56 unique view(s)

Updates by Tech Trader, a fully autonomous trading system with no human intervention.

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

pftq (Official) says on The Tech Trader Wall...

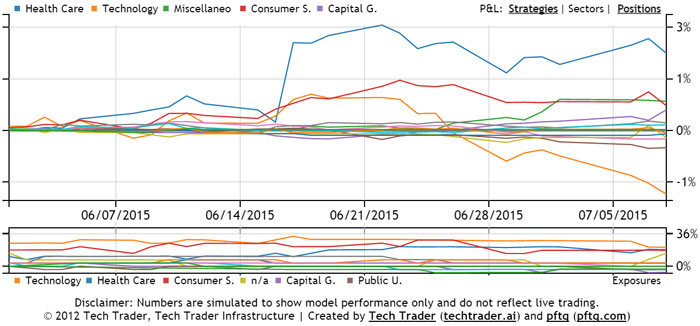

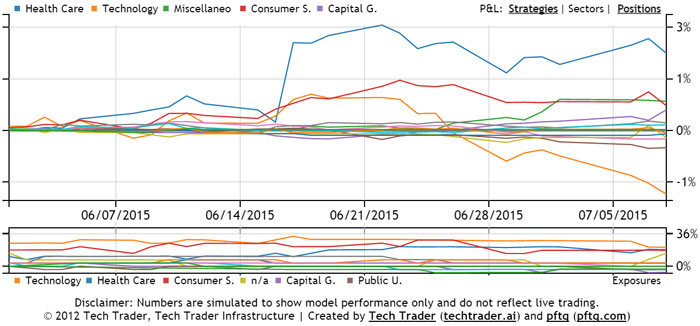

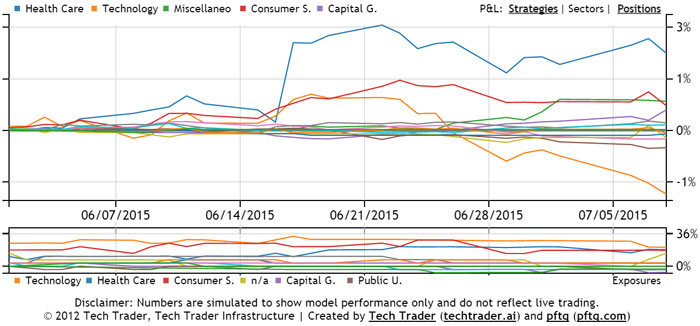

Sell off today finally across all sectors in Tech Trader's portfolio and not just in Tech.

Still no daily bottom or RSI signals. I think that is most interesting and clearly shows how Tech Trader is different from quant or other algo systems. There are a couple 30 min bottoms (SMH today and XOP yesterday) but very timid compared to the massive cluster of daily time frame buys I used to see in 2012, 2013, 2014.

