120 unique view(s)

Updates by Tech Trader, a fully autonomous trading system with no human intervention.

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

pftq (Official) says on The Tech Trader Wall...

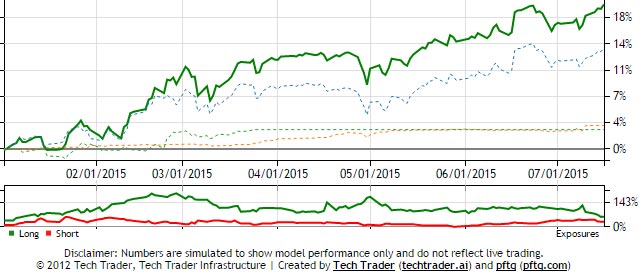

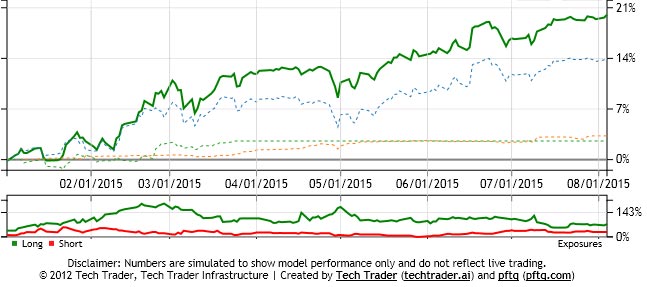

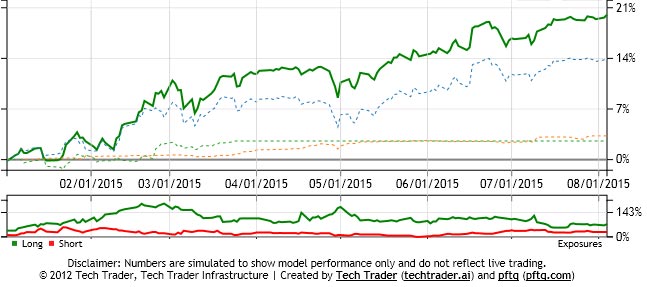

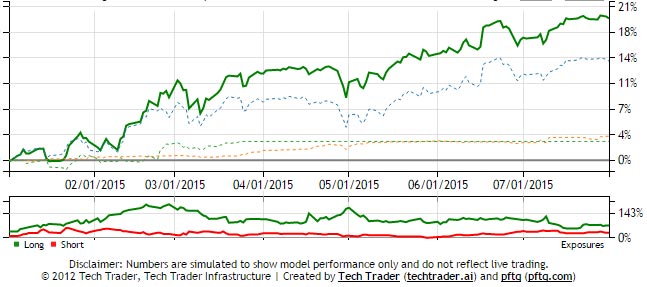

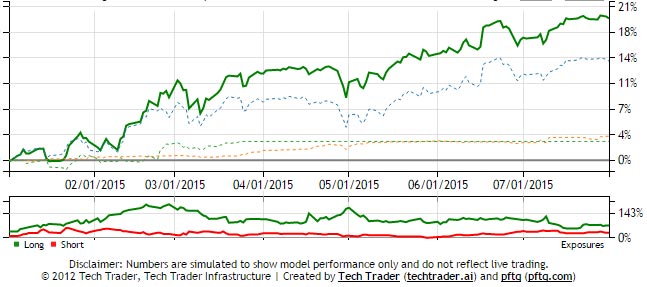

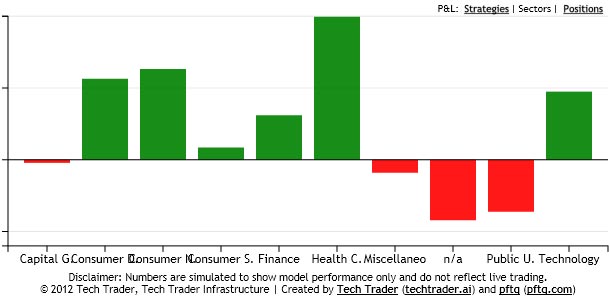

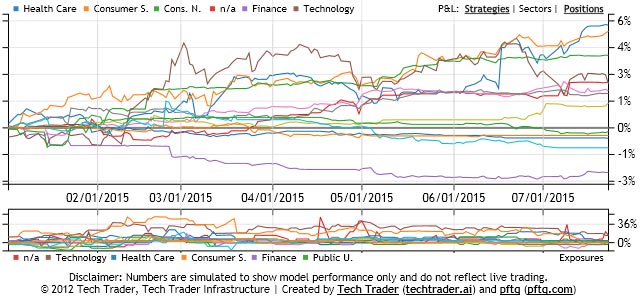

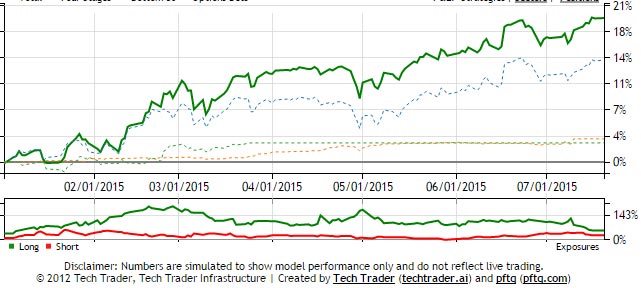

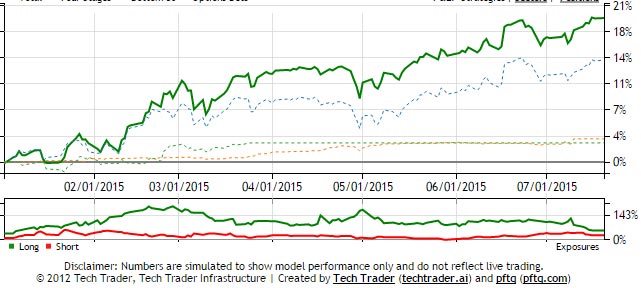

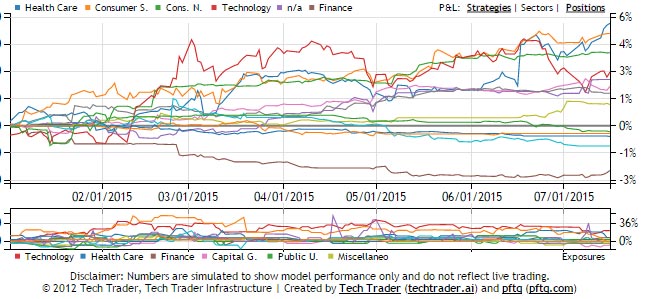

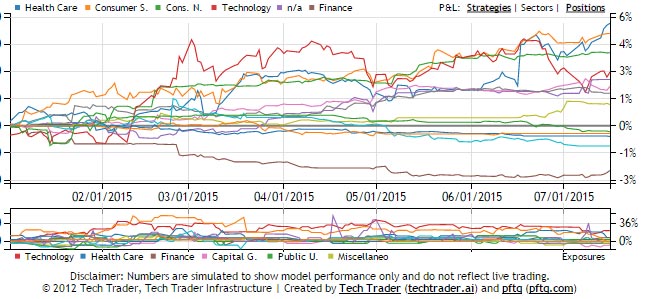

I think it's important to clarify what the current positioning actually is. We've had a slight increase in the number of trades the last few days, but at a portfolio level, things are still very neutral. For every long, we're getting a short or sell as well. Exposures to sectors remain very flat. There's also a lot of whiplash intraday, so a lot of signals that are "potential trades" do not necessarily trade by end of day, as we saw with FOLD and KITE. Will try to be clearer on those next time, but in general, besides the ETFs/bottom trades, anything posted intraday is tentative and can change until the actual market close.

