734 unique view(s)

Updates by Tech Trader, a fully autonomous trading system with no human intervention.

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

pftq (Official) says on The Tech Trader Wall...

So many people were doubting my price target as soon as I put that out, but now we're shooting straight up lol

This is the Power of Fate and Irony - letting the most ironic outcomes always be in your favor. Got me so inspired that I wrote an article on it, but hey, it's going to be the basis of my newest project so it's about time.

This is the Power of Fate and Irony - letting the most ironic outcomes always be in your favor. Got me so inspired that I wrote an article on it, but hey, it's going to be the basis of my newest project so it's about time.

pftq (Official) says on The Tech Trader Wall...

In spirit of the irony post I just wrote, I'll sell my weeklies now to ensure the success of our trade by regretting this decision tomorrow, but I'll survive this regret with my other calls lol

191x weekly calls up +200%. Still holding month out 191x up 85%.

BUT... I also have a fresh position in 197x calls at $.30 (now $1.01). Fate won't see it coming if we rally crazy tomorrow.

191x weekly calls up +200%. Still holding month out 191x up 85%.

BUT... I also have a fresh position in 197x calls at $.30 (now $1.01). Fate won't see it coming if we rally crazy tomorrow.

633 unique view(s)

August 25th, 2015

pftq (Official) says on The Tech Trader Wall...

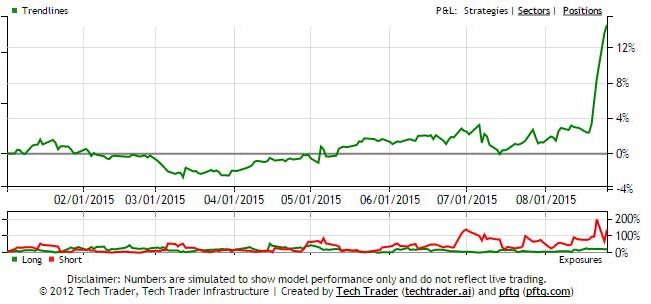

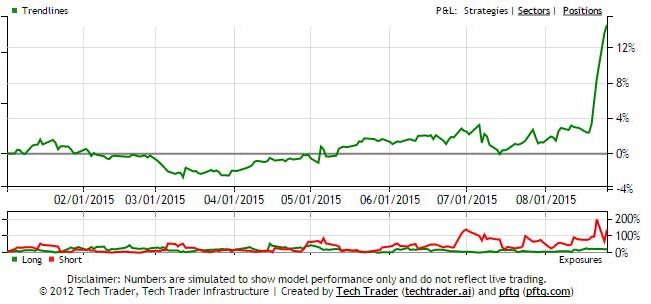

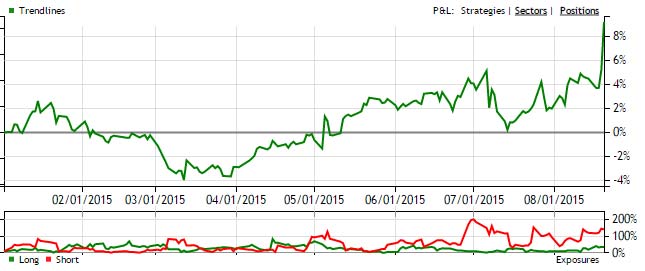

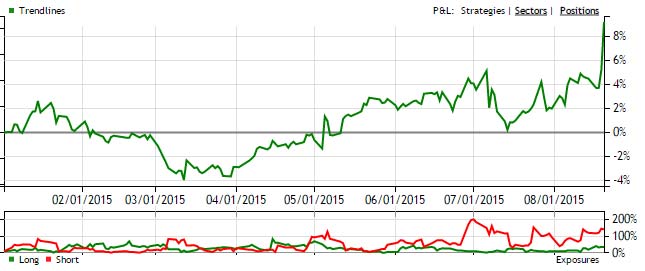

Freaking trendline breaks strategy (one of my first super-primitive ones years ago) is doing extremely well. Up 15% now for the month. Perhaps I should give the abandoned strategy a more serious look; hard to say.

pftq (Official) says on The Tech Trader Wall...