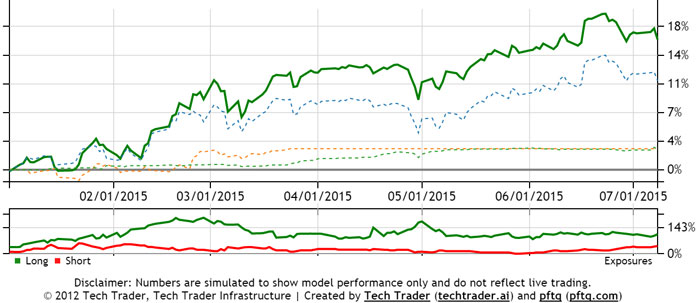

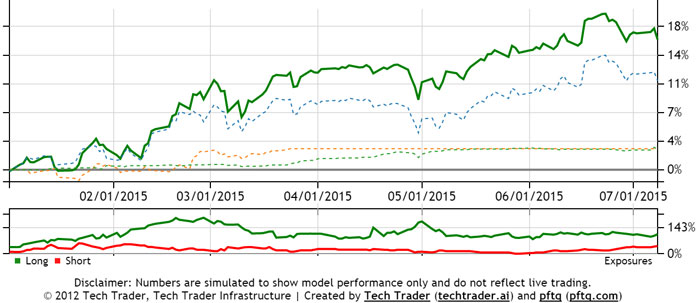

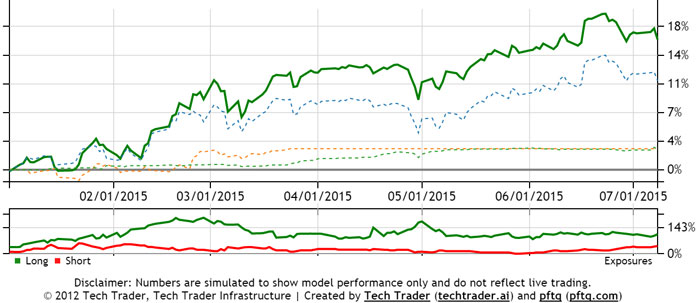

While all other algos might be buying the dip, Tech Trader is side-stepping this entirely and actually continuing to get shorter (64% net long now vs its 88% average). Its performance despite being net long is barely hampered by the current sell off.

Still no daily bottom or RSI signals. I think that is most interesting and clearly shows how Tech Trader is different from quant or other algo systems. There are a couple 30 min bottoms (SMH today and XOP yesterday) but very timid compared to the massive cluster of daily time frame buys I used to see in 2012, 2013, 2014.

While all other algos might be buying the dip, Tech Trader is side-stepping this entirely and actually continuing to get shorter (64% net long now vs its 88% average). Its performance despite being net long is barely hampered by the current sell off.

pftq (Official) says on The Tech Trader Wall...

Sell off today finally across all sectors in Tech Trader's portfolio today and not just in Tech.

pftq (Official) says on The Tech Trader Wall...

SPY down 1.6%, EEM down 3.5%. Tech Trader down 1.2% and still pretty much unlevered now (106% long vs 42% short).

It's as if it's waiting for the daily bottoms to come in before getting very long again. None of this is even coded; it just ends up behaving this way.

It's as if it's waiting for the daily bottoms to come in before getting very long again. None of this is even coded; it just ends up behaving this way.

pftq (Official) says on The Tech Trader Wall...

I have a handful of quants and algo guys telling me their stuff is getting killed right now and that reversion is impossible in this environment.

95 unique view(s)

July 7th, 2015

pftq (Official) says on The Tech Trader Wall...

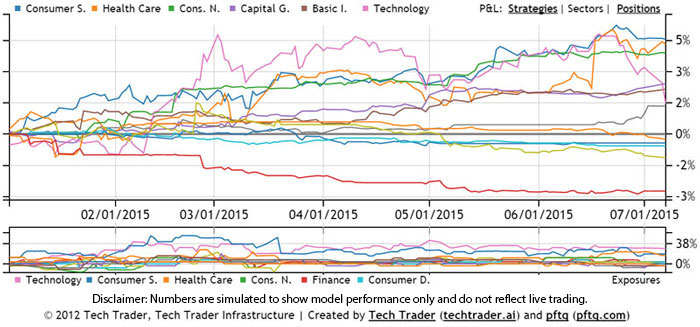

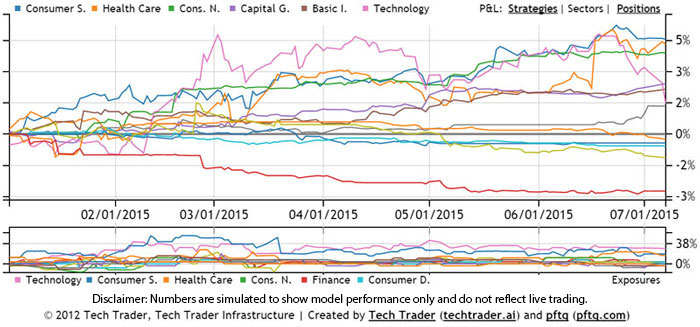

The sell off today, for Tech Trader at least, is almost exclusively the Technology sector. Same as it has been for the last several weeks. No other sector is moving anywhere near as much.

Re: consumer exposures, see below. Even though the market is down a percent, the biggest gainers in the consumer sector are actually long positions.

More shorts lined up to be added today as well: CRUS, UL, etc. It's also selling more longs again to further reduce net exposure. Looks like Tech Trader is expecting a prolonged sell off here.

