334 unique view(s)

Updates by Tech Trader, a fully autonomous trading system with no human intervention.

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

Saved 2 cents on XLU calls thanks to the option pricing mechanism lol

2015-08-21 08-02-48: TTFund_TDA_Options: Checking for fair value of XLU Sep 11 2015 46 Call...

2015-08-21 08-02-48: TTFund_TDA_Options: Spread too wide. Basing price on midpoint $0.37 between 0.35x0.38

2015-08-21 08-02-48: TTFund_TDA_Options: Comparing extrinsic value $0.37 on XLU Sep 11 2015 46 Call with $0.28 on XLU Sep 11 2015 46 Put...

2015-08-21 08-02-48: TTFund_TDA_Options: Buying at cheaper price $0.36 for XLU Sep 11 2015 46 Call

2015-08-21 08-02-48: TTFund_TDA_Options: Fair value check complete: Best price at $0.36 in spread of 0.35x0.38

2015-08-21 08-02-48: TTFund_TDA_Options: Checking for fair value of XLU Sep 11 2015 46 Call...

2015-08-21 08-02-48: TTFund_TDA_Options: Spread too wide. Basing price on midpoint $0.37 between 0.35x0.38

2015-08-21 08-02-48: TTFund_TDA_Options: Comparing extrinsic value $0.37 on XLU Sep 11 2015 46 Call with $0.28 on XLU Sep 11 2015 46 Put...

2015-08-21 08-02-48: TTFund_TDA_Options: Buying at cheaper price $0.36 for XLU Sep 11 2015 46 Call

2015-08-21 08-02-48: TTFund_TDA_Options: Fair value check complete: Best price at $0.36 in spread of 0.35x0.38

pftq (Official) says on The Tech Trader Wall...

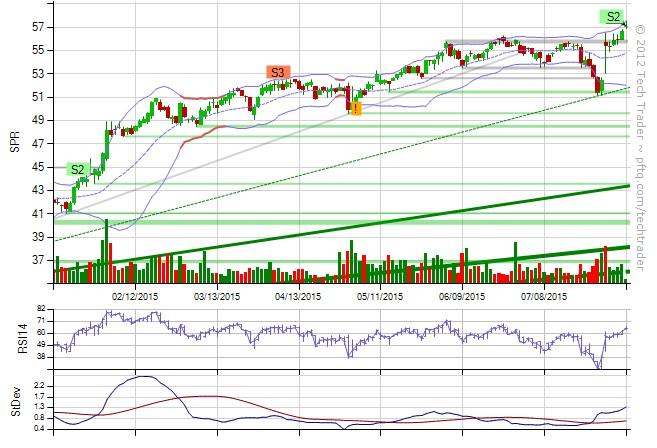

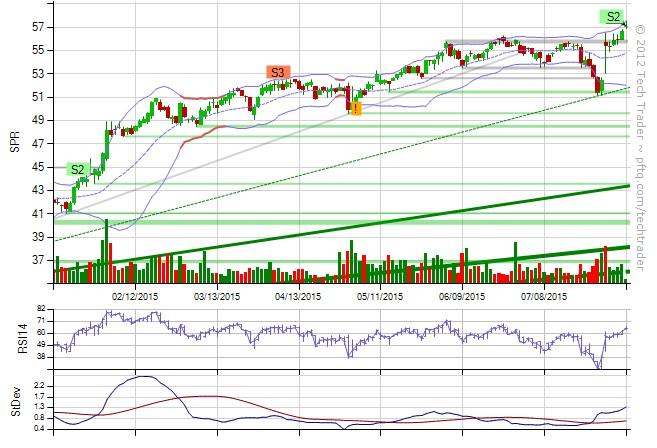

XLU bouncing already. Calls that TT bought up 20% month out and 30% weekly. The bounces from the capitulation point almost always happens, but it's hard to tell for how long and how high.

284 unique view(s)

August 20th, 2015

pftq (Official) says on The Tech Trader Wall...