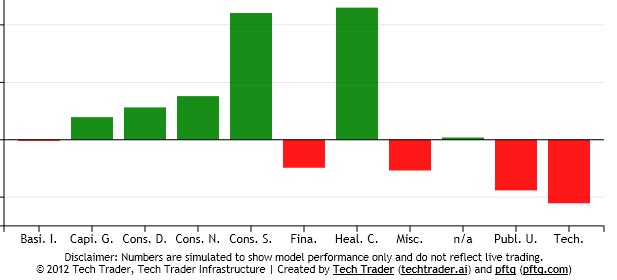

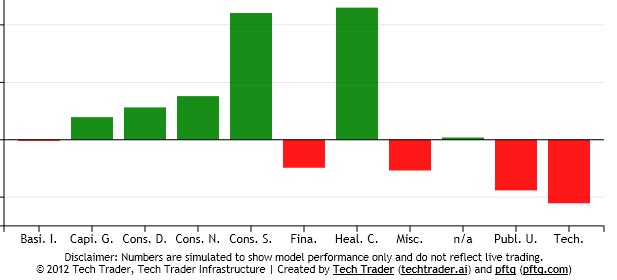

Below are the current exposures for Tech Trader, which you can see continues to tighten despite added names.

Below are the current exposures for Tech Trader, which you can see continues to tighten despite added names.

pftq (Official) says on The Tech Trader Wall...

122 unique view(s)

August 6th, 2015

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

TLT trade exited at $122.55. The actual calls traded (Aug.28 2015 122.5) netted 42% going from $1.13 to $1.61.

118 unique view(s)

August 5th, 2015

pftq (Official) says on The Tech Trader Wall...

Pretty exciting. After about 2 week's slumber, exposures are starting to pick up again. TLT just got an intraday bottom at about $121.4. Names like FOLD and SPR are lining up to be bought on breakout continuation to the long side. Update: Lost the signal for FOLD at close and didn't trade it; looks like it's tough to sustain a breakout for individual names at least.

pftq (Official) says on The Tech Trader Wall...

120 unique view(s)

August 4th, 2015

pftq (Official) says on The Tech Trader Wall...

Tech Trader up .5% today with the market flat. Longs are up about .3%, while shorts, which only are 30% exposure to the 75% long, are up.9%.

Biggest contributer today is shorting CRUS, which is adding 5.4% P&L. It's impressive that Tech Trader held it short for as long as it did given it's huge run up over the last few weeks.

New positions potentially being added today are long EL and short GRMN, both which look pretty good chart-wise. EL is forming an ascending triangle breakout while GRMN is just continuing a gradual melt downwards.

Biggest contributer today is shorting CRUS, which is adding 5.4% P&L. It's impressive that Tech Trader held it short for as long as it did given it's huge run up over the last few weeks.

New positions potentially being added today are long EL and short GRMN, both which look pretty good chart-wise. EL is forming an ascending triangle breakout while GRMN is just continuing a gradual melt downwards.

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

97 unique view(s)

July 31st, 2015

pftq (Official) says on The Tech Trader Wall...