Re: consumer exposures, see below. Even though the market is down a percent, the biggest gainers in the consumer sector are actually long positions.

More shorts lined up to be added today as well: CRUS, UL, etc. It's also selling more longs again to further reduce net exposure. Looks like Tech Trader is expecting a prolonged sell off here.

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

The consumer names from this morning are up an average of a percent now, with the market still flat/down. Top performers AEO, HT, and GES.

pftq (Official) says on The Tech Trader Wall...

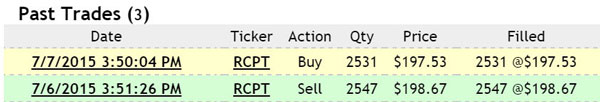

It bought back RCPT now.

pftq (Official) says on The Tech Trader Wall...

Tech Trader is positive now after being down a percent in the morning. What an insane day...

pftq (Official) says on The Tech Trader Wall...

There goes XOP over $45...

87 unique view(s)

July 6th, 2015

pftq (Official) says on The Tech Trader Wall...

This thread that hasn't been posted in for almost 3 years is revived...

Some very cool observations with Tech Trader below to start:

- Tech Trader covered GM and shorted FCAU last week.

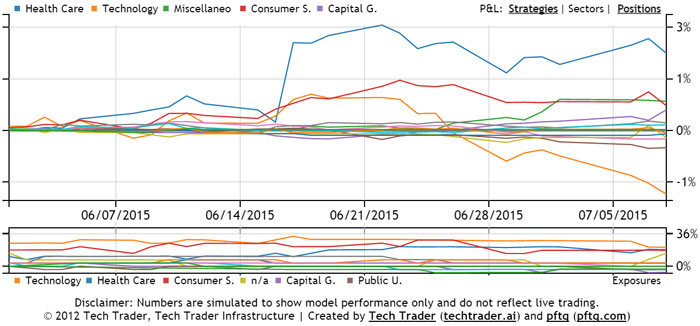

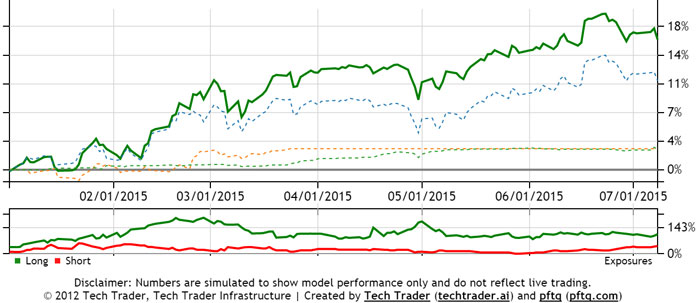

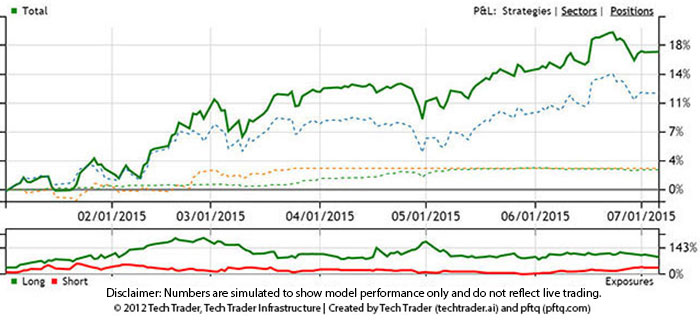

- Tech Trader has shorted 7 names in the past week and significantly trimmed long exposure. RSI and bottom signals are quiet, as if it knows the market is shaky right now (covered EEM almost immediately on last week's bounce). You can even see the exposure curves visibly tighten in the chart (longs going down, shorts rising):

- The names Tech Trader *is* buying now are all least likely to be affected by Greece: healthcare, consumer, etc.

- Market opened down as much as 1% today. Tech Trader was up while being net-long. End of discussion.

Some very cool observations with Tech Trader below to start:

- Tech Trader covered GM and shorted FCAU last week.