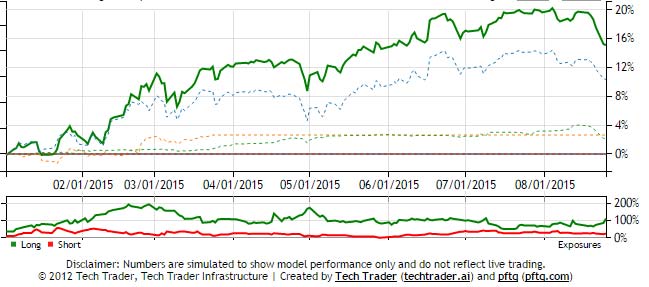

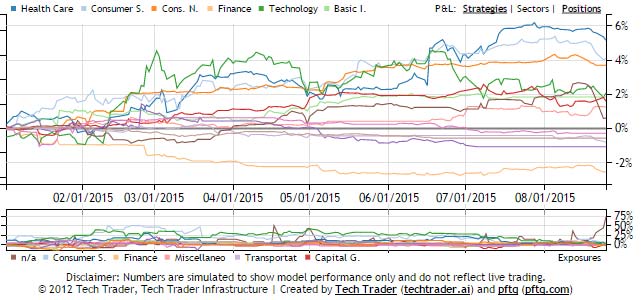

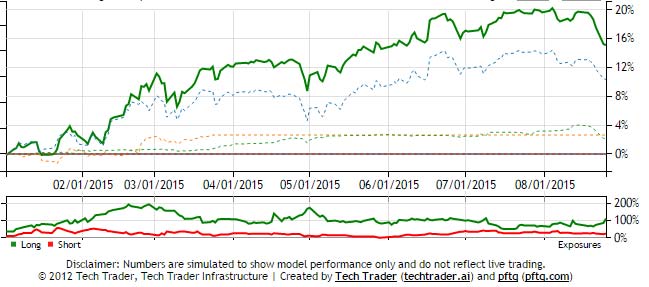

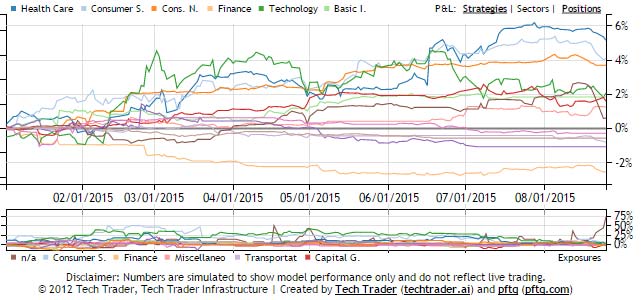

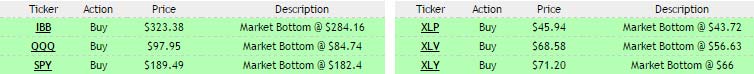

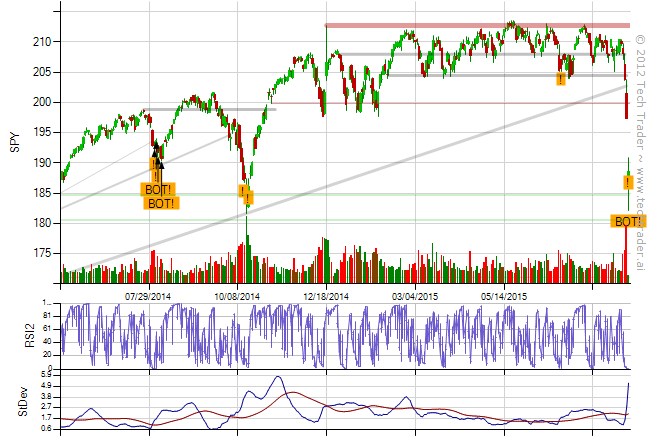

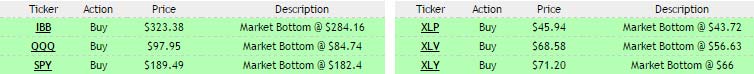

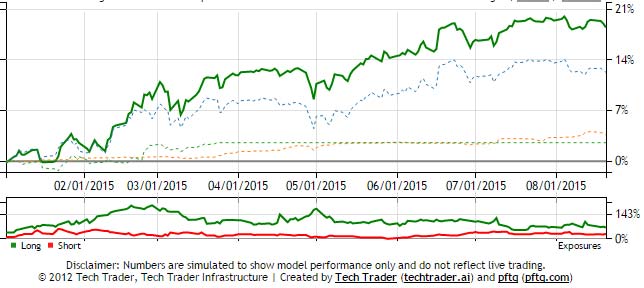

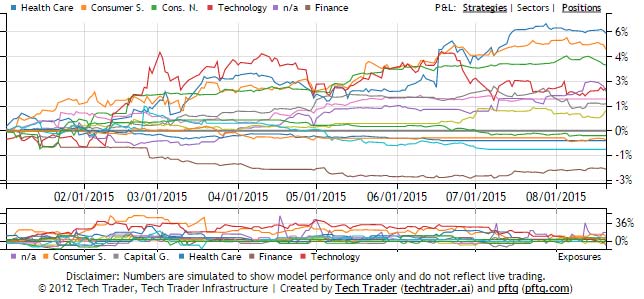

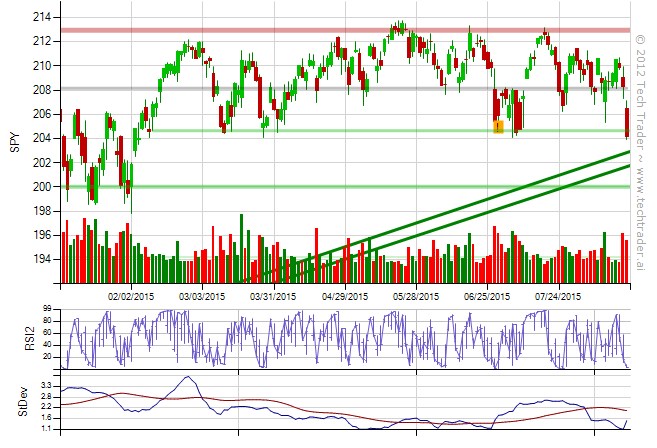

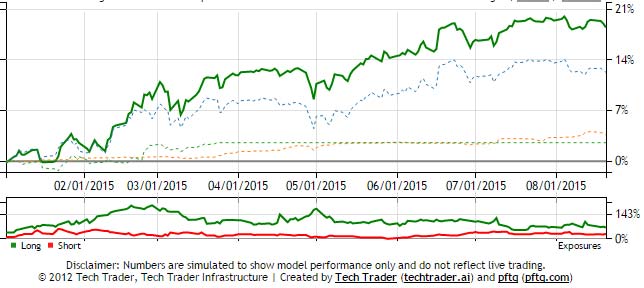

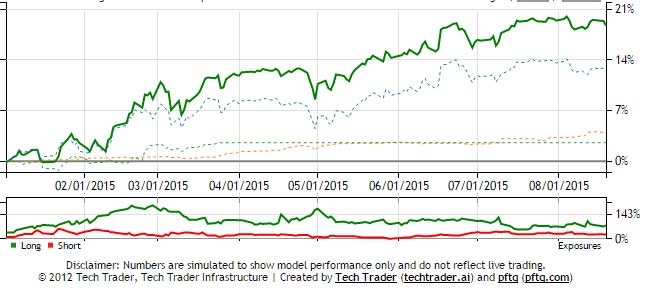

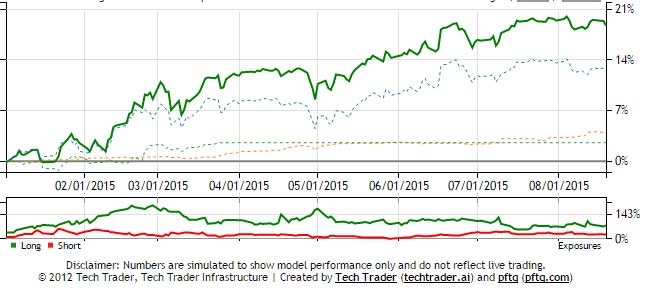

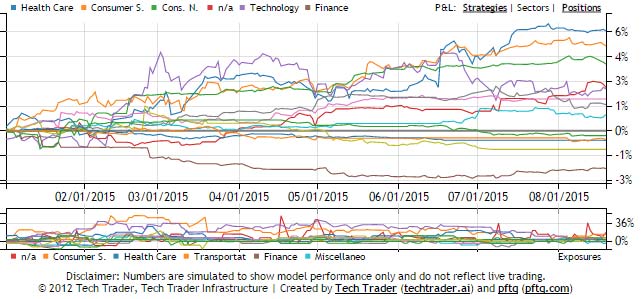

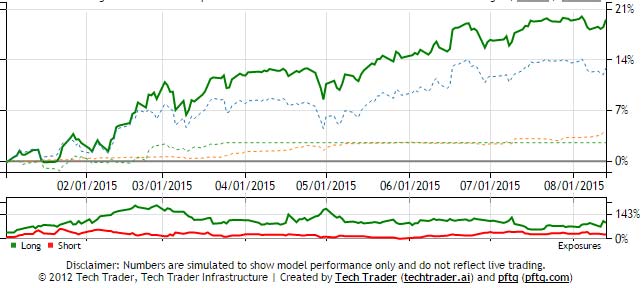

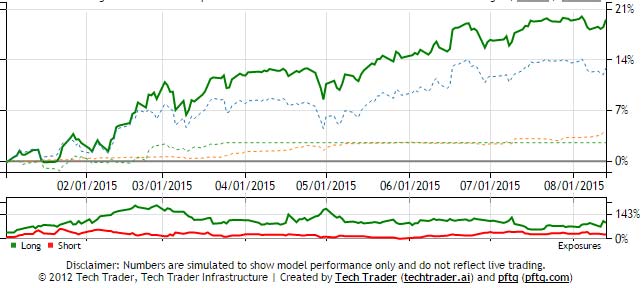

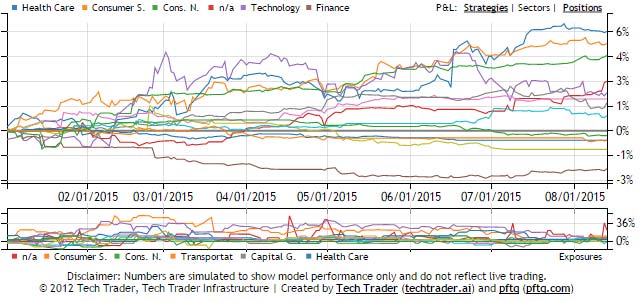

Here's a review of where things are at. Tech Trader did end up taking a hit (largely Monday) and is down 5% off the highs of 20%. Markets are off about 12% from the highs, however, and SPY is actually negative for the year now. The playbook currently is in ETFs and market timing. Positions in individual names remain very neutral as a portfolio thanks to the large exposure cutting that Tech Trader did in July. Tech Trader is getting longer on each sell off day but only in increments where it thinks might be the bottom, leaving a lot of dry powder to average down. As the market bounces, Tech Trader will scale some out, and if we go lower, it will average down again. It will do this until we get back into an uptrend of sorts where market timing signals will then recede and individual names start coming back into play.