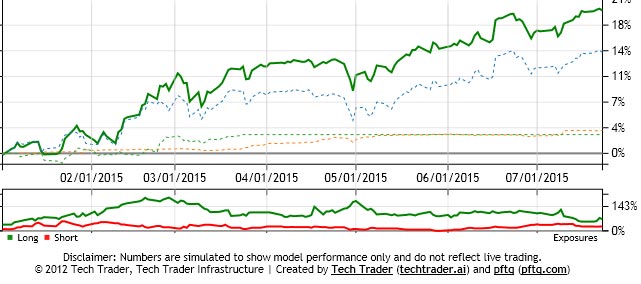

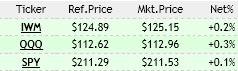

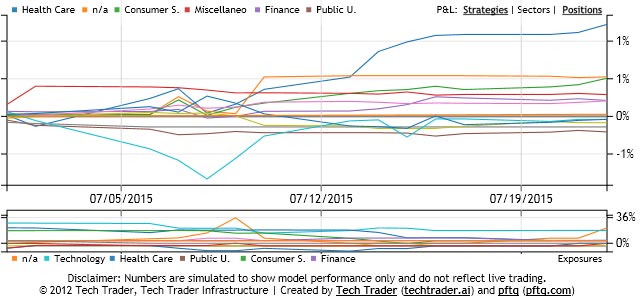

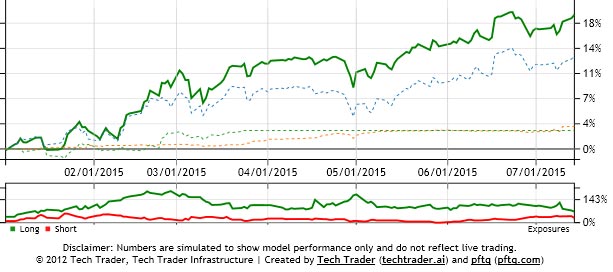

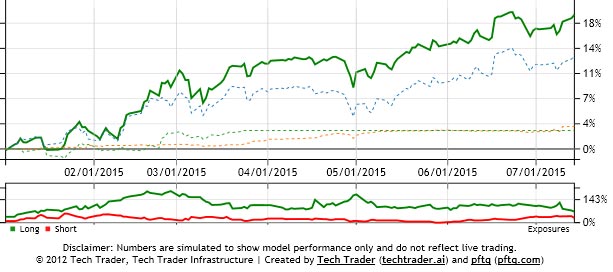

Tech Trader closing out the week flat and month up 3% when S&P has been whipsawing to be up 2%. For the year, the automated strategies in Tech Trader are up 20% and S&P up only a couple percent with much more volatility. Bottom 30Min etf positions are closed out now. Exposures are still very neutral at 72% long vs 29% short. Sector exposures also crushed way down on the lower chart. Need to get Tech Trader automatically posting its own updates unless I want to become its coffee boy lol

