exposure still a very tight 60% long by 30% short. Very boring month so far.

Up today about half a percent while market churns sideways.

Up today about half a percent while market churns sideways.

474 unique view(s)

October 15th, 2015

pftq (Official) says on The Tech Trader Wall...

476 unique view(s)

October 14th, 2015

pftq (Official) says on The Tech Trader Wall...

513 unique view(s)

September 30th, 2015

pftq (Official) says on The Tech Trader Wall...

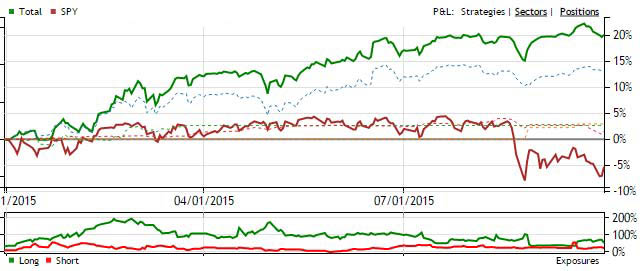

Slow way to end the quarter. Tech Trader remaining very tight at 52% long by 22% short and selling out of its intraday bottom ETF positions on today's bounce. Overall Tech Trader is up about 20% for the year while SPY is down 5%.

487 unique view(s)

September 28th, 2015

pftq (Official) says on The Tech Trader Wall...

Up today despite market being down a percent and Tech Trader being 60% long vs 25% short still. Thanks to shorts like GLNG and ISIS.

Can't wait till we get another daily bottom. So ready for it.

Can't wait till we get another daily bottom. So ready for it.

pftq (Official) says on The Tech Trader Wall...

Ended up closing down .7% but solely on the intraday bottom ETF signals which are starting to load up; it's small compared to SPY down about 2.5%.

539 unique view(s)

September 22nd, 2015

pftq (Official) says on The Tech Trader Wall...

Looking forward to seeing this sell off pick up and hopefully getting yet another rare SPY RSI2 signal.

pftq (Official) says on The Tech Trader Wall...

My comprehensive SPY strategy (the first strategy I ever wrote) just traded again, covering its short and going long on SPY. Again, no real idea if it'll be a 1-day trade or a 1-year trade (it can randomly switch from holding for 2 years to trading every day), but it's just interesting to see. As mentioned previously, a lot of my abandoned strategies have been waking up this year.

566 unique view(s)

September 21st, 2015

pftq (Official) says on The Tech Trader Wall...

That was probably the easiest flip in a while. After making a killing on the SPY short, the very next trading day has Tech Trader now making on the long side instead with the ETFs (XLK, XLB, DIA); also added IBB at pretty much the low of the day. The market has been chopping between negative and positive all day, but Tech Trader's held a steady 50bps up all day regardless of the market movement. Ironically the biggest winner today is its short on ISIS (the stock is down 8%).

What's most impressive is how quickly it flipped from neutral to net short to now net long in just the past week, each time getting the exact day the market turns, and it is now just grinding higher on each swing the market makes. This is after being "asleep" for most of September with no signals. SPY again shown in red for comparison.

What's most impressive is how quickly it flipped from neutral to net short to now net long in just the past week, each time getting the exact day the market turns, and it is now just grinding higher on each swing the market makes. This is after being "asleep" for most of September with no signals. SPY again shown in red for comparison.

587 unique view(s)

September 18th, 2015

pftq (Official) says on The Tech Trader Wall...

Tech Trader covered its RSI2 SPY trade today, out at $195.27 after shorting at about $200 on Wednesday, the exact top of the week (by closing price). Equity netted 2%. Weekly 200x puts made 95.3% from $2.32 to $4.53. Month-out 200x puts made 45.5% from $4.20 to $6.11.

The once-in-a-blue-moon RSI2 SPY signal's 100% hitrate since 2008 track record remains intact. As usual, the signal occurred while we were traveling and right before a major catalyst event (the Fed), but also as usual, the outcome of the actual event didn't matter.

Tech Trader is also now rotating into smaller intraday bottom-scalping long ETF positions (currently DIA, XLK, and XLB). Exposure flipped in one day from 55% short by 40% long to now 65% long by 23% short. Portfolio-level P&L finally stopped flat-lining and is going to new highs. SPY again shown for comparison.

The hybrid equity+options portfolio that replaces ETF-timing trades with month-out options is up 6.5% for September so far with .5% drawdown. Will be interesting to see if it can augment returns of the base strategies without increasing risk significantly, but we'll see with time. Again, this is all fully automated.

The once-in-a-blue-moon RSI2 SPY signal's 100% hitrate since 2008 track record remains intact. As usual, the signal occurred while we were traveling and right before a major catalyst event (the Fed), but also as usual, the outcome of the actual event didn't matter.

Tech Trader is also now rotating into smaller intraday bottom-scalping long ETF positions (currently DIA, XLK, and XLB). Exposure flipped in one day from 55% short by 40% long to now 65% long by 23% short. Portfolio-level P&L finally stopped flat-lining and is going to new highs. SPY again shown for comparison.

The hybrid equity+options portfolio that replaces ETF-timing trades with month-out options is up 6.5% for September so far with .5% drawdown. Will be interesting to see if it can augment returns of the base strategies without increasing risk significantly, but we'll see with time. Again, this is all fully automated.