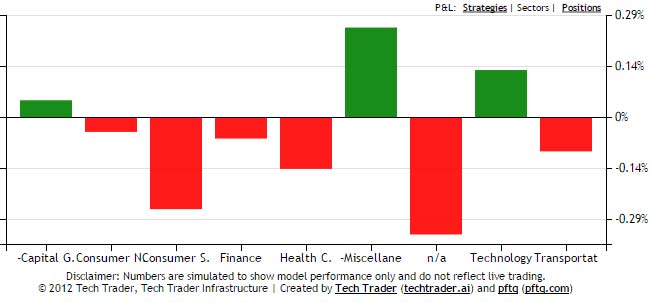

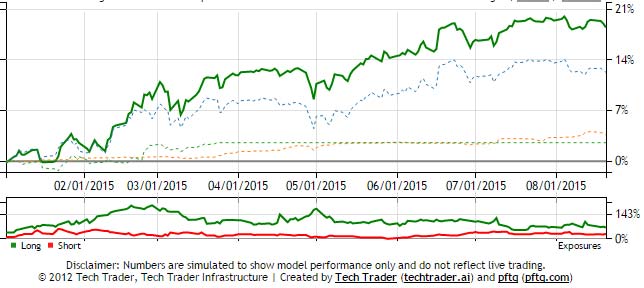

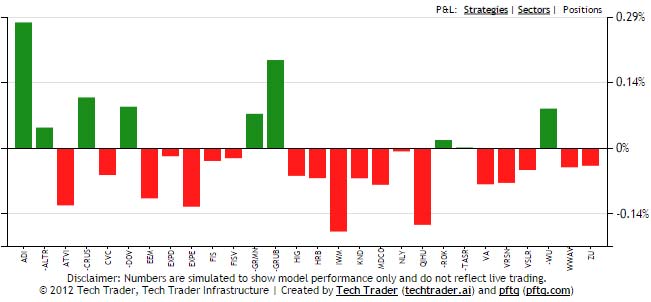

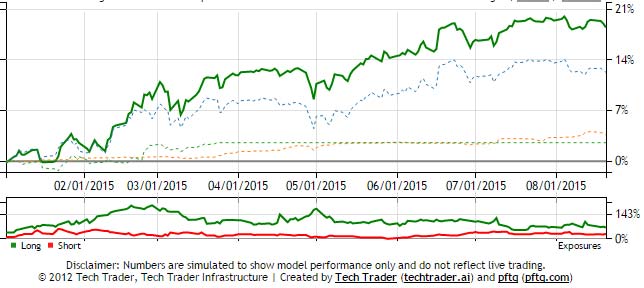

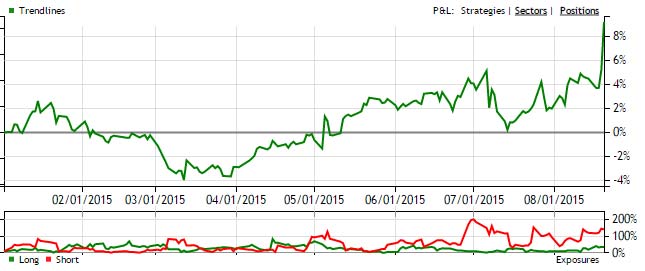

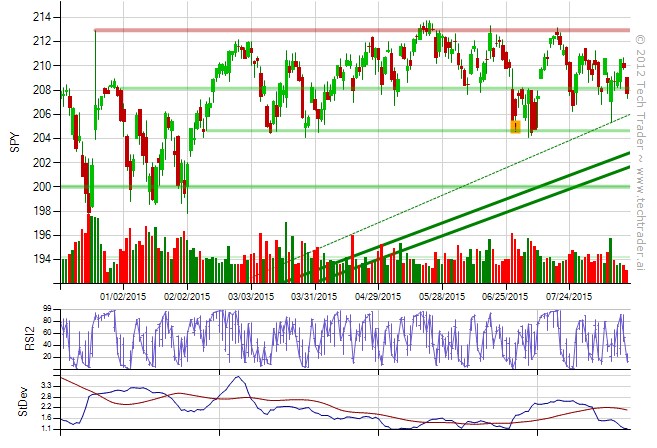

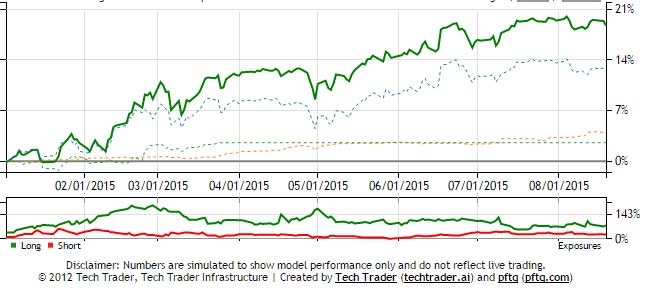

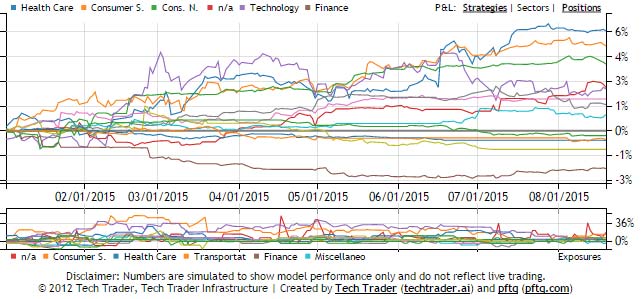

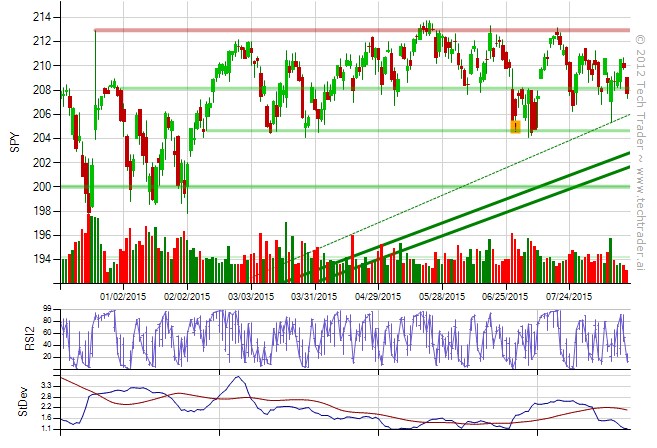

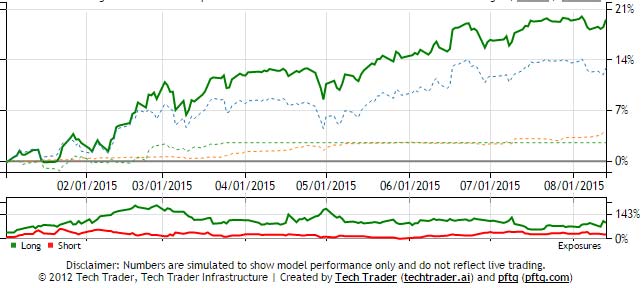

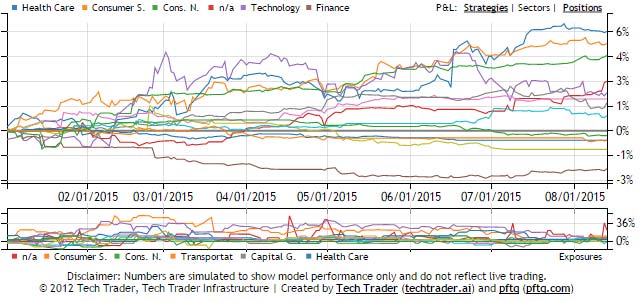