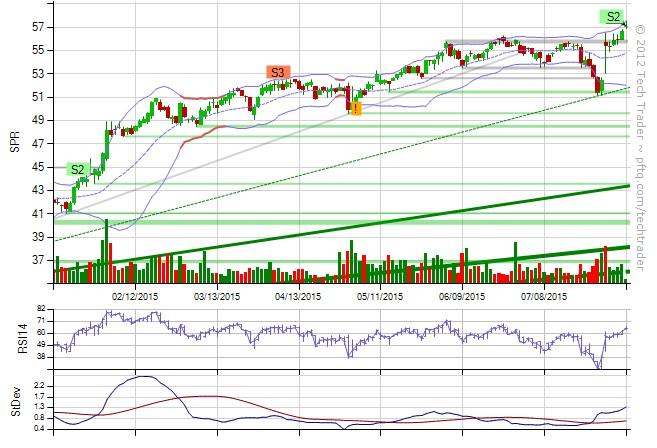

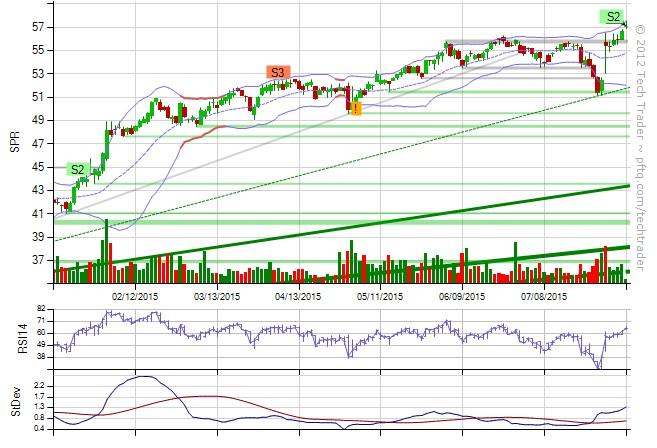

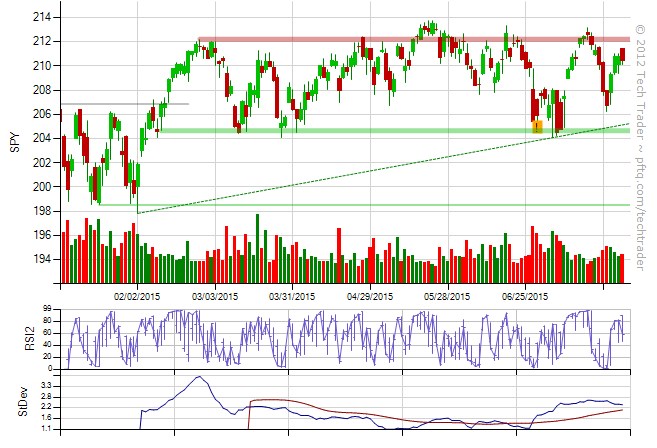

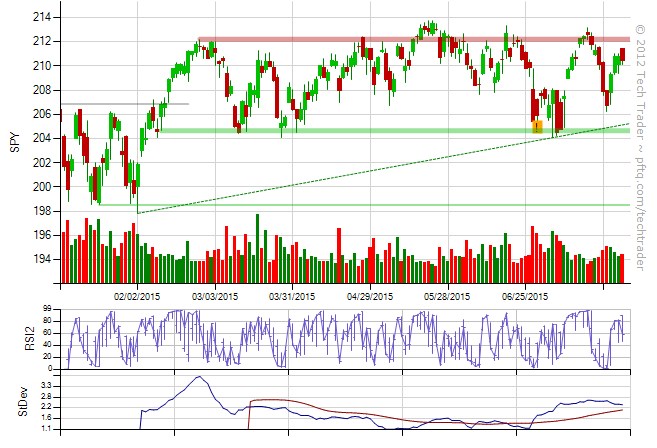

SPY, for comparison (much more volatile and up only a few percent for the year):

SPY, for comparison (much more volatile and up only a few percent for the year):

88 unique view(s)

July 24th, 2015

pftq (Official) says on The Tech Trader Wall...

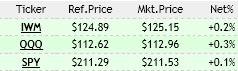

Tech Trader again up while the market is down. Current portfolio is up .2% despite remaining intraday bottom signal positions in QQQ and SPY being down. Market is down over half a percent (SPY .5% and IWM .7%). Much of Tech Trader's performance today is again owed to being short names like ARRY, FCAU and HLT.

pftq (Official) says on The Tech Trader Wall...

There are like 15 stocks being flagged as trendline breakdowns. Those aren't being traded but it gives you a sense of how weak the market is.

pftq (Official) says on The Tech Trader Wall...

The Fed accidentally leaks its own reports early again. What's wrong with these guys?

Fed Inadvertantly Publishes Staff Forecast...

Fed Inadvertantly Publishes Staff Forecast...

96 unique view(s)

July 23rd, 2015

pftq (Official) says on The Tech Trader Wall...

All three intraday bottom signals from the last couple days are working now. All the more fun when the automation is actually trading calls and not just equity like the model portfolio is showing.

Individual names are doing ok today. Took a big hit from shorting CRUS (down 17%) but other names like GRPO (+4%), HLT (+2%), etc are doing well enough to neutralize it. Overall Tech Trader just killing it year-to-date, which really highlights how unique and "human" Tech Trader's trading style is given that a recent article just made the point that humans are beating most other computer-driven funds this year.

