479 unique view(s)

Updates by Tech Trader, a fully autonomous trading system with no human intervention.

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

pftq (Official) says on The Tech Trader Wall...

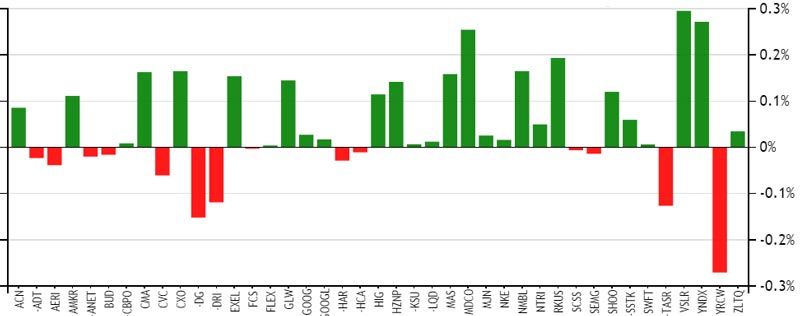

Tech Trader coming back to life here, putting on more names both long and short. Today up over 1% with the market slightly down.

Finally got the options data feed plugged back into TT as well, and that's just spinning in new trades like crazy the last couple days. The options-based trades alone added 1% over the last couple days.

Finally got the options data feed plugged back into TT as well, and that's just spinning in new trades like crazy the last couple days. The options-based trades alone added 1% over the last couple days.

pftq (Official) says on The Tech Trader Wall...

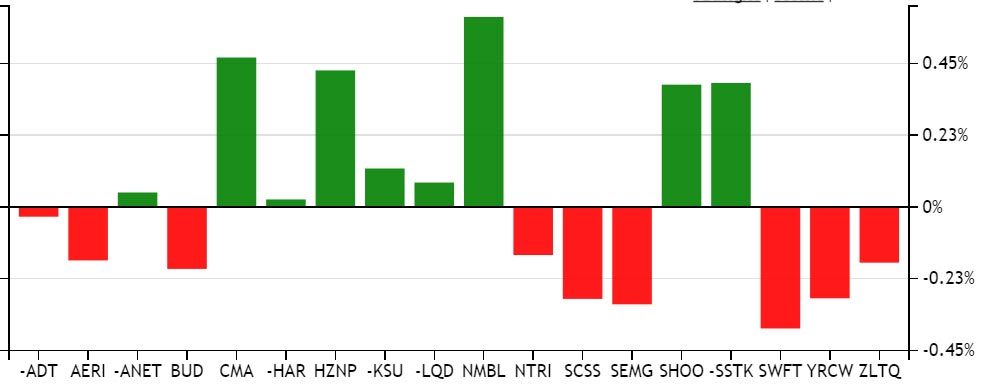

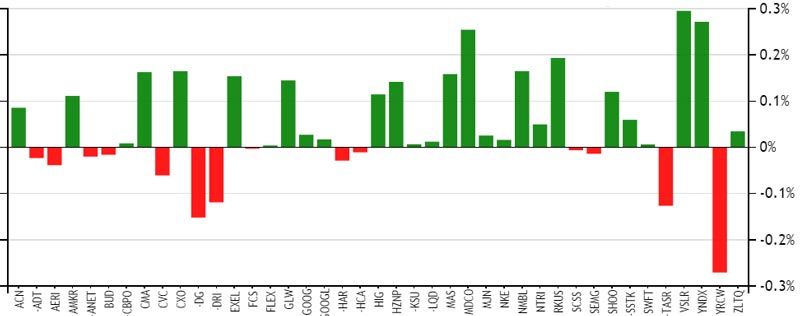

Tech Trader equity-only is up over 2% today by end of day. Exposures climbing back up at 120% by 50% short.

pftq (Official) says on The Tech Trader Wall...

Very exciting. I don't think we've seen this increase in exposure since June. Even without the options based positions, Tech Trader has added about 40% net long in the past week.

499 unique view(s)

October 23rd, 2015

pftq (Official) says on The Tech Trader Wall...

512 unique view(s)

October 21st, 2015

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

XLV calls up 20% and XBI calls up 10% now.

488 unique view(s)

October 20th, 2015

pftq (Official) says on The Tech Trader Wall...