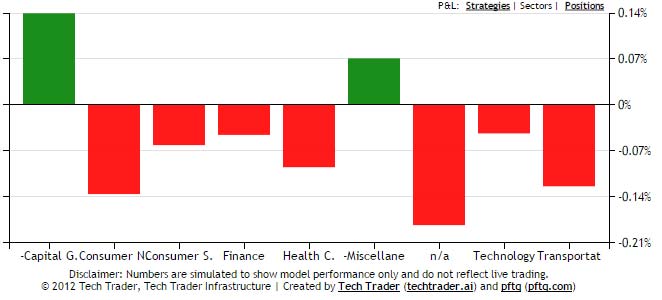

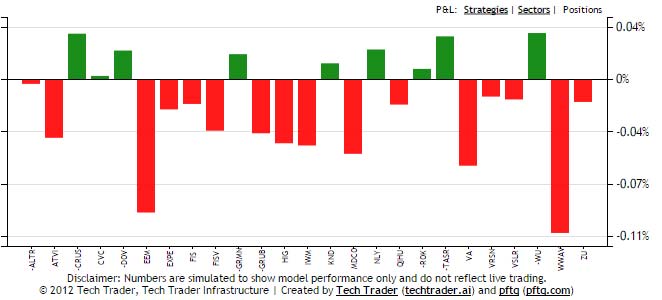

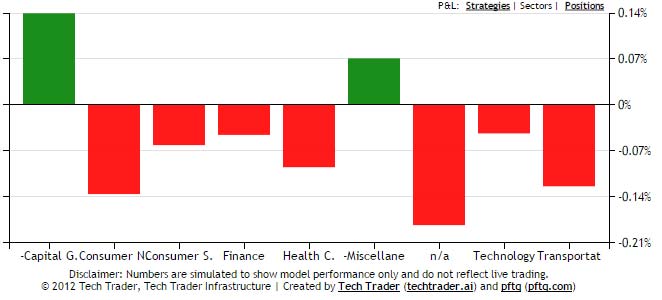

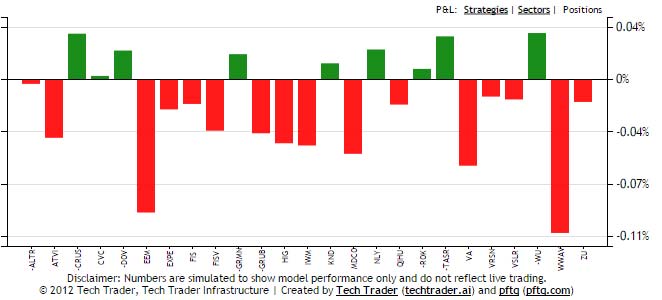

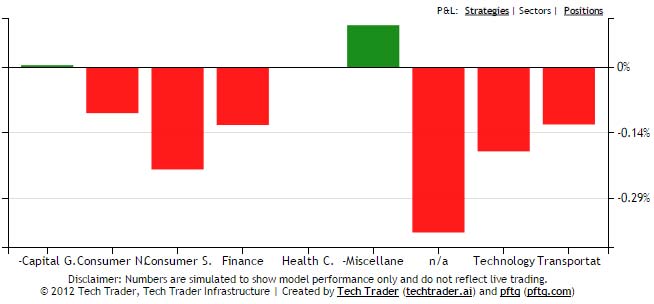

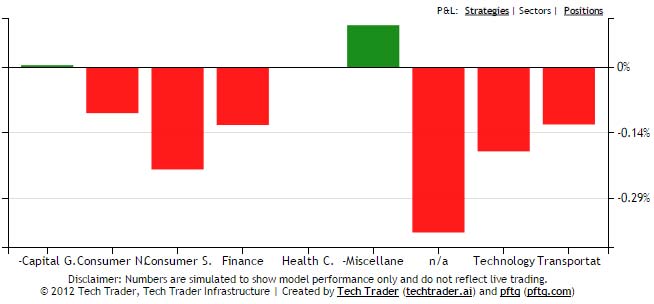

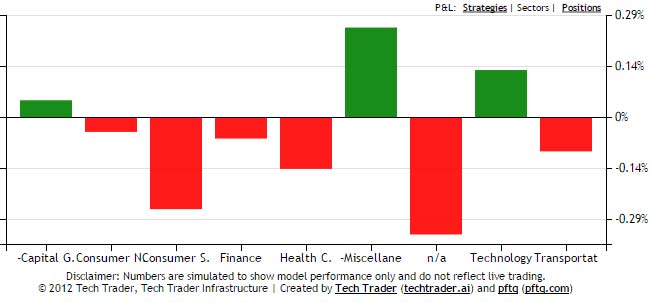

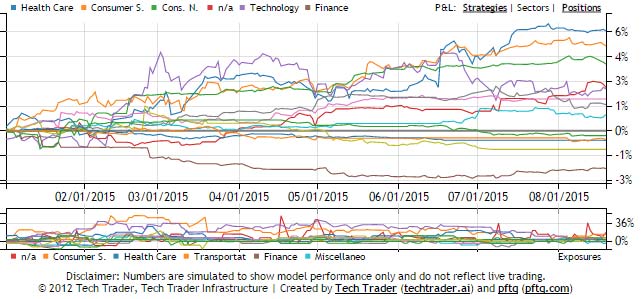

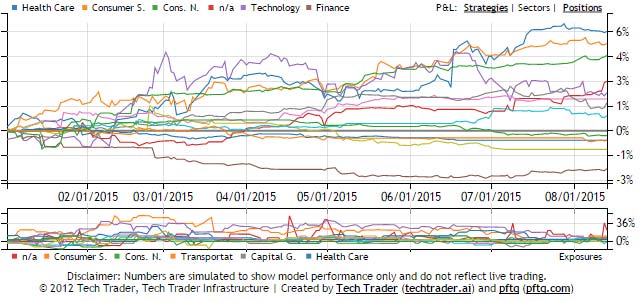

Currently it is 112% long by 24% short, with 30% of that long exposure just now being added from Tuesday's close. If you look at exposures below, you'll see that long is slowly increasing but in the sector charts, all the exposure is coming from ETFs (n/a) which is dwarfing any contribution from individual names right now.