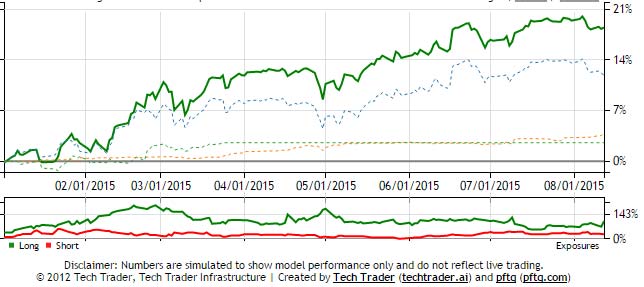

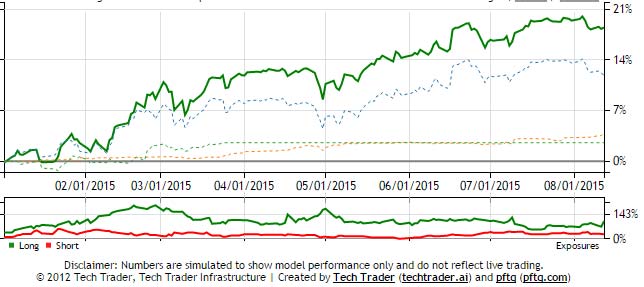

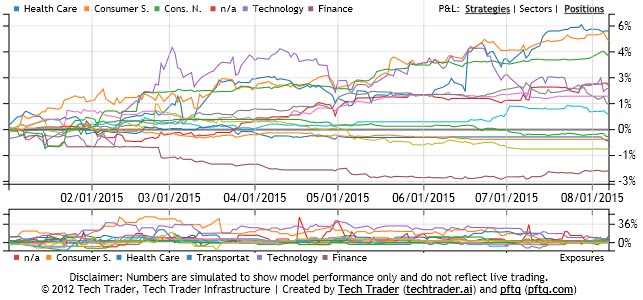

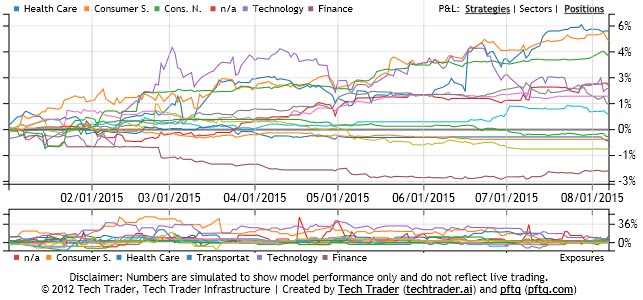

Great show of strength today for Tech Trader against the market sell off. Tech Trader in total, even with yesterday's IWM buy, is only down 0.5%. SPY is down over 2% and IWM is down almost 3%. Shorts like GRUB (5%), ADI (7%), and GRMN (2%) contributed a lot to outperformance, but it's nonetheless 40% net long, meaning longs were pretty resilient as well.