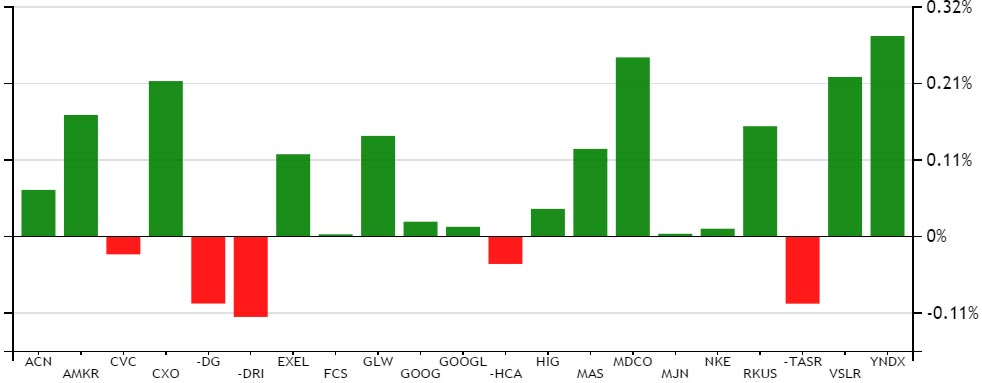

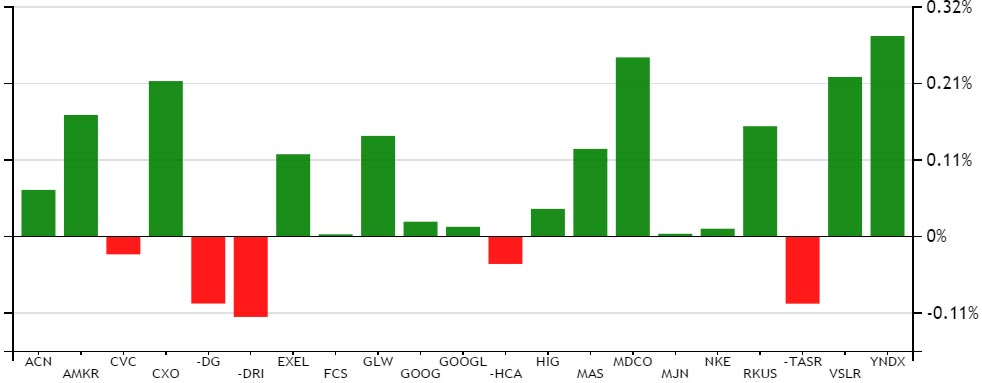

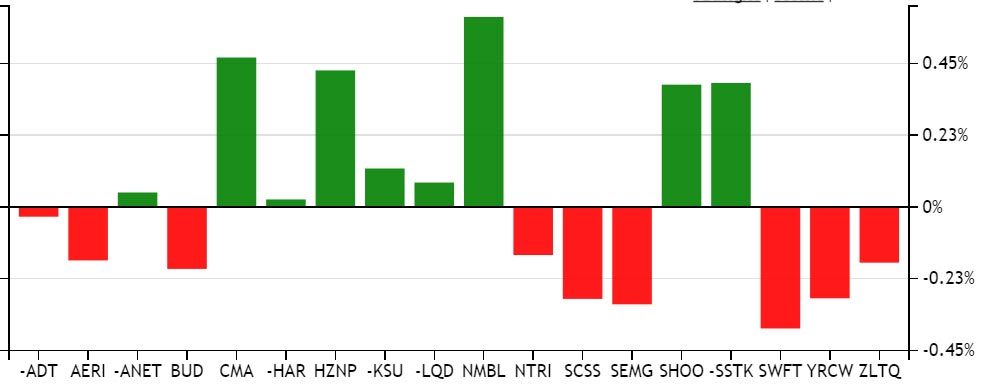

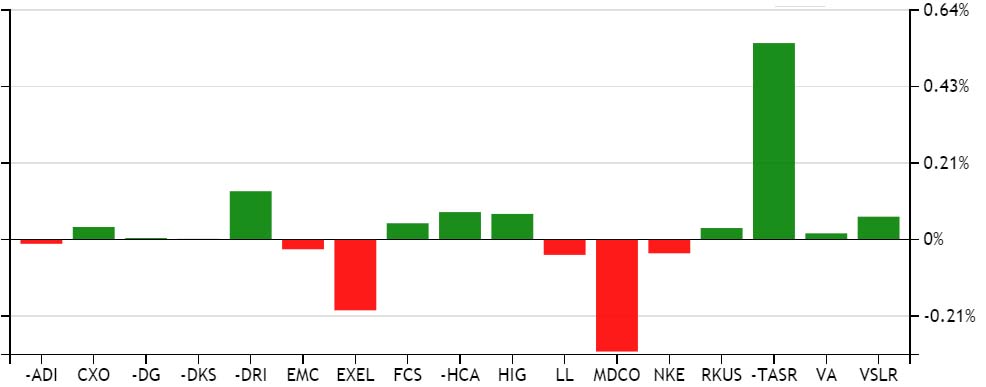

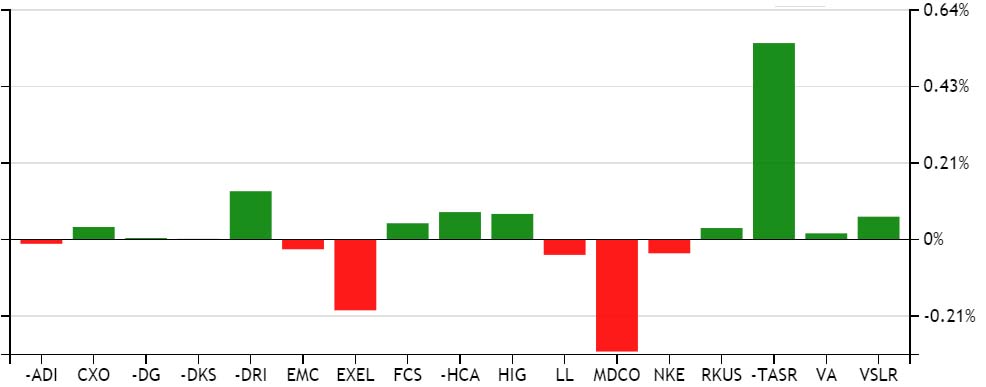

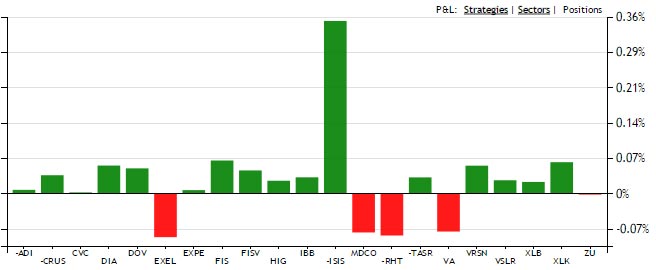

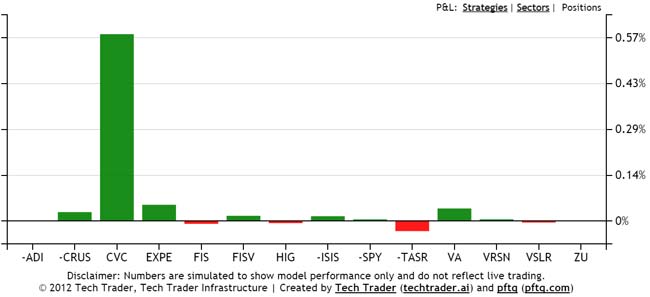

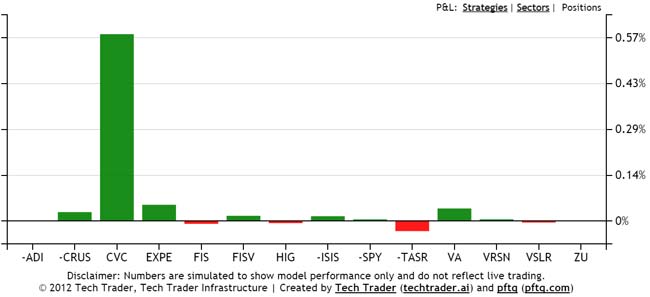

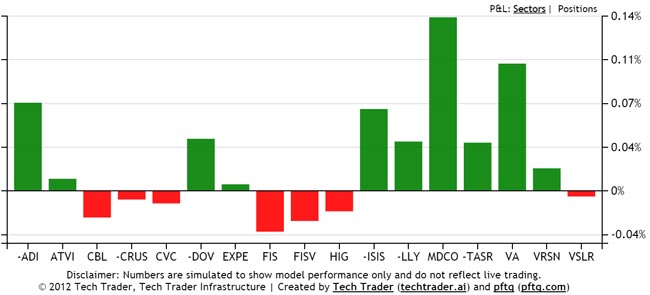

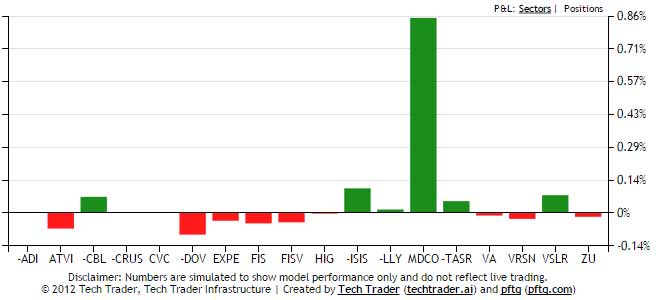

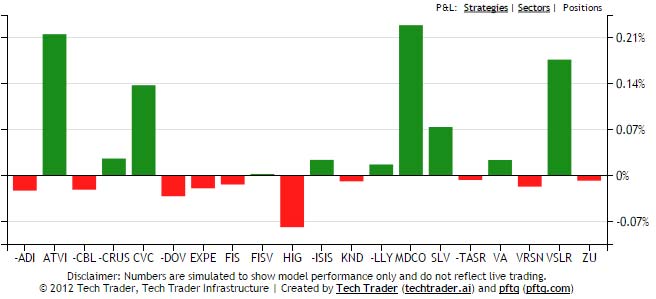

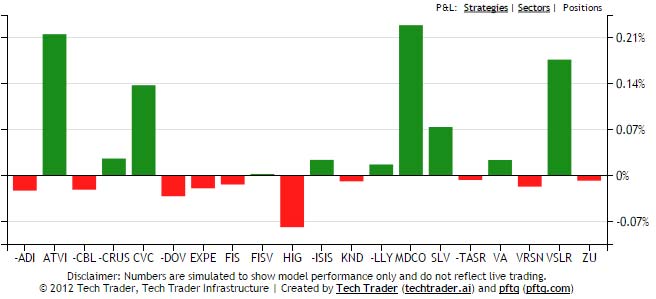

Tech Trader's short bet on TASR finally playing out after a few months. Overall Tech Trader's exposure still a very tight 60% long by 30% short. Very boring month so far.

Up today about half a percent while market churns sideways.

Up today about half a percent while market churns sideways.

482 unique view(s)

October 15th, 2015

pftq (Official) says on The Tech Trader Wall...

485 unique view(s)

October 14th, 2015

pftq (Official) says on The Tech Trader Wall...

524 unique view(s)

September 30th, 2015

pftq (Official) says on The Tech Trader Wall...