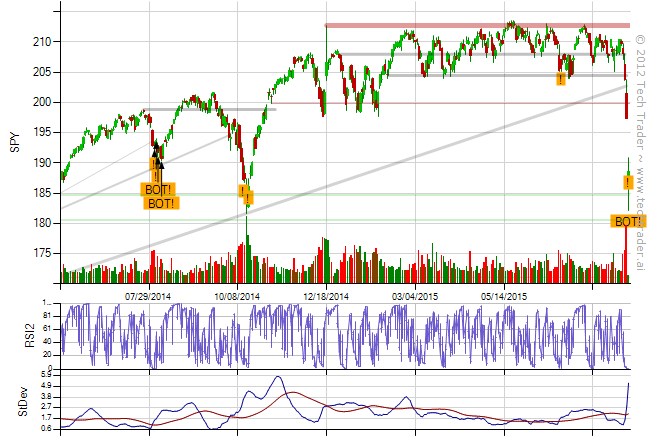

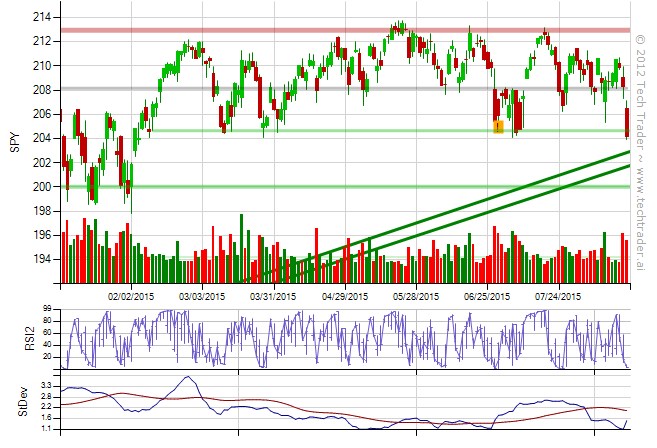

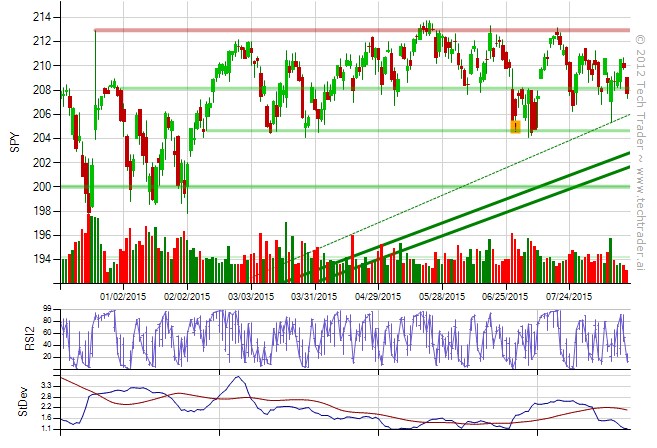

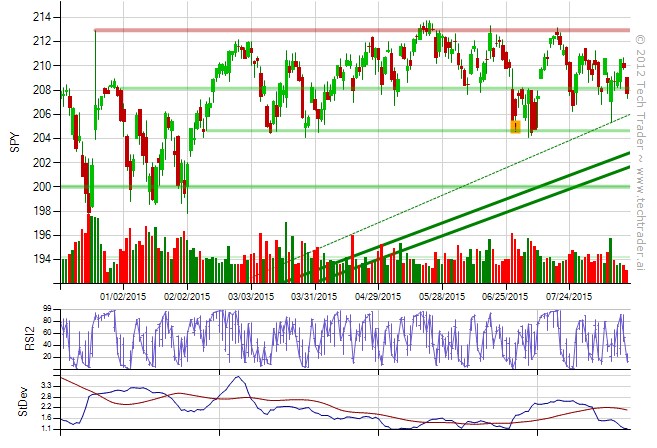

As usual, a YTD chart of SPY for comparison always highlights how stable Tech Trader's performance is compared to the market despite being largely net long most the year (let's not kid ourselves, SPY looks like a nightmare).

Currently it is 112% long by 24% short, with 30% of that long exposure just now being added from Tuesday's close. If you look at exposures below, you'll see that long is slowly increasing but in the sector charts, all the exposure is coming from ETFs (n/a) which is dwarfing any contribution from individual names right now.

As usual, a YTD chart of SPY for comparison always highlights how stable Tech Trader's performance is compared to the market despite being largely net long most the year (let's not kid ourselves, SPY looks like a nightmare).

pftq (Official) says on The Tech Trader Wall...

Prodigal signal returns again. Let's see if it can finally hold into the close.

Update: No bottom signal per se but Tech Trader bought anyway at the very last minute at $187.41 due to the volume and severe price decline. Fingers crossed; didn't take a bottom signal to bounce from October. Very last minute (literally) buy though at the sudden plunge below $188 and only possible because Tech Trader is fully automated.

Update: No bottom signal per se but Tech Trader bought anyway at the very last minute at $187.41 due to the volume and severe price decline. Fingers crossed; didn't take a bottom signal to bounce from October. Very last minute (literally) buy though at the sudden plunge below $188 and only possible because Tech Trader is fully automated.

590 unique view(s)

August 24th, 2015

pftq (Official) says on The Tech Trader Wall...

At long last, my once-in-a-blue-moon buy signal on SPY is finally here. I've been waiting all year for this.

Would wait until close, don't get hasty in case of the remote chance Tech Trader changes its mind.

(but seriously, what are the chances of filling a $10 gap in SPY by end of day?)

Update: Yet again cancelled near the close. The volume and price action is there though, so it'll probably be soon. I need to stop posting these in advance before they actually get traded. The only thing we got is a couple ETFs (XLV and SLV) intraday again. <_<

This is what a proper sell off looks like. Tech Trader wants to buy *everything*. Days like this are a beautiful example of how Tech Trader is NOT quant or conventional algo trading and definitely not mean reverting. All the other quants I know of started scaling in last week and got hit big time, unlike Tech Trader aiming for precision with technical analysis to figure out the exact bottoms (or at least pretty darn close).

Would wait until close, don't get hasty in case of the remote chance Tech Trader changes its mind.

(but seriously, what are the chances of filling a $10 gap in SPY by end of day?)