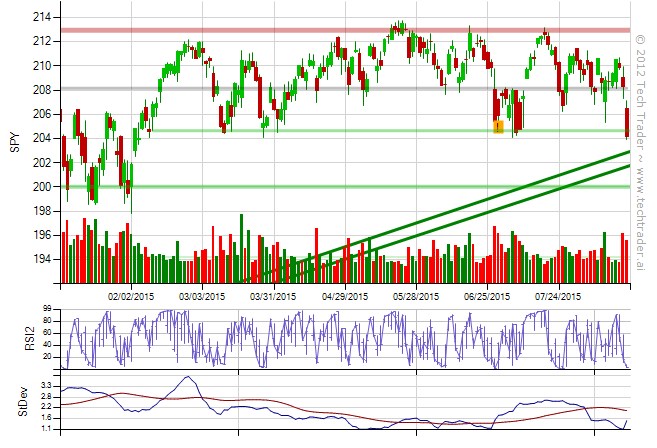

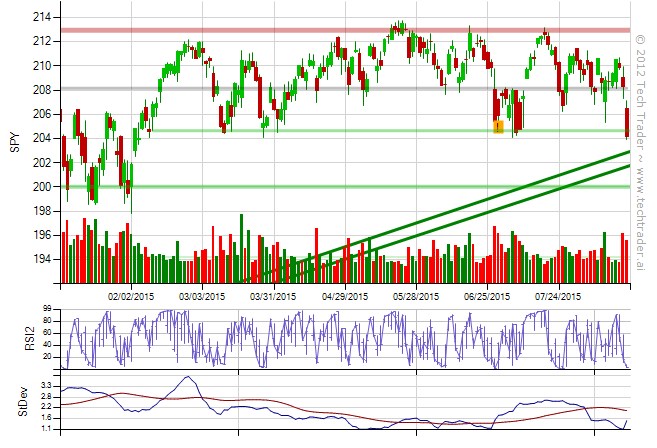

What's interesting to note is that Tech Trader isn't buying the dip today; no bottom or RSI signals on the major indices. There was one yesterday and a leftover from last week, but not the usual 3-5 cluster or more with aggressive averaging down. Again, exposures are at year lows of 65% long vs 28% short.