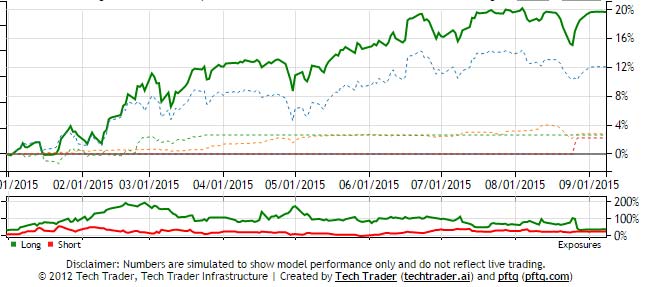

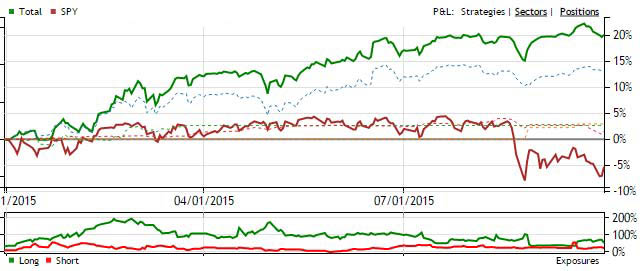

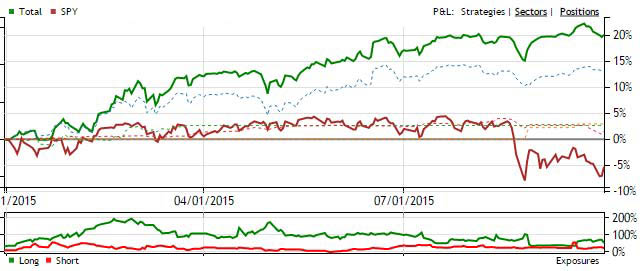

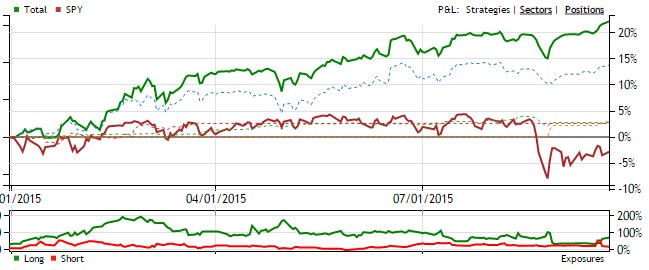

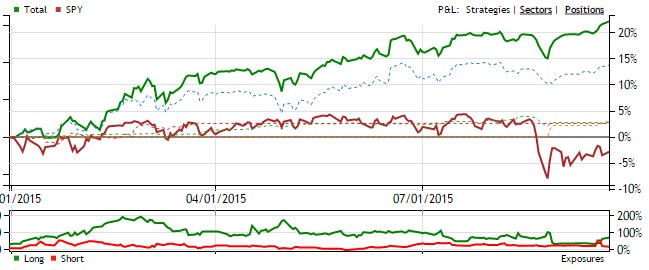

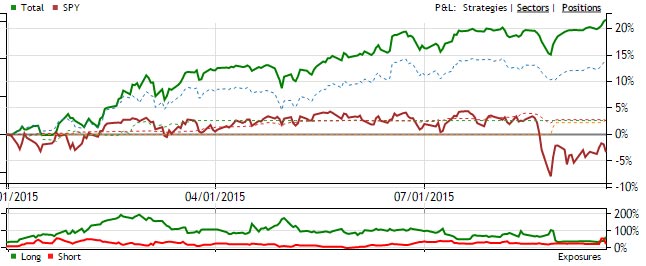

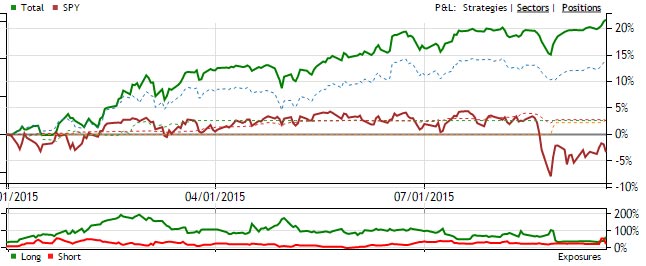

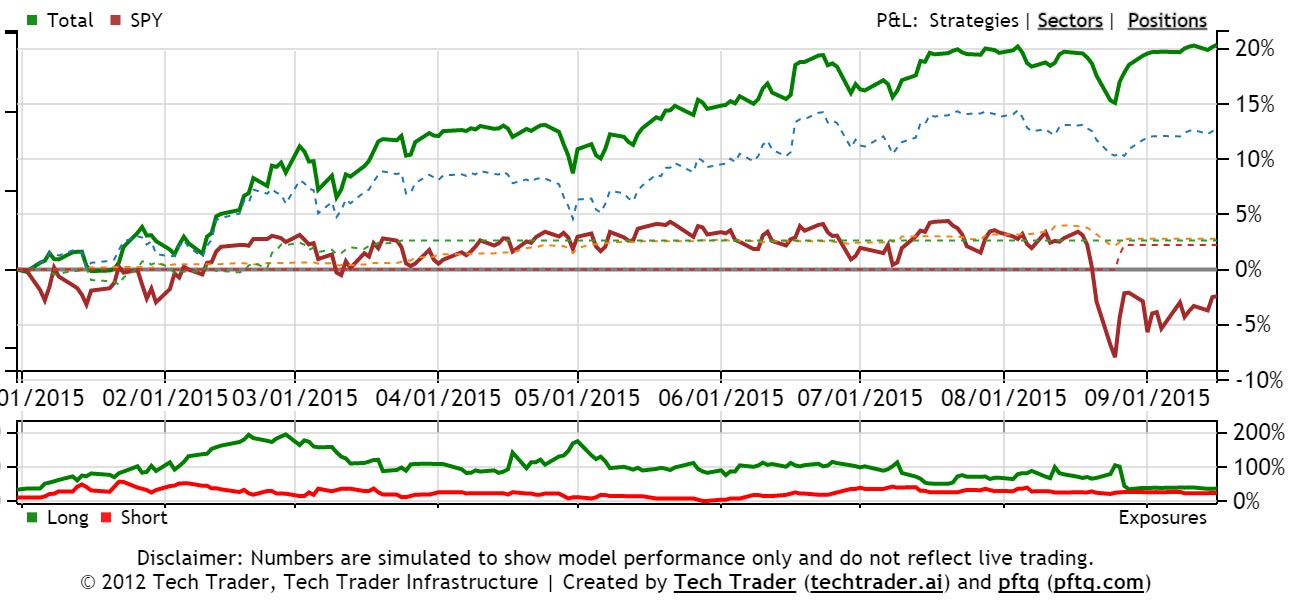

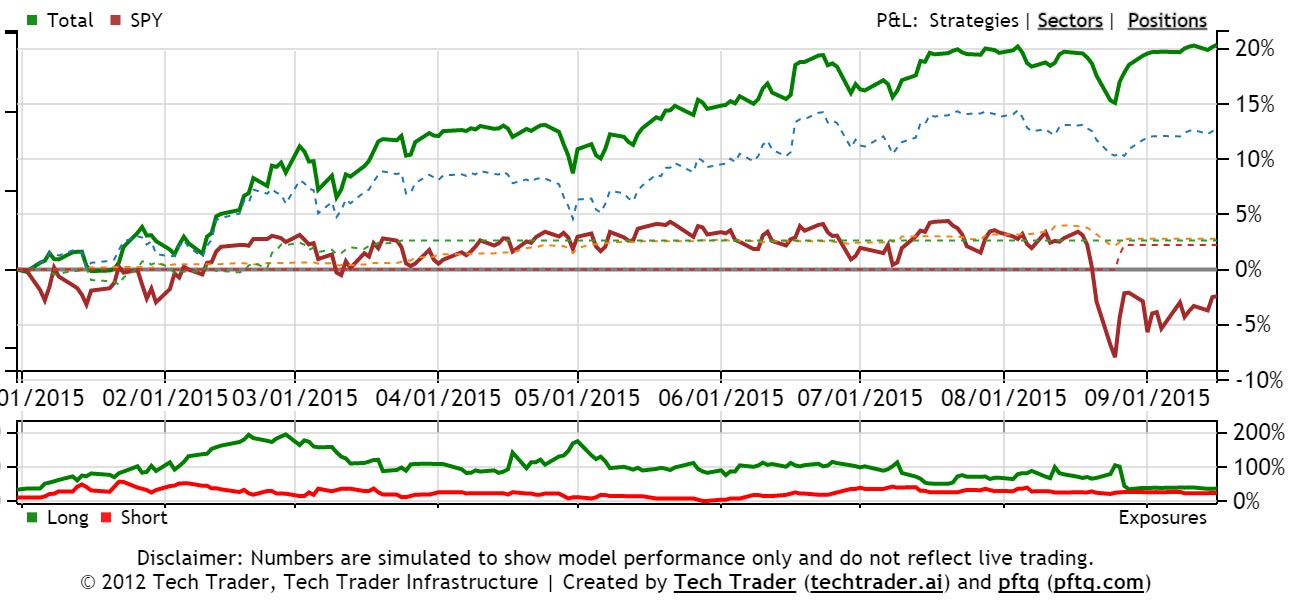

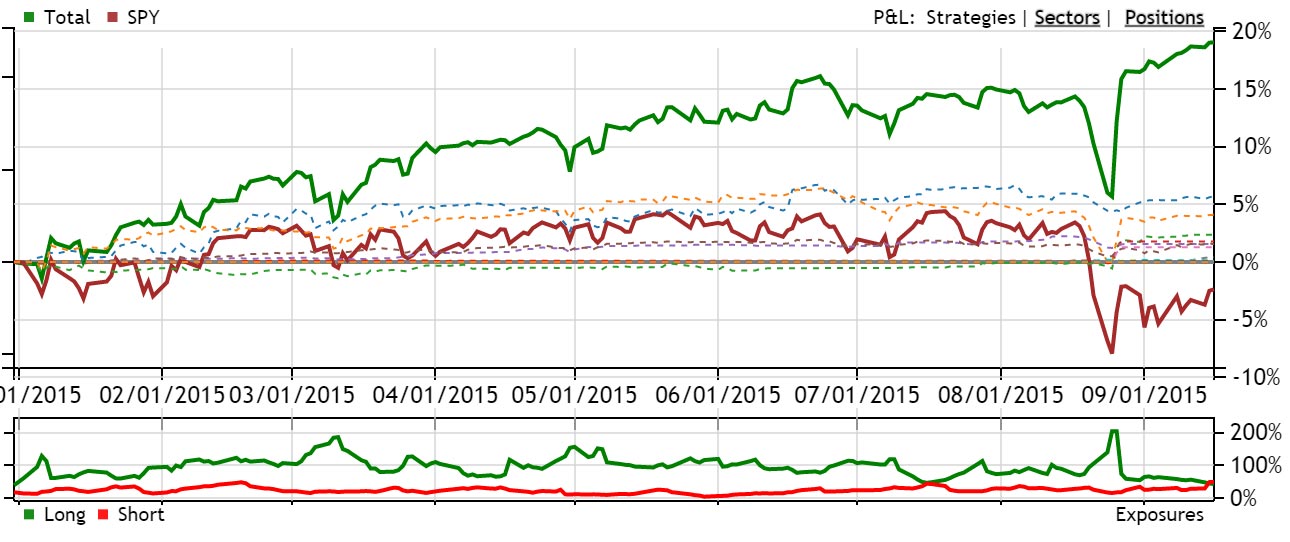

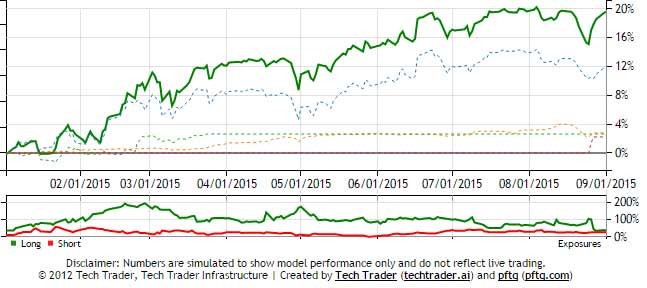

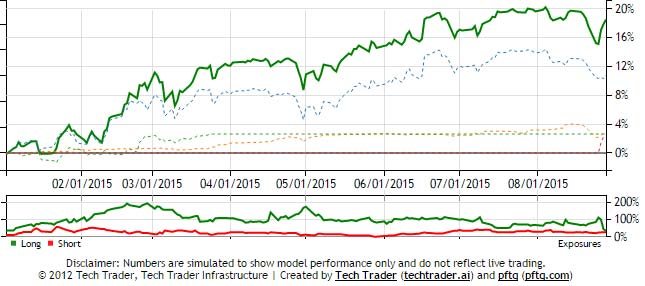

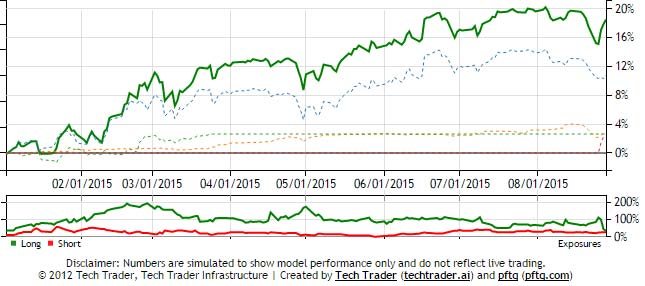