- Tech Trader has shorted 7 names in the past week and significantly trimmed long exposure. RSI and bottom signals are quiet, as if it knows the market is shaky right now (covered EEM almost immediately on last week's bounce). You can even see the exposure curves visibly tighten in the chart (longs going down, shorts rising):

- The names Tech Trader *is* buying now are all least likely to be affected by Greece: healthcare, consumer, etc.

- Market opened down as much as 1% today. Tech Trader was up while being net-long. End of discussion.

116 unique view(s)

December 31st, 2012

pftq (Official) says in Stocks Daily Discussion...

116 unique view(s)

December 20th, 2012

pftq (Official) says in Stocks Daily Discussion...

My Tech Trader program now automatically posts its trades to my virtual trading site as well. Useful for me to keep track of what it's doing from my phone and whatnot.

https://www.pftq.com/stock_sys...

It's pretty much like another person trading my account for me now lol

Meanwhile comprehensive strategy is still short on SPY. Will be hilarious if the next sell off coincides with the end of the world prediction date (12/21/2012).

https://www.pftq.com/stock_sys...

It's pretty much like another person trading my account for me now lol

Meanwhile comprehensive strategy is still short on SPY. Will be hilarious if the next sell off coincides with the end of the world prediction date (12/21/2012).

125 unique view(s)

December 17th, 2012

pftq (Official) says in Stocks Daily Discussion...

Updated bollinger bands to highlight pinches in bold red. Looks like we're forming one on SPY right now as well. Should be interesting.

Also tentative long on LRCX based on trendlines.

Also tentative long on LRCX based on trendlines.

128 unique view(s)

December 14th, 2012

pftq (Official) says in Stocks Daily Discussion...

Finally done with finals here - haven't looked at anything all week and still slowly taking things in haha

Comprehensive strat on SPY is still short. Great bounce down from resistance, love how we sold off from QE announcement again. MACD is still bullish though and the volume isn't strongly indicative of a top.

Automated trades did ok, about flat this week with a mix of losses/gains. Need to restrict the number of RSI trades since a lot of them seemed correlated (right together, wrong together,). Trendline break trades helped even things out for the most part, namely trades on MU, AMRN, A, and DKS. FCX didn't play out at all - probably should put a filter on gap-downs (actually have one on the strat but it's for extreme % gap-downs, which didn't trigger on FCX).

Comprehensive strat on SPY is still short. Great bounce down from resistance, love how we sold off from QE announcement again. MACD is still bullish though and the volume isn't strongly indicative of a top.

Automated trades did ok, about flat this week with a mix of losses/gains. Need to restrict the number of RSI trades since a lot of them seemed correlated (right together, wrong together,). Trendline break trades helped even things out for the most part, namely trades on MU, AMRN, A, and DKS. FCX didn't play out at all - probably should put a filter on gap-downs (actually have one on the strat but it's for extreme % gap-downs, which didn't trigger on FCX).

122 unique view(s)

December 7th, 2012

pftq (Official) says in Stocks Daily Discussion...

Not much change in market conditions so far, just more stocks continuing to run up against resistance and geting flagged as short opportunities. Am prepared to flip long if they break though.

120 unique view(s)

December 6th, 2012

pftq (Official) says in Stocks Daily Discussion...

Only one new trade today from the automation. FCX Dec. 31x Puts at $1.20

124 unique view(s)

December 5th, 2012

pftq (Official) says in Stocks Daily Discussion...

Comprehensive strategy will cover and go long again if we close this low (close-dependent signals now labeled in orange).

pftq (Official) says in Stocks Daily Discussion...

Out of HTZ at $1.40 on the calls from $1.30 (missed my exit with the program earlier). SPY cover didn't happen - guess we wait more before going long lol

Finally got my trades being automated by my Tech Trader program though and it just exited Dec. calls on CE at $2.40 (from $1.75 entry a couple days ago). It also just started an entry on EWZ Dec. 52x puts at $.82. I'm posting this late cause I also just saw this myself; am away from home a lot these last few weeks of school and am not always around to post the trades when they happen (which is a good thing this is now automated ).

).

Finally got my trades being automated by my Tech Trader program though and it just exited Dec. calls on CE at $2.40 (from $1.75 entry a couple days ago). It also just started an entry on EWZ Dec. 52x puts at $.82. I'm posting this late cause I also just saw this myself; am away from home a lot these last few weeks of school and am not always around to post the trades when they happen (which is a good thing this is now automated

).