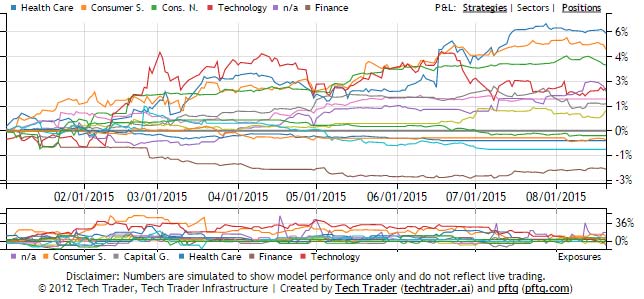

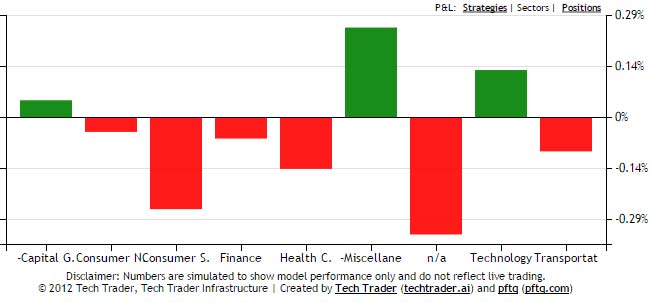

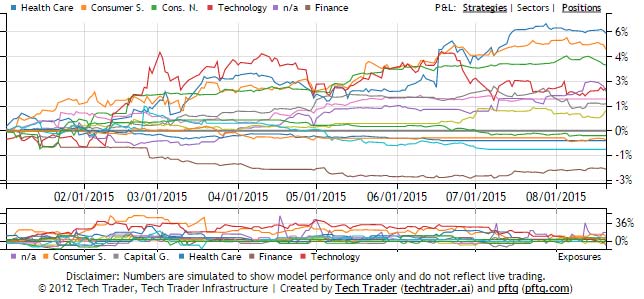

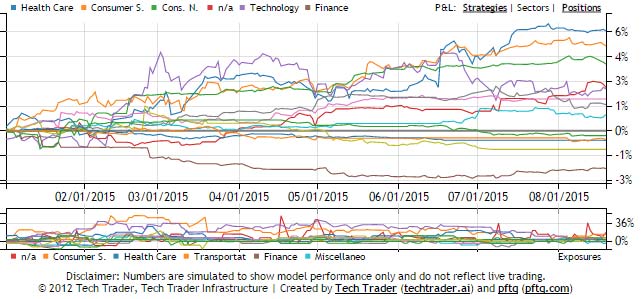

The n/a sector is ETFs, which consists of EEM and IWM collectively being down about 2% individually but affect less than .3% of the portfolio and are offset everything else. The most any individual name is losing the portfolio is no more than about .1% either.

Again, the sell off is barely a blip in Tech Trader's P&L while you can see SPY for the YTD time frame being very volatile.

What's interesting to note is that Tech Trader isn't buying the dip today; no bottom or RSI signals on the major indices. There was one yesterday and a leftover from last week, but not the usual 3-5 cluster or more with aggressive averaging down. Again, exposures are at year lows of 65% long vs 28% short.

The n/a sector is ETFs, which consists of EEM and IWM collectively being down about 2% individually but affect less than .3% of the portfolio and are offset everything else. The most any individual name is losing the portfolio is no more than about .1% either.

Again, the sell off is barely a blip in Tech Trader's P&L while you can see SPY for the YTD time frame being very volatile.

pftq (Official) says on The Tech Trader Wall...

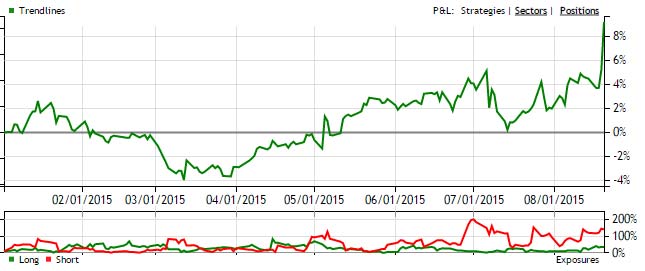

A lesser talked about strategy for Trendline Breaks is also killing it this week. This is the one that a friend and I used to trade around manually because it doesn't have automated exits. The paper portfolio just gets out on the first day of gain or after 1 stdev loss. It's a good gauge for where things are at though, especially if it's >100% short and making 4% in a few days.

pftq (Official) says on The Tech Trader Wall...

Updated the last post to include percentages on the column charts and a second chart showing how no single name lost more than .1% of the portfolio.

pftq (Official) says on The Tech Trader Wall...

What's interesting to note is that Tech Trader isn't buying the dip today; no bottom or RSI signals on the major indices. There was one yesterday and a leftover from last week, but not the usual 3-5 cluster or more with aggressive averaging down. Again, exposures are at year lows of 65% long vs 28% short.