Update: Yet again cancelled near the close. The volume and price action is there though, so it'll probably be soon. I need to stop posting these in advance before they actually get traded. The only thing we got is a couple ETFs (XLV and SLV) intraday again. <_<

This is what a proper sell off looks like. Tech Trader wants to buy *everything*. Days like this are a beautiful example of how Tech Trader is NOT quant or conventional algo trading and definitely not mean reverting. All the other quants I know of started scaling in last week and got hit big time, unlike Tech Trader aiming for precision with technical analysis to figure out the exact bottoms (or at least pretty darn close).

pftq (Official) says on The Tech Trader Wall...

Lost the SPY bottom at close. Those last minutes really matter. The signal eludes me yet again. Fingers crossed we get it tomorrow.

pftq (Official) says on The Tech Trader Wall...

What's even more amazing is how all the intraday signals just sidestepped today's action and stayed quiet to let the big daily ones take over. None of this is coded. Freaking swarm intelligence at work here lol

Days like this are a beautiful example of how Tech Trader is NOT quant or conventional algo trading and definitely not mean reverting. All the other quants I know of started scaling in last week and got hit big time, unlike Tech Trader aiming for precision with technical analysis to figure out the exact bottoms (or at least pretty darn close).

Days like this are a beautiful example of how Tech Trader is NOT quant or conventional algo trading and definitely not mean reverting. All the other quants I know of started scaling in last week and got hit big time, unlike Tech Trader aiming for precision with technical analysis to figure out the exact bottoms (or at least pretty darn close).

463 unique view(s)

August 23rd, 2015

pftq (Official) says on The Tech Trader Wall...

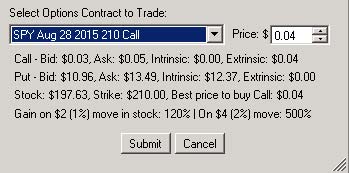

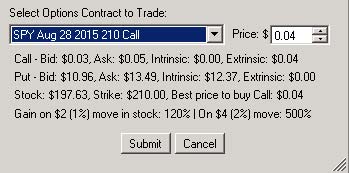

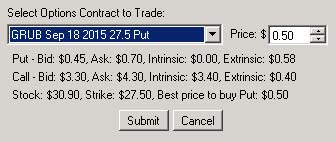

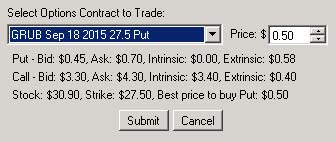

Added the strike selection logic for options to the Tech Trader interface.

(note, prices are a bit out of wack on weekends, so if this were run tomorrow morning, we would probably get a nearer-money strike)

I don't know if this is delta or some other metric/technique. It's how I've always picked my own strikes when trading options, but I never had a name for it.

(note, prices are a bit out of wack on weekends, so if this were run tomorrow morning, we would probably get a nearer-money strike)

I don't know if this is delta or some other metric/technique. It's how I've always picked my own strikes when trading options, but I never had a name for it.

420 unique view(s)

August 22nd, 2015

pftq (Official) says on The Tech Trader Wall...

It just hit me that SPY is really under $200. This is like one of the once-in-a-blue-moon opportunities to buy SPY on Tech Trader's bottom signal once it hits. That's the one we should really be waiting for and should be lining up capital to go in on. Need to wake up here and stop getting side tracked with UNG and all these other distractions.

This is the bottom signal on SPY since 2008. Super rare.

This is the bottom signal on SPY since 2008. Super rare.

416 unique view(s)

August 21st, 2015

pftq (Official) says on The Tech Trader Wall...

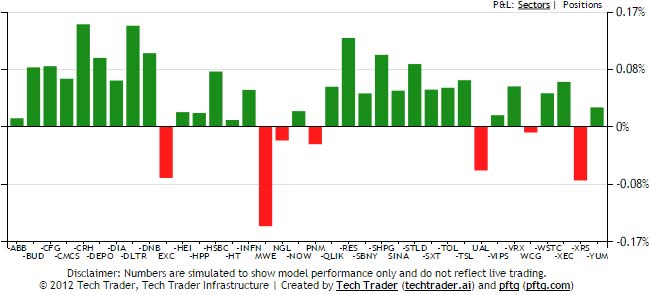

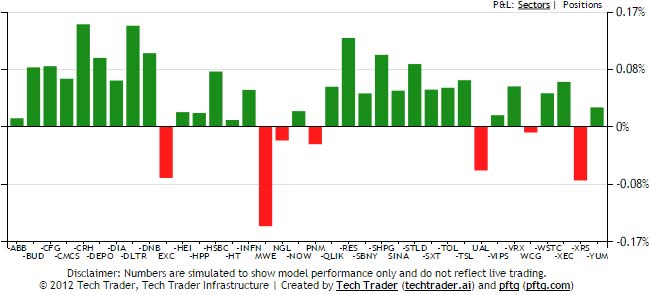

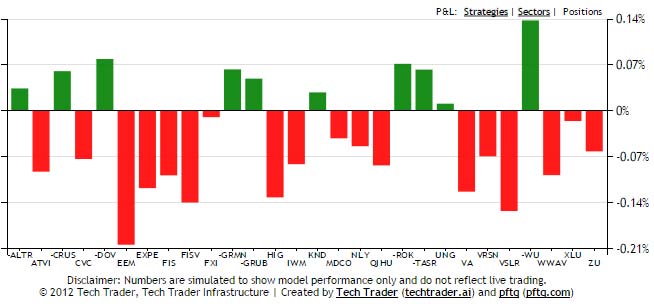

It's only the first half hour of the day, and Tech Trader is already outpeforming market again, down only .5% when the indicies are down 1%. Shorts like TASR (5%) helping a lot today. Added - signs to the charts to show where exposures are short.