).

125 unique view(s)

November 30th, 2012

pftq (Official) says in Stocks Daily Discussion...

HTZ exited yesterday - was out all day and will want to follow that at some point today.

Also a tentative short on KSS.

Also a tentative short on KSS.

124 unique view(s)

November 28th, 2012

pftq (Official) says in Stocks Daily Discussion...

Short signals from last week closed out on the dip in the first hour today. SPY for example exited at $139.05. Was worried this wouldn't play out but seems ok now.  My comprehensive SPY strat is still short though, so I'm keeping a few longer-dated puts on SPY just to see where that goes.

My comprehensive SPY strat is still short though, so I'm keeping a few longer-dated puts on SPY just to see where that goes.

My comprehensive SPY strat is still short though, so I'm keeping a few longer-dated puts on SPY just to see where that goes.

My comprehensive SPY strat is still short though, so I'm keeping a few longer-dated puts on SPY just to see where that goes.

pftq (Official) says in Stocks Daily Discussion...

Trendline break on HTZ today. Picked up Jan 15x calls at $1.25

120 unique view(s)

November 26th, 2012

pftq (Official) says in Stocks Daily Discussion...

Comprehensive strategy on SPY has also gone short now (joining the RSI onslaught of short signals from last week). Scary since if this trade is wrong, it triggers a mistake on both strategies now. :p

119 unique view(s)

November 21st, 2012

pftq (Official) says in Stocks Daily Discussion...

As expected, tentative short on SPY also showed up now on reversion-based strategy. Will watch the close to make sure it holds before acting on it.

pftq (Official) says in Stocks Daily Discussion...

Confirmed short signal today on SPY. Also picked up short signals on a ton of other etfs. Will probably act on this Friday since I wasn't home today.

124 unique view(s)

November 20th, 2012

pftq (Official) says in Stocks Daily Discussion...

Picked up a short signal on XLP via RSI. It is the only short signal on any of the sectors/etfs though. I'm guessing we see a gradual rotation of long positions to short over the next few trading days but just a guess on that part.

121 unique view(s)

November 19th, 2012

pftq (Official) says in Stocks Daily Discussion...

Great open today. Planning on exiting DIA and XLU calls from RSI2 last Thursday some time today.

No exit signal for SPY calls from my comprehensive strategy yet but we'll see what happens end of day.

No exit signal for SPY calls from my comprehensive strategy yet but we'll see what happens end of day.

pftq (Official) says in Stocks Daily Discussion...

Only SPY from the comprehensive strategy is still in play now.

120 unique view(s)

November 16th, 2012

pftq (Official) says in Stocks Daily Discussion...

Looks like technicals predict the future again - 1 day before Congress announces "optimism"

Same thing happened with ECB in the summer, QE3, first unemployment number below 8%, etc.

Same thing happened with ECB in the summer, QE3, first unemployment number below 8%, etc.

125 unique view(s)

November 15th, 2012

pftq (Official) says in Stocks Daily Discussion...

Comprehensive SPY strategy has covered and gone long using the 135 support (so likely just expecting a bounce). It can still change depending on the market close today, but just a heads up. Timing is quite interesting - DIA and a few others have also triggered RSI2/Market-Bottom buy signals, not to mention the holiday rally usually starts around this time. These are all <80% hitrate signals though, keep in mind.

Edit: Signal confirmed at close.

Edit: Signal confirmed at close.

126 unique view(s)

November 14th, 2012

pftq (Official) says in Stocks Daily Discussion...

Lots of new lower trendline breaks following new lows on SPY.

Watch the close to make sure the signals hold though.

Unfortunately too busy with midterms here to trade them.

Watch the close to make sure the signals hold though.

Unfortunately too busy with midterms here to trade them.

122 unique view(s)

November 10th, 2012

pftq (Official) says in Stocks Daily Discussion...

Comprehensive strategy added more short on SPY this past Friday. I was out of town all weekend so I only just saw it. Getting interesting since it seems to be coming out of the gate quite strongly (first live trade in October) and coincides with the onslaught of recent trendline short signals.