222 unique view(s)

August 19th, 2015

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

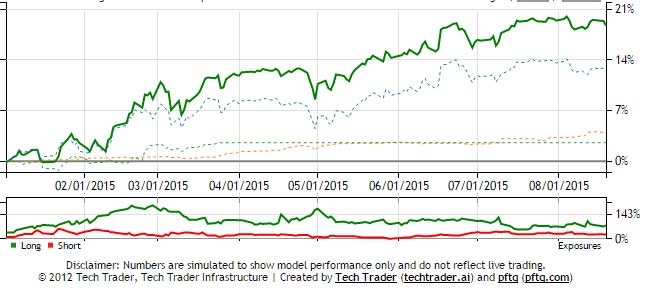

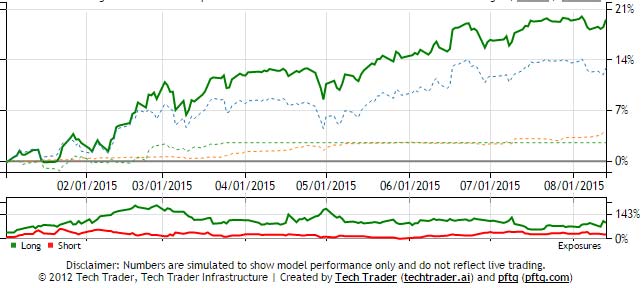

Pretty much every time we have a big sell off like today, we're seeing Tech Trader yet again hold up fine despite being more than 50% net long. Right now SPY is down 1.2%, IWM 1.5%, and EEM 2%, but Tech Trader is only down 0.5%, which is basically a normal fluctuation on any given day. On the performance chart for the year, it's barely a blip whereas you see SPY chopping up and down below.

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

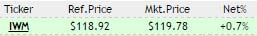

Looks like the algos were expecting the news not to come out until 2pm EST and are just now reading it lol. IWM surging above $120 now. Well over 1% from the bottom signal on IWM

pftq (Official) says on The Tech Trader Wall...

It turns out Tech Trader would have bought these months ago if we just had the stocks in the scan list. Unfortunately, Tech Trader is only looking at top 1000 stocks right now; need to have much more capital before we can think of increasing the universe, else the size of each position will be too small. Just something to keep in mind for the future as far as capacity for Tech Trader is concerned.

190 unique view(s)

August 17th, 2015

pftq (Official) says on The Tech Trader Wall...

Great example on GRUB of Tech Trader's option pricing algo at work. Normally I would have just crossed the spread, but it now knows to aim for $.50 on a spread of $.45x$.70 based on how other contracts are priced.

Edit: Not trading this specific strike/contract. Just wanted to show how TT would price a wide spread. Sorry for the confusion.

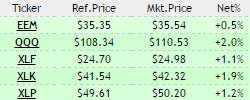

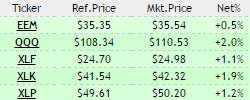

In other news, XLP has exited around $50.20 for about a 1.2% total gain (QQQ had 2.4%, XLK 2.1%, and XLF 2%). Still holding EEM which is taking a hit, but it's small compared to what the others made already. Slow day overall.

Edit: Not trading this specific strike/contract. Just wanted to show how TT would price a wide spread. Sorry for the confusion.

In other news, XLP has exited around $50.20 for about a 1.2% total gain (QQQ had 2.4%, XLK 2.1%, and XLF 2%). Still holding EEM which is taking a hit, but it's small compared to what the others made already. Slow day overall.

pftq (Official) says on The Tech Trader Wall...

Clarification on GRUB - Not trading this specific strike/contract. Just wanted to show how TT would price a wide spread. Sorry for the confusion.

160 unique view(s)

August 15th, 2015

pftq (Official) says on The Tech Trader Wall...

Fixed images

144 unique view(s)

August 14th, 2015

pftq (Official) says on The Tech Trader Wall...

Just finished adding the ability for Tech Trader to automatically figure out fair value for options based on intrinsic/extrinsic of other contracts. I'll never get ripped off by a 40% spread again! Bahaha

pftq (Official) says on The Tech Trader Wall...

Seeing some slight rotation into other sectors like XLP and XLF while QQQ and XLK retreat, which is great since QQQ and XLK were sold yesterday while XLP and XLF are still being held.