Slow way to end the quarter. Tech Trader remaining very tight at 52% long by 22% short and selling out of its intraday bottom ETF positions on today's bounce. Overall Tech Trader is up about 20% for the year while SPY is down 5%.

496 unique view(s)

September 28th, 2015

pftq (Official) says on The Tech Trader Wall...

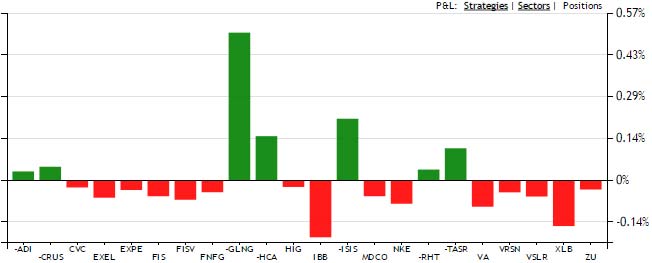

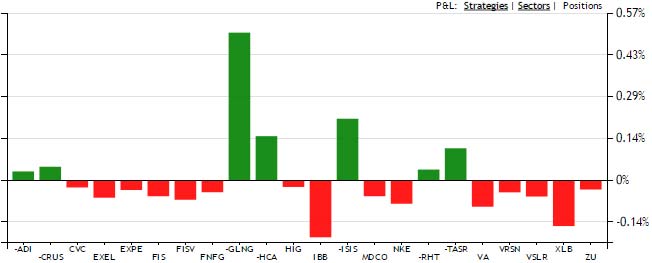

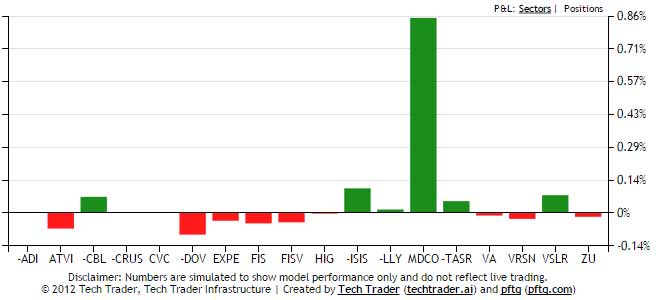

Up today despite market being down a percent and Tech Trader being 60% long vs 25% short still. Thanks to shorts like GLNG and ISIS.