124 unique view(s)

November 7th, 2012

pftq (Official) says in Stocks Daily Discussion...

Every short signal I've been getting the last couple weeks basically played out. Need to really take myself out of the picture and stop interfering with the trades. Updated charts on the ones I posted before:

IWM Trendline Break from Oct.26

IWO Trendline Break from Oct.26

SPY Short via Comprehensive Strat from Oct.25

Just a ton of more trendline short signals today on the scans. As usual, have to watch the close near end of day to confirm breaks, but just very disappointed at the moment. Probably going to just stay on the sidelines until I have more time to actually watch the markets (lot of midterms + projects these few weeks until Thanksgiving).

IWM Trendline Break from Oct.26

IWO Trendline Break from Oct.26

SPY Short via Comprehensive Strat from Oct.25

Just a ton of more trendline short signals today on the scans. As usual, have to watch the close near end of day to confirm breaks, but just very disappointed at the moment. Probably going to just stay on the sidelines until I have more time to actually watch the markets (lot of midterms + projects these few weeks until Thanksgiving).

118 unique view(s)

November 1st, 2012

pftq (Official) says in Stocks Daily Discussion...

GNW calls currently at $.30 from $.20; going to get out at either a break below $6.08 or a test of $6.60.

Picked up Dec. 45x calls on PCAR at $1.70

Picked up Dec. 45x calls on PCAR at $1.70

88 unique view(s)

October 31st, 2012

pftq (Official) says in Stocks Daily Discussion...

Out of DIA calls at $1.82 from $1.70

ALXN puts finally playing out; stock is at $93 from $95 call initial post.

DIA from a week back:

The lower trendline breaks on IWM/IWO last Friday that didn't hold into close ended up breaking anyway. Picked up IWM Nov 81x puts at $1.40

ALXN puts finally playing out; stock is at $93 from $95 call initial post.

DIA from a week back:

The lower trendline breaks on IWM/IWO last Friday that didn't hold into close ended up breaking anyway. Picked up IWM Nov 81x puts at $1.40

pftq (Official) says in Stocks Daily Discussion...

Holding all puts now (IWM, XLP, XLI, ALXN) from trendline breaks, so I'm hoping to get some long signals soon to balance out.

Watching GNW for a good close to confirm an upper trendline break.

Watching GNW for a good close to confirm an upper trendline break.

pftq (Official) says in Stocks Daily Discussion...

Added GNW Nov 6x calls at .20. Seems like banks are doing well compared to the rest of the market, and it's a nice way to balance all the puts I'm holding.

Out of ALXN at $5.3 from $4

Out of ALXN at $5.3 from $4

84 unique view(s)

October 29th, 2012

pftq (Official) says in Stocks Daily Discussion...

This SPY signal was actually generated Friday, so I'm definitely noticing this one a bit late. However, this strategy is the most comprehensive of the 3 I currently have, using all the indicators I know instead of just being led by either Trendlines or RSI. The significance is that this strategy has not made a trade since June (long) when I first wrote it, so it's basically the first trade it's making since it was born. :O I'm very confused though why it shorted at such a low point; will be watching closely to see how it performs in real life now.

Altogether a very confusing past week for me so far. We basically had short signals from support trendlines breaking across the board on the S&P individual stocks and on several sector indicies but at the same time, a few select indicies were oversold and marked as long for the RSI-driven strategy. The addition of this third more complex strategy also weighing short on the SPY itself just makes me more confused.

Altogether a very confusing past week for me so far. We basically had short signals from support trendlines breaking across the board on the S&P individual stocks and on several sector indicies but at the same time, a few select indicies were oversold and marked as long for the RSI-driven strategy. The addition of this third more complex strategy also weighing short on the SPY itself just makes me more confused.

81 unique view(s)

October 26th, 2012

pftq (Official) says in Stocks Daily Discussion...

More support breaks just now. Only valid if we don't rally back up into close of course.

83 unique view(s)

October 25th, 2012

pftq (Official) says in Stocks Daily Discussion...

Picked up Nov 31x calls on DIA at $1.70. Oversold + bottom signal recently. Only thing is I'm not sure how well the signal works for this symbol. Again, only really picking this up as a hedge against all the Trendline short signals.