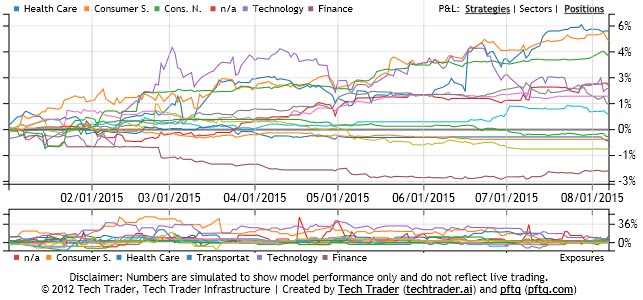

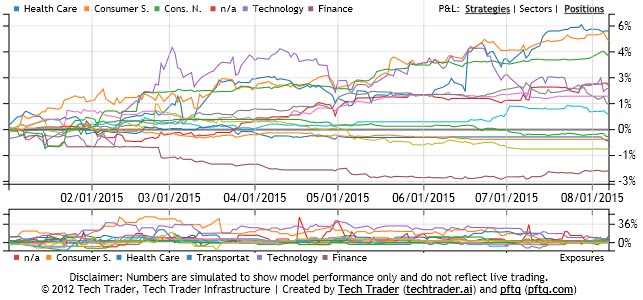

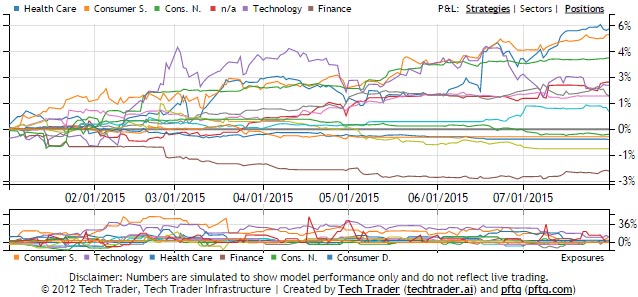

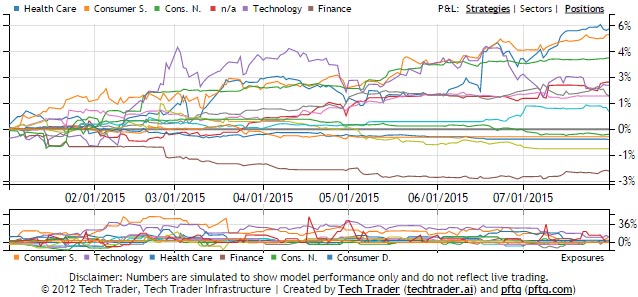

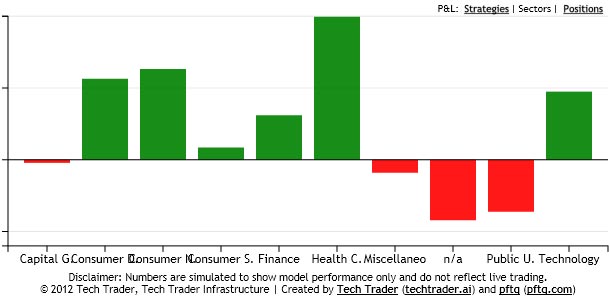

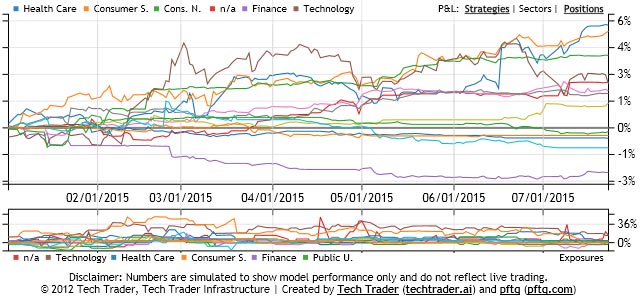

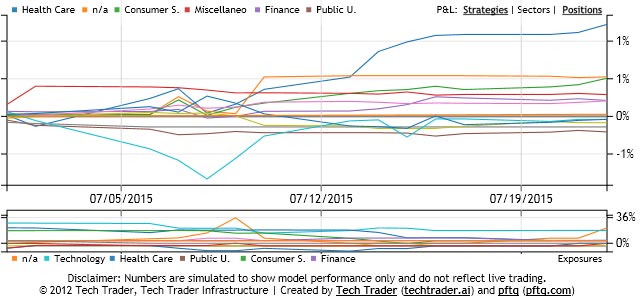

Also interesting to note that consumer is starting to take a lead from Healthcare for dominant driver of performance. Again, none of this is coded. Tech Trader just looks at individual names like a trader, but the macro themes arise on their own.

Individual names are doing ok today. Took a big hit from shorting CRUS (down 17%) but other names like GRPO (+4%), HLT (+2%), etc are doing well enough to neutralize it. Overall Tech Trader just killing it year-to-date, which really highlights how unique and "human" Tech Trader's trading style is given that a recent article just made the point that humans are beating most other computer-driven funds this year.

Also interesting to note that consumer is starting to take a lead from Healthcare for dominant driver of performance. Again, none of this is coded. Tech Trader just looks at individual names like a trader, but the macro themes arise on their own.

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

Market ended the day down .5% on SPY and 1% on IWM. Tech Trader only down .2%. Gross exposure on breakout names starting to rise a bit again but very selective as usual. Long INFN and USG while re-shorting FOSL. The fact any fresh breakout names are being caught on the long side at all shows how idiosyncratic things are, as it has been for most this year.

pftq (Official) says on The Tech Trader Wall...