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

Trendlines killing it again today up 2% on average across its names. 80% of them working in its favors and majority of them short signals. Really regret not seeing the DIA short yesterday; need to not neglect my older strategies so much.

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

Very strong outperformance in Tech Trader again by the end of day. SPY is down 3% at the end of the day. Tech Trader is down only 1%, again while gradually covering shorts and adding ETF names (currently 82% long by 24% short).

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

Saved 2 cents on XLU calls thanks to the option pricing mechanism lol

2015-08-21 08-02-48: TTFund_TDA_Options: Checking for fair value of XLU Sep 11 2015 46 Call...

2015-08-21 08-02-48: TTFund_TDA_Options: Spread too wide. Basing price on midpoint $0.37 between 0.35x0.38

2015-08-21 08-02-48: TTFund_TDA_Options: Comparing extrinsic value $0.37 on XLU Sep 11 2015 46 Call with $0.28 on XLU Sep 11 2015 46 Put...

2015-08-21 08-02-48: TTFund_TDA_Options: Buying at cheaper price $0.36 for XLU Sep 11 2015 46 Call

2015-08-21 08-02-48: TTFund_TDA_Options: Fair value check complete: Best price at $0.36 in spread of 0.35x0.38

2015-08-21 08-02-48: TTFund_TDA_Options: Checking for fair value of XLU Sep 11 2015 46 Call...

2015-08-21 08-02-48: TTFund_TDA_Options: Spread too wide. Basing price on midpoint $0.37 between 0.35x0.38

2015-08-21 08-02-48: TTFund_TDA_Options: Comparing extrinsic value $0.37 on XLU Sep 11 2015 46 Call with $0.28 on XLU Sep 11 2015 46 Put...

2015-08-21 08-02-48: TTFund_TDA_Options: Buying at cheaper price $0.36 for XLU Sep 11 2015 46 Call

2015-08-21 08-02-48: TTFund_TDA_Options: Fair value check complete: Best price at $0.36 in spread of 0.35x0.38

pftq (Official) says on The Tech Trader Wall...

XLU bouncing already. Calls that TT bought up 20% month out and 30% weekly. The bounces from the capitulation point almost always happens, but it's hard to tell for how long and how high.

292 unique view(s)

August 20th, 2015

pftq (Official) says on The Tech Trader Wall...

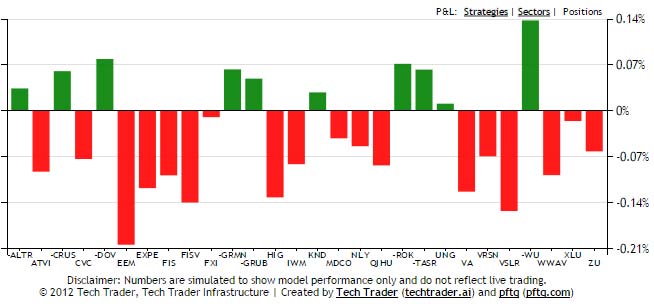

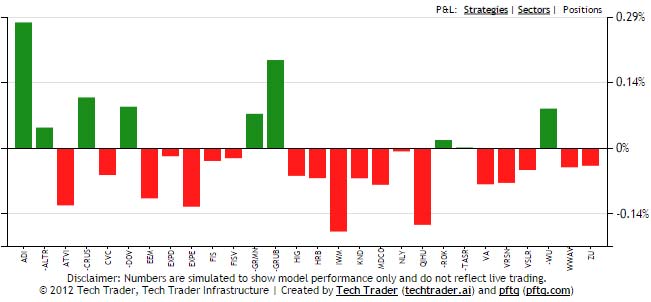

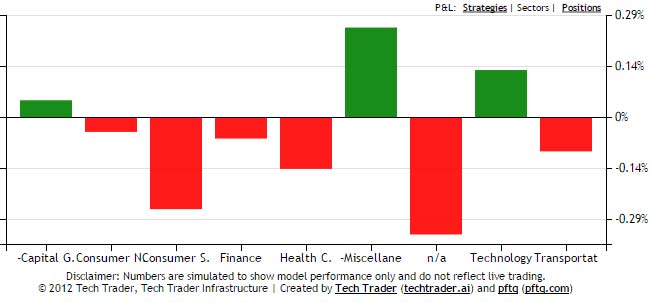

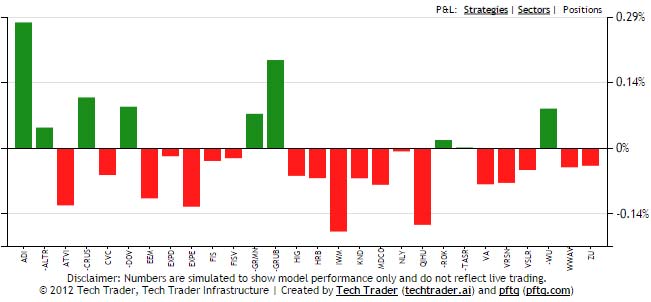

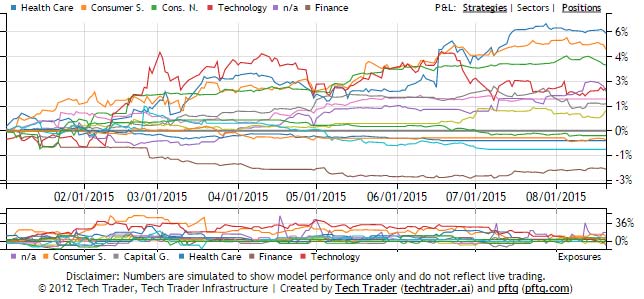

Great show of strength today for Tech Trader against the market sell off. Tech Trader in total, even with yesterday's IWM buy, is only down 0.5%. SPY is down over 2% and IWM is down almost 3%. Shorts like GRUB (5%), ADI (7%), and GRMN (2%) contributed a lot to outperformance, but it's nonetheless 40% net long, meaning longs were pretty resilient as well.