Can't wait till we get another daily bottom. So ready for it.

Can't wait till we get another daily bottom. So ready for it.

pftq (Official) says on The Tech Trader Wall...

Ended up closing down .7% but solely on the intraday bottom ETF signals which are starting to load up; it's small compared to SPY down about 2.5%.

545 unique view(s)

September 22nd, 2015

pftq (Official) says on The Tech Trader Wall...

Looking forward to seeing this sell off pick up and hopefully getting yet another rare SPY RSI2 signal.

pftq (Official) says on The Tech Trader Wall...

My comprehensive SPY strategy (the first strategy I ever wrote) just traded again, covering its short and going long on SPY. Again, no real idea if it'll be a 1-day trade or a 1-year trade (it can randomly switch from holding for 2 years to trading every day), but it's just interesting to see. As mentioned previously, a lot of my abandoned strategies have been waking up this year.

573 unique view(s)

September 21st, 2015

pftq (Official) says on The Tech Trader Wall...

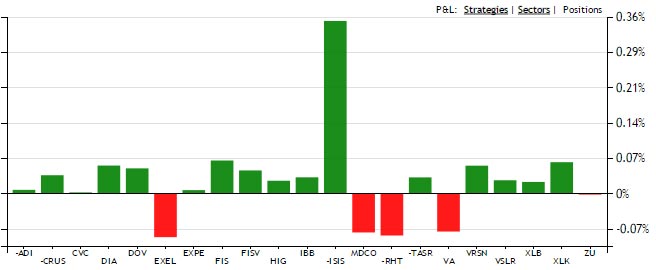

That was probably the easiest flip in a while. After making a killing on the SPY short, the very next trading day has Tech Trader now making on the long side instead with the ETFs (XLK, XLB, DIA); also added IBB at pretty much the low of the day. The market has been chopping between negative and positive all day, but Tech Trader's held a steady 50bps up all day regardless of the market movement. Ironically the biggest winner today is its short on ISIS (the stock is down 8%).

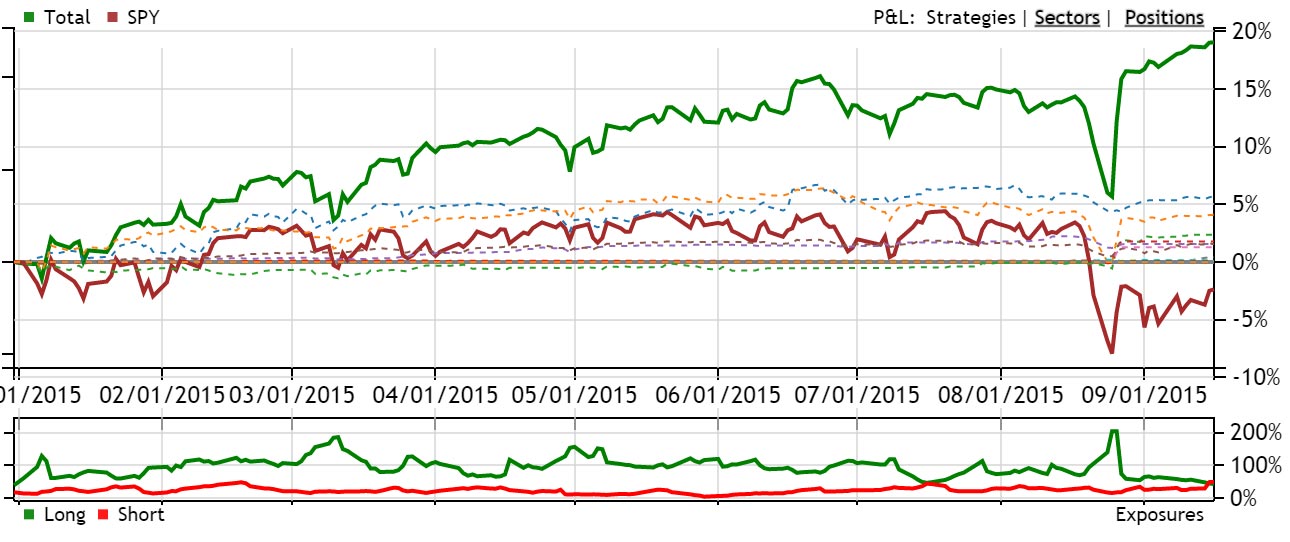

What's most impressive is how quickly it flipped from neutral to net short to now net long in just the past week, each time getting the exact day the market turns, and it is now just grinding higher on each swing the market makes. This is after being "asleep" for most of September with no signals. SPY again shown in red for comparison.

What's most impressive is how quickly it flipped from neutral to net short to now net long in just the past week, each time getting the exact day the market turns, and it is now just grinding higher on each swing the market makes. This is after being "asleep" for most of September with no signals. SPY again shown in red for comparison.

597 unique view(s)

September 18th, 2015

pftq (Official) says on The Tech Trader Wall...

Tech Trader covered its RSI2 SPY trade today, out at $195.27 after shorting at about $200 on Wednesday, the exact top of the week (by closing price). Equity netted 2%. Weekly 200x puts made 95.3% from $2.32 to $4.53. Month-out 200x puts made 45.5% from $4.20 to $6.11.

The once-in-a-blue-moon RSI2 SPY signal's 100% hitrate since 2008 track record remains intact. As usual, the signal occurred while we were traveling and right before a major catalyst event (the Fed), but also as usual, the outcome of the actual event didn't matter.