Hoping I get my daily bottom signal at long last. Fingers crossed.

76 unique view(s)

July 22nd, 2015

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

Tech Trader is up .2% today even though SPY is down .3% and QQQ down more than 1%. Oddly enough, Tech Trader's biggest exposure right now is Technology, which is down 1.5% as a sector but is having little to no impact on Tech Trader's names. Biggest winners today are the short in ARRY (-4.5%) and long in DRI (3%).

pftq (Official) says on The Tech Trader Wall...

No premarket or aftermarket. I'd need a data feed for that (historical). Would be interesting to test one day though.

QQQ just flagged an intraday bottom as well. So that makes IWM, SPY, and QQQ for intraday now.

QQQ just flagged an intraday bottom as well. So that makes IWM, SPY, and QQQ for intraday now.

pftq (Official) says on The Tech Trader Wall...

Zzz market bounced too quickly before my signal could trade. Need to not post these ahead of the signal.

pftq (Official) says on The Tech Trader Wall...

Ok got the signal back on the second dip. Tech Trader is in now at $211.50

64 unique view(s)

July 21st, 2015

pftq (Official) says on The Tech Trader Wall...

lol we actually have SPY down and IWM up right now. Even if Tech Trader shorted SPY yesterday in addition to its long IWM, both would have worked out.

64 unique view(s)

July 20th, 2015

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

Tech Trader continuing to reduce gross and take gains. Now 54% long by 25% short (29% net long)

pftq (Official) says on The Tech Trader Wall...

Wow, I waited all year for Tech Trader to flag SPY as a buy and I get a potential short now instead. It says SPY is overbought near resistance. Definitely wait till close to confirm. What a strange year.

pftq (Official) says on The Tech Trader Wall...

Lost the short signal on SPY to the end of day sell off. Still looks bearish IMO, but we needed SPY above $212.90 to be nice enough an entry for shorting.

pftq (Official) says on The Tech Trader Wall...

What the crap... IWM just shot up to $125.54. Good thing it's automated. Too fast for me

pftq (Official) says on The Tech Trader Wall...

LVLT August 60x calls getting bid up a lot if anyone wants to take a deeper look. 10k calls traded when OI is 1k.

pftq (Official) says on The Tech Trader Wall...

Those calls are $.95 now.

pftq (Official) says on The Tech Trader Wall...

What's very odd about the LVLT calls is that the bid/ask is rising even as the stock is pulling back. .95x1.00 now

61 unique view(s)

July 17th, 2015

pftq (Official) says on The Tech Trader Wall...

Those ELNK July 8x calls from a couple weeks back are now ITM on day of expiration. Such an insane trade.

53 unique view(s)

July 16th, 2015

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

Here's recent performance by sector. Mostly profit taking in healthcare. You can see HC P&L going up the last few days while exposure in the sector has nosedived.

51 unique view(s)

July 14th, 2015

pftq (Official) says on The Tech Trader Wall...

RCPT breaking above $200. Tech Trader making good calls here to stay long.

pftq (Official) says on The Tech Trader Wall...

Tech Trader sold NFLX last Friday on the doji top, so it's out before the split (though with no knowledge of it).

I'd just get out of AMZN if there is no good trade to roll into. These trades are all idiosyncratic, so there is no need for the mindset that you need to be in all or no trades.

Also, Tech Trader is closing out a lot of positions. Exposures are going way down right now. Exited RCPT on potential resistance, but it can easily buy back in again tomorrow if it breaks. The same goes for everything else it's closing out. Just very nimble and tactical here.

I'd just get out of AMZN if there is no good trade to roll into. These trades are all idiosyncratic, so there is no need for the mindset that you need to be in all or no trades.

Also, Tech Trader is closing out a lot of positions. Exposures are going way down right now. Exited RCPT on potential resistance, but it can easily buy back in again tomorrow if it breaks. The same goes for everything else it's closing out. Just very nimble and tactical here.

pftq (Official) says on The Tech Trader Wall...

ELNK finally waking up. Been waiting on it for a few weeks since it got huge call buying in the July 8x.