What's interesting to note is that Tech Trader isn't buying the dip today; no bottom or RSI signals on the major indices. There was one yesterday and a leftover from last week, but not the usual 3-5 cluster or more with aggressive averaging down. Again, exposures are at year lows of 65% long vs 28% short.

The n/a sector is ETFs, which consists of EEM and IWM collectively being down about 2% individually but affect less than .3% of the portfolio and are offset everything else. The most any individual name is losing the portfolio is no more than about .1% either.

Again, the sell off is barely a blip in Tech Trader's P&L while you can see SPY for the YTD time frame being very volatile.

What's interesting to note is that Tech Trader isn't buying the dip today; no bottom or RSI signals on the major indices. There was one yesterday and a leftover from last week, but not the usual 3-5 cluster or more with aggressive averaging down. Again, exposures are at year lows of 65% long vs 28% short.

The n/a sector is ETFs, which consists of EEM and IWM collectively being down about 2% individually but affect less than .3% of the portfolio and are offset everything else. The most any individual name is losing the portfolio is no more than about .1% either.

Again, the sell off is barely a blip in Tech Trader's P&L while you can see SPY for the YTD time frame being very volatile.

pftq (Official) says on The Tech Trader Wall...

A lesser talked about strategy for Trendline Breaks is also killing it this week. This is the one that a friend and I used to trade around manually because it doesn't have automated exits. The paper portfolio just gets out on the first day of gain or after 1 stdev loss. It's a good gauge for where things are at though, especially if it's >100% short and making 4% in a few days.

pftq (Official) says on The Tech Trader Wall...

Updated the last post to include percentages on the column charts and a second chart showing how no single name lost more than .1% of the portfolio.

pftq (Official) says on The Tech Trader Wall...

What's interesting to note is that Tech Trader isn't buying the dip today; no bottom or RSI signals on the major indices. There was one yesterday and a leftover from last week, but not the usual 3-5 cluster or more with aggressive averaging down. Again, exposures are at year lows of 65% long vs 28% short.

230 unique view(s)

August 19th, 2015

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

Pretty much every time we have a big sell off like today, we're seeing Tech Trader yet again hold up fine despite being more than 50% net long. Right now SPY is down 1.2%, IWM 1.5%, and EEM 2%, but Tech Trader is only down 0.5%, which is basically a normal fluctuation on any given day. On the performance chart for the year, it's barely a blip whereas you see SPY chopping up and down below.

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

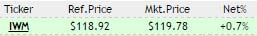

Looks like the algos were expecting the news not to come out until 2pm EST and are just now reading it lol. IWM surging above $120 now. Well over 1% from the bottom signal on IWM

pftq (Official) says on The Tech Trader Wall...

It turns out Tech Trader would have bought these months ago if we just had the stocks in the scan list. Unfortunately, Tech Trader is only looking at top 1000 stocks right now; need to have much more capital before we can think of increasing the universe, else the size of each position will be too small. Just something to keep in mind for the future as far as capacity for Tech Trader is concerned.

196 unique view(s)

August 17th, 2015

pftq (Official) says on The Tech Trader Wall...

Great example on GRUB of Tech Trader's option pricing algo at work. Normally I would have just crossed the spread, but it now knows to aim for $.50 on a spread of $.45x$.70 based on how other contracts are priced.

Edit: Not trading this specific strike/contract. Just wanted to show how TT would price a wide spread. Sorry for the confusion.

In other news, XLP has exited around $50.20 for about a 1.2% total gain (QQQ had 2.4%, XLK 2.1%, and XLF 2%). Still holding EEM which is taking a hit, but it's small compared to what the others made already. Slow day overall.

Edit: Not trading this specific strike/contract. Just wanted to show how TT would price a wide spread. Sorry for the confusion.

In other news, XLP has exited around $50.20 for about a 1.2% total gain (QQQ had 2.4%, XLK 2.1%, and XLF 2%). Still holding EEM which is taking a hit, but it's small compared to what the others made already. Slow day overall.

pftq (Official) says on The Tech Trader Wall...

Clarification on GRUB - Not trading this specific strike/contract. Just wanted to show how TT would price a wide spread. Sorry for the confusion.

166 unique view(s)

August 15th, 2015

pftq (Official) says on The Tech Trader Wall...

Fixed images

152 unique view(s)

August 14th, 2015

pftq (Official) says on The Tech Trader Wall...

Just finished adding the ability for Tech Trader to automatically figure out fair value for options based on intrinsic/extrinsic of other contracts. I'll never get ripped off by a 40% spread again! Bahaha

pftq (Official) says on The Tech Trader Wall...

Seeing some slight rotation into other sectors like XLP and XLF while QQQ and XLK retreat, which is great since QQQ and XLK were sold yesterday while XLP and XLF are still being held.

149 unique view(s)

August 13th, 2015

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

Tech Trader barely took a hit during the market sell off and is now outperforming the market again on the rally. SPY only up .3% and QQQ up .5%, but Tech Trader is up over 1% with only 68% net long exposure and no leverage. Both the market timing ETF plays (QQQ, etc) and idiosyncratic stock picks (GPRO, HIG, etc) are contributing significantly today.

pftq (Official) says on The Tech Trader Wall...

Every pullback and higher low we get reduces the desire for Tech Trader to sell. If anything, we'd want a slow grind up here to really squeeze as much gain as we can from this trade.

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

Market closes down 10-20 bps. Tech Trader is up 80bps end of day.