Tech Trader is also now rotating into smaller intraday bottom-scalping long ETF positions (currently DIA, XLK, and XLB). Exposure flipped in one day from 55% short by 40% long to now 65% long by 23% short. Portfolio-level P&L finally stopped flat-lining and is going to new highs. SPY again shown for comparison.

The hybrid equity+options portfolio that replaces ETF-timing trades with month-out options is up 6.5% for September so far with .5% drawdown. Will be interesting to see if it can augment returns of the base strategies without increasing risk significantly, but we'll see with time. Again, this is all fully automated.

The once-in-a-blue-moon RSI2 SPY signal's 100% hitrate since 2008 track record remains intact. As usual, the signal occurred while we were traveling and right before a major catalyst event (the Fed), but also as usual, the outcome of the actual event didn't matter.

Tech Trader is also now rotating into smaller intraday bottom-scalping long ETF positions (currently DIA, XLK, and XLB). Exposure flipped in one day from 55% short by 40% long to now 65% long by 23% short. Portfolio-level P&L finally stopped flat-lining and is going to new highs. SPY again shown for comparison.

The hybrid equity+options portfolio that replaces ETF-timing trades with month-out options is up 6.5% for September so far with .5% drawdown. Will be interesting to see if it can augment returns of the base strategies without increasing risk significantly, but we'll see with time. Again, this is all fully automated.

pftq (Official) says on The Tech Trader Wall...

Even with the dividend, SPY is down a dollar. Looks like the RSI2 SPY short signal is set here, but I'll be stuck on flight for most the morning. Bah

pftq (Official) says on The Tech Trader Wall...

Make that SPY down $2 to $197 now after dividends. Weeklies will be up at least 50% here. Man, this just always has to happen while on flight lol Going to have to just trust in Tech Trader here

612 unique view(s)

September 17th, 2015

pftq (Official) says on The Tech Trader Wall...

CVC up 16% on acquisition. No matter what happens today with the Fed, Tech Trader is already up almost a percent and at new highs for the year.

pftq (Official) says on The Tech Trader Wall...

622 unique view(s)

September 16th, 2015

pftq (Official) says on The Tech Trader Wall...

Tech Trader continuing to churn higher - currently at new highs for the year now. SPY (with divs) now included in the same chart for comparison.

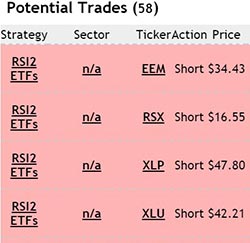

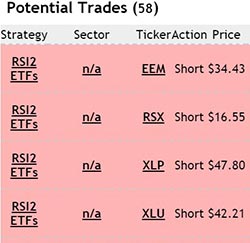

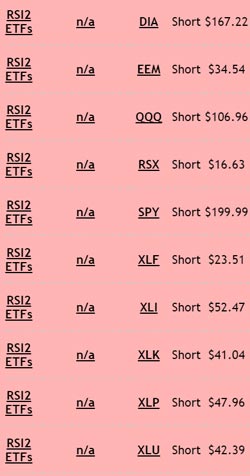

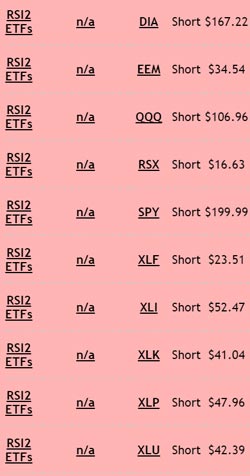

What's more interesting are the abandoned strategies that I monitor in a separate book. They're catching up to the official portfolio now. The older strategies are actually net short now for the first time since July, which is pretty scary given that Fed is tomorrow. It's also planning to add another 50 potential names or so on the short side off of SPY's little rally today due to being overbought near resistance, with heavy-weight ETF positions among them.

What's more interesting are the abandoned strategies that I monitor in a separate book. They're catching up to the official portfolio now. The older strategies are actually net short now for the first time since July, which is pretty scary given that Fed is tomorrow. It's also planning to add another 50 potential names or so on the short side off of SPY's little rally today due to being overbought near resistance, with heavy-weight ETF positions among them.

pftq (Official) says on The Tech Trader Wall...

Now Tech Trader is thinking about shorting virtually every ETF at the end of day. Meanwhile I'm literally on a plane the next two mornings.

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

And we're in... rare RSI2 SPY signal is short the day before probably the year's most anticipated Fed announcement. This is like the feeling you get when you're so excited for a rollercoaster until you're actually looking down from the top of the hill... (and it doesn't help that we'll be out on a flight during tomorrow morning!  )

)

)

)

pftq (Official) says on The Tech Trader Wall...

Why are we always out traveling when all this happens?? <_<

pftq (Official) says on The Tech Trader Wall...

CVC up 16% after hours on acquisition deal. This is like the 5th trade this year Tech Trader got that jumped 15% overnight, with the last one being MDCO. Another great example of the idiosyncratic alpha Tech Trader captures that is more characteristic of fundamental/technical guys than quants. Should be nice padding for the big day tomorrow.

687 unique view(s)

September 10th, 2015

pftq (Official) says on The Tech Trader Wall...

lol this will change once we start traveling next week. Market goes nuts as soon as our backs are turned.

695 unique view(s)

September 9th, 2015

pftq (Official) says on The Tech Trader Wall...

Pretty hilariously awesome day. SPY opens up a percent before selling off and ending up down a percent. Tech Trader opens flat as usual but then actually gains half a percent as the market sells off, despite being net long at 30% long x 20% short. As usual, the most exciting days happen when one of us is out traveling (me this time); had the foresight this time to blindly throw on a few SPY weekly 201 puts before boarding, which are already up 100%. Getting pretty good at mastering this Fate and Irony stuff. Can't wait to see what happens when all 3 of us are out traveling on Fed Day.

Meanwhile SPY... flopping like a dead fish as usual these past weeks.

Meanwhile SPY... flopping like a dead fish as usual these past weeks.

708 unique view(s)

September 8th, 2015

pftq (Official) says on The Tech Trader Wall...

717 unique view(s)

September 1st, 2015

pftq (Official) says on The Tech Trader Wall...