140 unique view(s)

August 13th, 2015

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

Tech Trader barely took a hit during the market sell off and is now outperforming the market again on the rally. SPY only up .3% and QQQ up .5%, but Tech Trader is up over 1% with only 68% net long exposure and no leverage. Both the market timing ETF plays (QQQ, etc) and idiosyncratic stock picks (GPRO, HIG, etc) are contributing significantly today.

pftq (Official) says on The Tech Trader Wall...

Every pullback and higher low we get reduces the desire for Tech Trader to sell. If anything, we'd want a slow grind up here to really squeeze as much gain as we can from this trade.

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

Market closes down 10-20 bps. Tech Trader is up 80bps end of day.

115 unique view(s)

August 12th, 2015

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

SPY closed well into positive. Market bottom trades absolutely killed it today. All positions are in green, with QQQ making 2% in less than a day.

Tech Trader's portfolio is sharply longer now but mainly on its market bet; idiosyncratic names are still relatively tight, though it just sold FIS which also killed it today (8% up today).

FIS sold at $70 today (entered a few weeks ago).

Tech Trader's portfolio is sharply longer now but mainly on its market bet; idiosyncratic names are still relatively tight, though it just sold FIS which also killed it today (8% up today).

FIS sold at $70 today (entered a few weeks ago).

pftq (Official) says on The Tech Trader Wall...

SPY positive for a moment just now. QQQ calls now 70%

pftq (Official) says on The Tech Trader Wall...

Literally every bottom position just bounced into green. What an insane move.

pftq (Official) says on The Tech Trader Wall...

QQQ is actually up for the day now. Freaking incredible. The one month out

calls are up over 50% from the morning.

calls are up over 50% from the morning.

104 unique view(s)

August 10th, 2015

pftq (Official) says on The Tech Trader Wall...

113 unique view(s)

August 7th, 2015

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

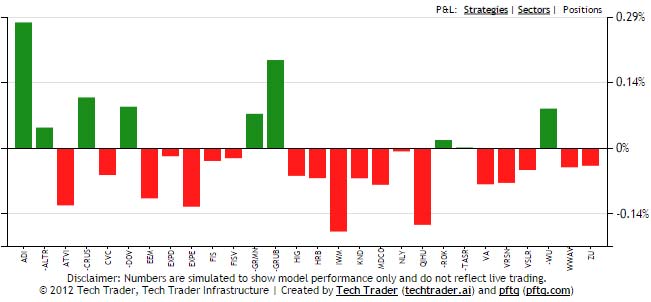

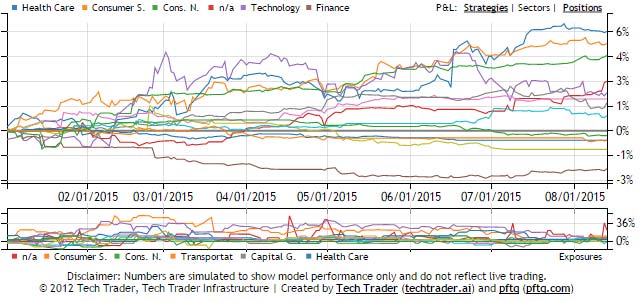

I think it's important to clarify what the current positioning actually is. We've had a slight increase in the number of trades the last few days, but at a portfolio level, things are still very neutral. For every long, we're getting a short or sell as well. Exposures to sectors remain very flat. There's also a lot of whiplash intraday, so a lot of signals that are "potential trades" do not necessarily trade by end of day, as we saw with FOLD and KITE. Will try to be clearer on those next time, but in general, besides the ETFs/bottom trades, anything posted intraday is tentative and can change until the actual market close.

Below are the current exposures for Tech Trader, which you can see continues to tighten despite added names.

Below are the current exposures for Tech Trader, which you can see continues to tighten despite added names.

pftq (Official) says on The Tech Trader Wall...

113 unique view(s)

August 6th, 2015

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

TLT trade exited at $122.55. The actual calls traded (Aug.28 2015 122.5) netted 42% going from $1.13 to $1.61.

111 unique view(s)

August 5th, 2015

pftq (Official) says on The Tech Trader Wall...

Pretty exciting. After about 2 week's slumber, exposures are starting to pick up again. TLT just got an intraday bottom at about $121.4. Names like FOLD and SPR are lining up to be bought on breakout continuation to the long side. Update: Lost the signal for FOLD at close and didn't trade it; looks like it's tough to sustain a breakout for individual names at least.