Tech Trader yet again positive for the day and at year highs, while the market is down 3% today and at year lows. Still 38% long vs 25% short, but the shorts are greatly outperforming what little the longs are down.

As usual, notice just how unaffected Tech Trader's performance is from SPY's whiplashing up and down. Shown in the SPY chart below is also the old Comprehensive SPY strategy's short signal from yesterday which pretty much nailed it. It's not in the core portfolio for Tech Trader, but we're having fun just manually trading weeklies in small lots around it here in our PAs. Interesting again that many of my older strategies (first Trendlines and now Comprehensive SPY strategy) are coming back to life.

As usual, notice just how unaffected Tech Trader's performance is from SPY's whiplashing up and down. Shown in the SPY chart below is also the old Comprehensive SPY strategy's short signal from yesterday which pretty much nailed it. It's not in the core portfolio for Tech Trader, but we're having fun just manually trading weeklies in small lots around it here in our PAs. Interesting again that many of my older strategies (first Trendlines and now Comprehensive SPY strategy) are coming back to life.

720 unique view(s)

August 31st, 2015

pftq (Official) says on The Tech Trader Wall...

Market grinds down another percent. Tech Trader is yet again up a percent while being only 30% long by 20% short. Idiosyncratic returns coming into play here while the market timing signals are quiet, this time from MDCO which it's held since July and is up over 20% today on.

pftq (Official) says on The Tech Trader Wall...

Hm.. the first strategy I ever wrote now wants to short SPY after selling around 213 a couple months ago. Kind of disturbing. It's made plenty of mistakes in the past though and is more of a slow moving guy, can hold for years, so it's just fun to watch more than anything. Again, just very interesting to see all my older, abandoned 2012-era strategies coming back alive now after several years of silence.

753 unique view(s)

August 28th, 2015

pftq (Official) says on The Tech Trader Wall...

The fluid rotation in Tech Trader's strategies is constantly impressive, despite having absolutely no portfolio awareness or central control (every position is independently monitored/traded). First the individual names wind down exposure in July, then Bottom 30 Min strategies recede into the background to let Trendlines short everything on the market correction, then Trendlines closes out in lock step with RSI2 SPY buying the bottom (and making an insane +700% in calls), and now that RSI2 SPY is done, the torch passes back to individual names, which again are up a solid percent while the market is flat.

pftq (Official) says on The Tech Trader Wall...

Tech Trader's overall equity-only portfolio (not including the SPY options trade, only the equity) is already back within 2% of the year highs. Exposures are also crushed to an extremely neutral 34% long by 26% short. SPY meanwhile is still down about 7% from the highs and under $200.

739 unique view(s)

August 27th, 2015

pftq (Official) says on The Tech Trader Wall...

SPY at $197! Jinxed it by exiting the $191 weekly calls yesterday ($4.5 from $1.5, +200%)... Except I still have my $197 weeklies (now $1.7 from $.3, >+500% gain) and $191 month-out ($8.5 from $3.93, >+100% gain). Take that Fate! Tech Trader is one step ahead of you. Bahaha!

Again, Tech Trader's 100% hitrate on calling SPY tops/bottoms (aka the once-in-a-blue-moon SPY signal) remains intact.

(Note the orange sell means it's thinking about but hasn't sold yet... though I'll probably at least let go of the weeklies mid-day to avoid decay)

Again, Tech Trader's 100% hitrate on calling SPY tops/bottoms (aka the once-in-a-blue-moon SPY signal) remains intact.

(Note the orange sell means it's thinking about but hasn't sold yet... though I'll probably at least let go of the weeklies mid-day to avoid decay)

pftq (Official) says on The Tech Trader Wall...

And that's the end of Tech Trader's once-in-a-blue-moon 100% hitrate SPY signal.

6.5% on the equity from $187 to $199

200% on the initial weekly 191 calls from $1.5 to $4.5

700% on the roll to weekly 197 calls from $.3 to $2.12 (my bad for selling early, would have been $3 if I let Tech Trader do this, sorry Tech Trader)

57% on the 197.5 calls Tech Trader rebought this morning in disagreement to my selling from $1.47 to $2.32

160% on the month-out 191 calls that Tech Trader bought and held the whole time as a baseline return from $3.93 to 10.23.

I think I might have to step down here after costing Tech Trader 200% on potential gains lol. There was actually a funny moment today where I literally couldn't sell because something in Tech Trader was blocking my order. Now we know why. I'm officially unneeded.

6.5% on the equity from $187 to $199

200% on the initial weekly 191 calls from $1.5 to $4.5

700% on the roll to weekly 197 calls from $.3 to $2.12 (my bad for selling early, would have been $3 if I let Tech Trader do this, sorry Tech Trader)

57% on the 197.5 calls Tech Trader rebought this morning in disagreement to my selling from $1.47 to $2.32

160% on the month-out 191 calls that Tech Trader bought and held the whole time as a baseline return from $3.93 to 10.23.

I think I might have to step down here after costing Tech Trader 200% on potential gains lol. There was actually a funny moment today where I literally couldn't sell because something in Tech Trader was blocking my order. Now we know why. I'm officially unneeded.

pftq (Official) says on The Tech Trader Wall...

Man... those 191x calls I sold yesterday... Tech Trader saw it was missing and bought it back. Only the initial base capital size, but they're already up 20%. I'm no longer in charge anymore lol

Edit: The calls it bought were 197.5x to replace the 191x. Just clarification.

Edit: The calls it bought were 197.5x to replace the 191x. Just clarification.

pftq (Official) says on The Tech Trader Wall...

Alright, out of my moonshot 197x weeklies at $2.12 (~700% from .3). I'll let Tech Trader take the reins from here with the new reset weekly calls it bought this morning and the month-out calls it's still holding.

727 unique view(s)

August 26th, 2015

pftq (Official) says on The Tech Trader Wall...

The blue moon SPY signal nailed the market bottom (from a close-to-close basis of which it operates anyway). Currently up 2% in stock, 50% in 191x weeklies, and 25% in 191x month-out calls. I totally forgot it also had a price target. Currently its target is 197 and will adjust according to market conditions. I went ahead and added some 197x weekly calls as well in case we do jump that high.

pftq (Official) says on The Tech Trader Wall...